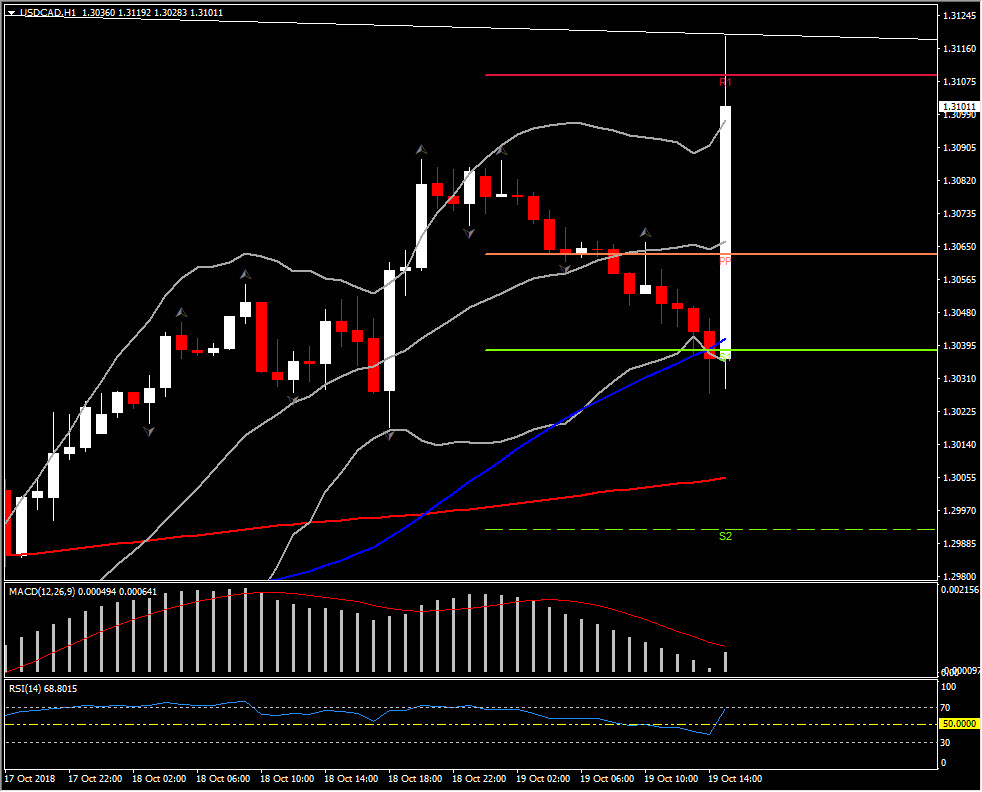

USDCAD, H1

USDCAD rallied to a better than one-month high of 1.3109 from near 1.3040, following the cooler Canada CPI numbers, and weak retail sales outcome. The pairing had faded to 1.3028 lows overnight on firmed Oil prices, but the data obviously trumped market sentiment.

Canada’s CPI grew at a 2.2% y/y pace in September, undershooting expectations for a modest dip (median +2.7%) following the 2.8% pace in August and cycle high 3.0% pace in July. CPI dropped 0.4% (m/m, nsa), contrary to expectations (median +0.1%) after the 0.1% decline in August. The Core CPI measures edged lower in September: CPI-trim to 2.1% from 2.2%, CPI-median to 2.0% following a 2.1% gain in and CPI-common to 1.9% from 2.0%.

Canada retail sales values dipped 0.1% in August after a revised 0.2% gain in July (was +0.3%). The retail sales ex-autos aggregate fell 0.4% in August following a revised 0.8% increase in July (was +0.9%). The declines in total and ex-autos retail sales were contrary to projections for at least modest gains in both. Total sales volumes declined 0.3% in August.

While CPI and retail sales were surprisingly soft relative to expectations, these reports do not alter the strong case for a 25 bp rate hike from Bank of Canada next week. The rapid slowing in total CPI growth back towards 2% y/y from 3% y/y realises BoC’s expectations that the pop higher to a 3% y/y CPI growth pace in July was due to temporary factors. The core CPI measures remain consistent with an economy operating around potential. Even if the data does not alter a rate hike for BoC, the inflation report supports the possible scenario to a gradual approach to normalising rates.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/10/23 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.