FX News Today

Asian Market Wrap:

10-year Treasury yields are down -1.7 bp at 3.165% after coming back from yesterday’s holiday and catching up with the broad move lower in global core yields yesterday. 10-year JGB yields are down -0.3 bp at 0.104% as Asian equity markets outside of China headed south once again. Japan is underperforming after the tech-led slump on Wall Street yesterday, that was triggered by concerns over disappointing demand for iPhones, which put Apple Inc suppliers under pressure. Chinese markets meanwhile managed to recoup early losses and move broadly higher on hopes of progress in the US-Sino trade spat after reports that China’s Vice Premier Liu He will visit the US to prepare for a meeting between US and Chinese leaders. Shanghai and Shenzen Comps managed gains of 1.25% and 2.03% respectively. The CSI 300 is up 1.42%, the Hang Seng 0.26%, while Topix and Nikkei are still down -2.00% and -2.06%, despite also moving up from early lows. Equally, the ASX dipped -1.80%. US futures are broadly higher though, while Oil prices fell back again and the WTI future is trading marginally above the USD 59 per barrel mark.

FX Summary:The Dollar posted an up day in relatively thin conditions, being a Monday and amid the Remembrance Day holidays in North America. The USDIndex settled 0.6% higher at 97.46 having earlier posted a 17-month high of 97.58. EURUSD concurrently printed a 16-month low of 1.1240 and USDJPY a 6-week high at 114.20. Sterling underperformed, and was showing a 1% decline at 1.2827, which is a 2-week low, before closing out in London at 1.2862-64. Reports from the BBC and Telegraph citing cabinet members suggesting their flagging support for the government’s Brexit plan, coming after late Friday’s resignation of cabinet member Joe Johnson, weighed on the Pound with time fast running out for the UK and EU to strike a deal on divorcing terms. As for the Dollar’s outperformance today, last Friday’s hot PPI numbers, and the Fed’s policy guidance following last week’s FOMC meeting, have fanned expectations for a resumption in Fed tightening at December’s policy meeting, which in turn has fuelled a rotation into the Greenback.

Charts of the Day

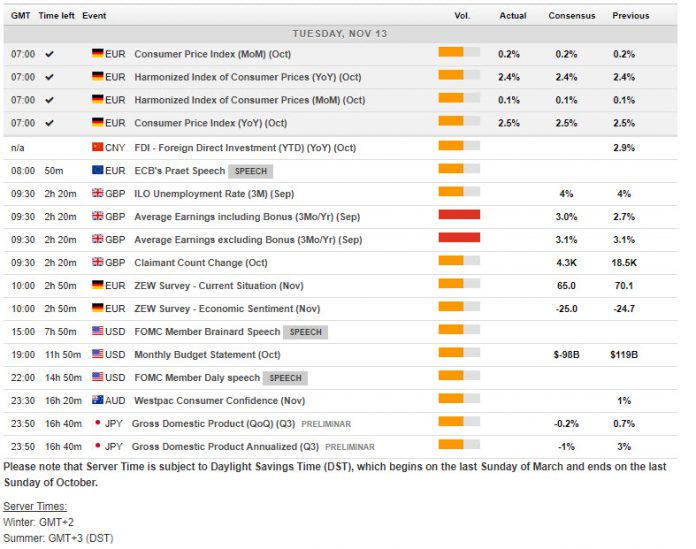

Main Macro Events Today

- UK ILO unemployment Rate and Average Earnings – Expectations – The labour data is anticipated to show the unemployment rate holding unchanged at 4.0%. The Average Earnings expected to rise to 3.0% from 2.7% last month.

- German ZEW – Expectations – German HICP is expected to be confirmed at 2.4% y/y.

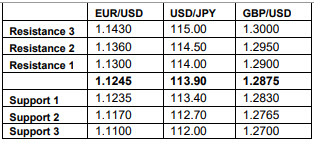

Support and Resistance Levels

Click here to access the HotForex Economic Calendar.

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.