Companies are missing earnings season forecasts at a higher-than-usual rate, but this week we’ll see how reports from tech giants including Mastercard turn out.

Mastercard Inc. is a financial company that provides a leading global payment solution by providing a range of services to support credit, debit, mobile, web-based and other related electronic payment programs for financial institutions and other entities. The company, which has a market cap of $334.47B as of July 2022, is expected to report earnings for the fiscal quarter ending June 2022 on Thursday (28/07), before the market opens. It is estimated that Mastercard will post earnings of $2.36 per share for the quarter.

The company released its Q1 earnings report on April 28, when it reported Q1 2022 earnings of $2.76 per share, exceeding expectations of 27.2%. The revenue of the leading technology company in the global payments industry totaled $5.2 billion, an increase of 24% year-on-year in the quarter under review. Quarterly results benefited from a substantial recovery in cross-border volume, resulting from a rebound of cross-border travel to pre-pandemic levels in March 2022. Increased gross dollar volume and higher diverted transactions contributed to the gains. However, this increase was partially offset by higher operating costs.

Mastercard is projected to report earnings of $2.36 per share, representing year-on-year growth of 21.03%. Meanwhile, Zack’s latest consensus forecast calls for revenue of $5.26 billion, up 16.26% from the year-earlier quarter. The full-year Zacks Consensus estimate calls for earnings of $10.52 per share and revenue of $22.13 billion. These results would represent a year-on-year change of +25.24% and +17.21%, respectively. Mastercard is currently at Zacks Rank #3 (Hold).

At the end of June the company announced a quarterly dividend, which will be paid on Tuesday, August 9. Shareholders listed on Friday, July 8 will receive a $0.49 dividend. This represents an annual dividend of $1.96 and a yield of 0.57%. The ex-dividend date of this dividend is Thursday, July 7. Mastercard’s current payout ratio is 20.40%.

Technical Overview

Mastercard shares have grown over 9% throughout July 2022 and the share price weakness in June 2022 has been offset by gains this July. This can be seen from the rebound of 303.23 which reached the level of 61.8% FR at the end of last week, even approaching the level of 76.8% FR at 350.93. Mastercard shares were up 2.6% in pre-market trading, thanks to better-than-expected Q1 results. And if the Q2 result this time is much better than the market forecast, then the stock price increase could test 368.18. Meanwhile, if the report data is below expectations then investor agitation could bring stock prices down to test the support at 312.94 and the low at 303.23.

Technically, a break of the 336.95 resistance might be an indication of market confidence in the results to be reported in the short term. However, the stock price is currently stuck on the horizontal 200-day moving average line, because the price movements during the last 2 years have not shown any significant changes. In the short term, the price has been sitting above the 26-day and 52-day EMA and oscillating in the positive zone which supports a further rally.

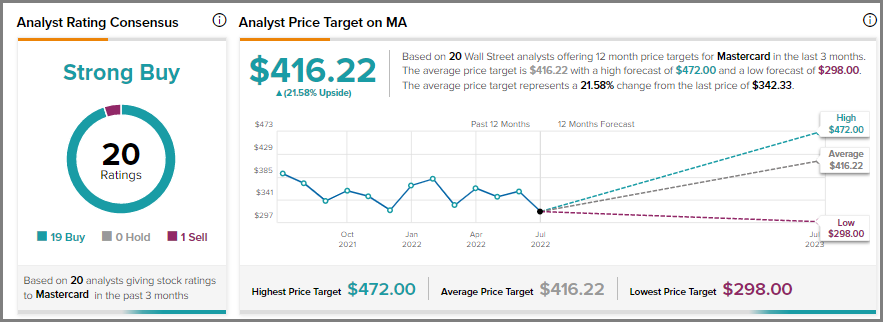

Several equity research analysts recently issued reports on Mastercard’s price projections. BMO Capital Markets lowered their target price from $412.00 to $402.00. Truist Financial lowered their target price from $450.00 to $420.00. Piper Sandler lowered the stock’s target price from $357.00 to $298.00 and assigned the stock an “underweight” rating in a research report on Wednesday, July 6. JPMorgan Chase & Co. lowered their target price on Mastercard stock from $430.00 to $425.00. According to MarketBeat, the stock currently has a “Medium Buy” average rating and a consensus target price of $415.95. Meanwhile TipRanks, based on 20 Wall Street analysts, offer a 12-month price target for Mastercard in the last 3 months. The average price target is $416.22 with a forecast high of $472.00 and a forecast low of $298.00. The average price target represents a 21.51% change from the last price of $342.54.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.