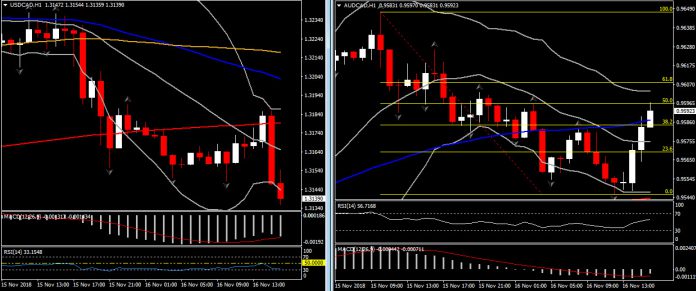

AUDCAD and USDCAD, H1

The Canadian manufacturing report came in close to expectations, although the lack of growth for total shipment volumes was a tad disappointing.

Canada manufacturing shipments nudged 0.2% higher in September after a revised 0.5% decline in August shipment values (was -0.4%). By sector, gains were narrowly based in September, as 8 of 21 industries saw increases. A 3.1% gain in transportation industry sales led the way in September, which was driven by a 6.1% bounce in motor vehicle assembly and a 1.9% climb in motor vehicle parts. Production picked-up following motor vehicle assembly plant shutdowns in July and August. Total sales volumes fell 0.1%, which is rather disappointing for the September GDP outlook. We are maintaining our 0.1% estimate for September GDP for the time being, but this report tips the risk around our projection to the downside.

USDCAD pulled below, the overnight bottom of 1.3150, and currently traded to 1.3138 lows, following the Canadian manufacturing data. Stronger oil prices kept a cap on the pairing since Thursday’s close, as WTI crude tops $57.70. Next floor for the pair is at 1.3100 and Resistance at 1.3193.

Conversely, AUDCAD spiked up to 0.9597 highs reversing up to 50% of yesterday’s losses. If the pair manages to close at the bottom of the hour above 38.2% Fib. retracement level, we could see a retest of the PP level at 0.9600 level and also yesterday’s high at 0.9647.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.