One of the most prominent rating agencies, Moody’s, has published a report saying that “credit conditions will weaken in 2019 as economic growth decelerates, funding costs increase, liquidity tightens and market volatility returns”. This comes in addition to projections of a US recession in 2020 by two-thirds of US business economists. Given the importance of the US economy in the global markets, it is easy to see how the two are connected.

The two forecasts echo similar arguments, namely tightening monetary policy, trade-related and other disputes, and stock market volatility, which could lead to growth deceleration and potentially to a full-blown recession. The arguments behind these forecasts appear to be justified, however, to an extent: there is no reason to expect that higher interest rates could lead to recessionary pressures given that rates adjust to higher growth rates in the economy on their own and hence they would move upwards themselves, even in the absence of Central Bank action (you don’t have to trust me, trust Milton Friedman instead).

In essence, what this suggests is that in order for monetary policy to really have an impact it needs to be above what the economy is able to sustain. This is what Paul Volcker did in 1980-81 when, being the Fed Chairman, he pushed rates high enough to create a recession in order to fight off supply-side inflation from surging oil prices. Volcker’s success was so undeniable that it is universally considered as the Fed’s moment of glory. This is the quintessential monetary policy as, for the first (and only) time, the interest rate moved in an effort to control the increase in the money supply as well as to control government deficits.

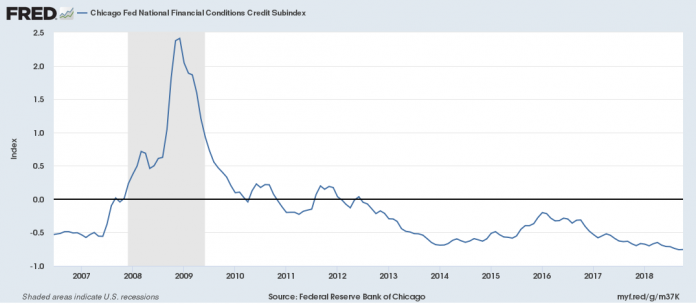

What should be taken away from the previous two paragraphs is that monetary policy is not a reason as to why lending conditions should tighten. Just to prove this, the graph above shows the Chicago Fed’s Financial Conditions Index, where a negative number suggests that financial conditions are looser than normal. As is clearly shown, conditions have been loosening for a while now and have continued to do so despite the monetary policy tightening last month.

In addition, the reason behind tightened liquidity conditions does not appear to be clear, as short-term lending to businesses appears to continue its increase, at least until the second quarter of 2018. If this is interlinked with tightening financial conditions then this also does not appear to have much merit given that they have not been tightening at all.

What deserves the most attention with regards to the proposed reasons for a recession are the ones referring to trade policy and the subsequent stock market volatility. As the effects from the trade tariffs start to become more visible in the US economy, corporate profits will decline as prices will increase, a theme revisited late last month. This should push company valuations lower and hence the overall market down, subsequently increasing volatility in the markets. Furthermore, in a problem not mentioned by any of the above analyses, raising interest rates will also have an impact on government spending, as servicing the existing fiscal debt will become much harder as yields increase.

Can these two factors be enough to provoke a recession? If the US government is forced to consolidate at the time when companies are already hurt by tariffs then this could lead to a recession. In this case, the Fed will be forced to at least halt the increase in interest rates and ease conditions, thus blunting the impact.

As for this analyst’s forecast: the Fed will delay interest rate increases in 2019 for as long as it possibly can, in order to allow for the economy to adjust to the new trade war environment. The world will, expectedly, be affected by the ongoing trade tensions, however the drag on growth should not be strong enough to go into recession, unless we observe an important escalation. Note that the banks do not currently have the weak position they had back in 2007 and thus any type of a recession should not look like a banking crisis, making it easier to deal with using just traditional monetary policy tools.

Click here to access the HotForex Economic Calendar

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.