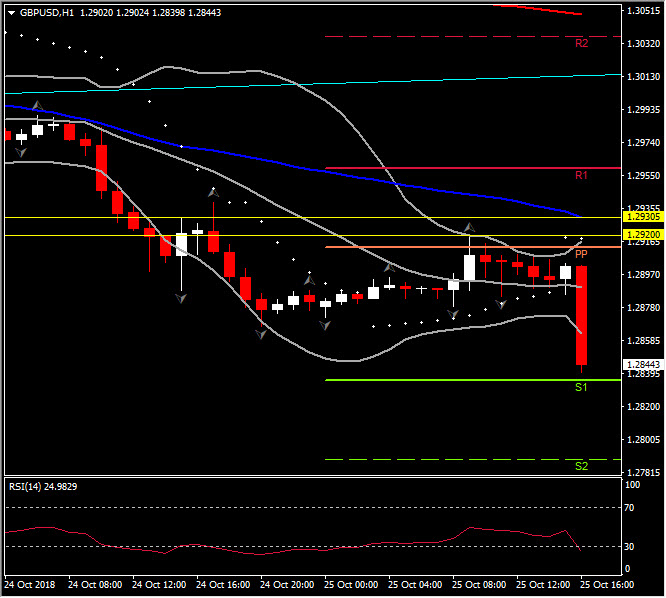

GBPUSD, H1

The Sterling has come under pressure, and is presently showing declines on the day versus both the Dollar and the Euro. The Cable, which is seeing its biggest weekly decline since early August, has printed a fresh seven-week low at 1.2839, which is nearly 60 pips down on the intraday high seen in Asian trade.

Compared to levels that were prevailing a week ago, however, the Sterling is down by an average 0.9% versus the G3 currencies, and is off by 1.9% versus levels seen a month ago, reflecting an increase in the Brexit discount as the clock ticks towards the UK’s exit from the EU, on March 29 – without any real sign of a solution to the Irish border problem. It also looks highly uncertain that whatever deal might be agreed on would be passed in the UK’s House of Commons, which, if so, would prompt a general election or a new referendum (or both).

There is a risk that as the available time for negotiation ahead of Brexit D-day next March diminishes, markets will start to push the Sterling lower as the risk of a no-deal Brexit ratchets higher. The Cable has trend Resistance is at 1.2933-35, while the early-September low at 1.2786 provides a possible downside waypoint.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/10/30 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.