Fintech giant PayPal Holdings, Inc. is expected to report earnings for the fiscal quarter ending June 2022, on Tuesday (02/08), after market close. The company projects year-on-year revenue growth of 9% at current and currency-neutral spot rates for Q2. The Zacks Consensus forecast for revenue was pegged at $6.76 billion, representing an 8.3% increase from the figure reported in the previous year’s quarter.

PayPal reported non-GAAP earnings of 88 cents per share in Q1 2022, down 28% y/y and 20.7% from the previous quarter. Net revenue of $6.5 billion represents growth y/y of 8% on an FX-neutral basis and 7% on a report basis. Venmo’s strong performance is another positive. Total payout volume (TPV) growth, thanks to a net increase in new active accounts, is driving results.

PayPal projects non-GAAP earnings of 86 cents per share. The Zacks Consensus forecast for earnings is pegged at 85 cents per share, representing a 26.09% decline from the figure reported last year. Furthermore, the figure has moved down 1.2% over the past 30 days. Based on 15 analyst estimates, the consensus EPS forecast for the quarter is $0.54. The reported EPS for the same quarter last year was $0.88.

PayPal’s continued efforts to strengthen its product portfolio may have helped the company gain traction among customers in Q2. It has introduced three new products which are expected to have a positive impact on quarterly performance: The PayPal Cashback credit card, issued by Synchrony, offers unlimited 3% cash back when paying with PayPal at checkout and unlimited 2% cash back on all other purchases wherever Mastercard is accepted; The PayPal business credit card, Business Cashback Mastercard, offers 2% cashback on all purchases, and PayPal Pay Monthly, a buy now pay later solution, which allows customers to divide the total cost of goods purchased into monthly payments.

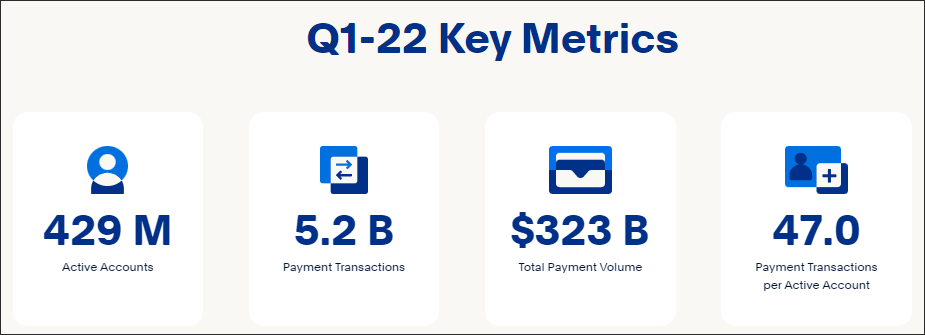

In general, total payment volume (TPV), active customer accounts, payment transactions per active account, and total number of payment transactions are often considered the main metrics for analyzing PayPal’s business growth.

For Q2, the Zacks Consensus pegged the TPV at $345.01 billion, representing 10.9% year-on-year growth. Active customer accounts are pegged at 433 million, up 7.4% from the figure reported in last year’s quarter. Payment transactions per active account are pegged at 48.69 million, representing an 11.9% growth from the amount reported in last year’s quarter. The total number of payment transactions was pinned at 5.5 billion, representing a 16.5% increase from the figure reported in the previous year’s quarter. Zacks ranks the stock at position #3 (Hold). ¹)

However, the company’s weakening momentum in the international market is expected to be a hindrance. The impact of uncertainty regarding the ongoing coronavirus pandemic and foreign exchange headwinds is likely to be reflected in Q2 results this time around. Investors are concerned that the market may experience a downturn in e-commerce transactions for now, as the world shifts to live shopping. However, PayPal’s growing scale of operations, the addition of Venmo and its somewhat interesting valuation present prospects for the future as digital payments adoption in the long term will continue to grow. Q2 performance is likely to benefit from the strength of the Venmo product line, which is expected to continue to aid customer engagement on the PayPal platform. The company’s CEO highlighted the importance of Venmo by saying that it is an area of growth that PayPal needs to focus on. This is expected to have helped the growth of total active accounts in the quarter under review.

An interesting aspect of Venmo is the partnership between Amazon and PayPal. The collaboration between the two companies will allow customers to check out on Amazon using the Venmo app. This means the Venmo app will be exposed to Amazon’s large customer base, which represents a substantial increase in active users for Venmo. These partnerships may have little impact at the moment, but they could be profitable in the long run and be a significant growth driver for the company.

Technical Overview

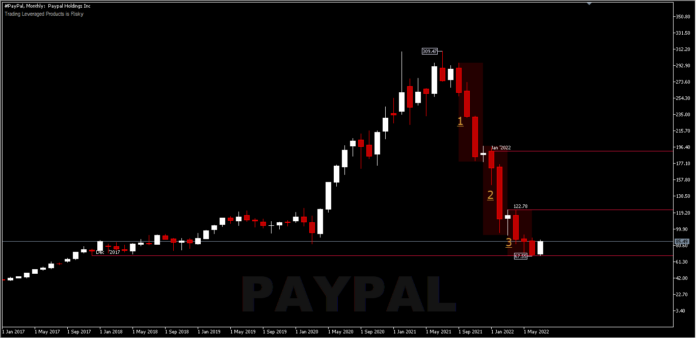

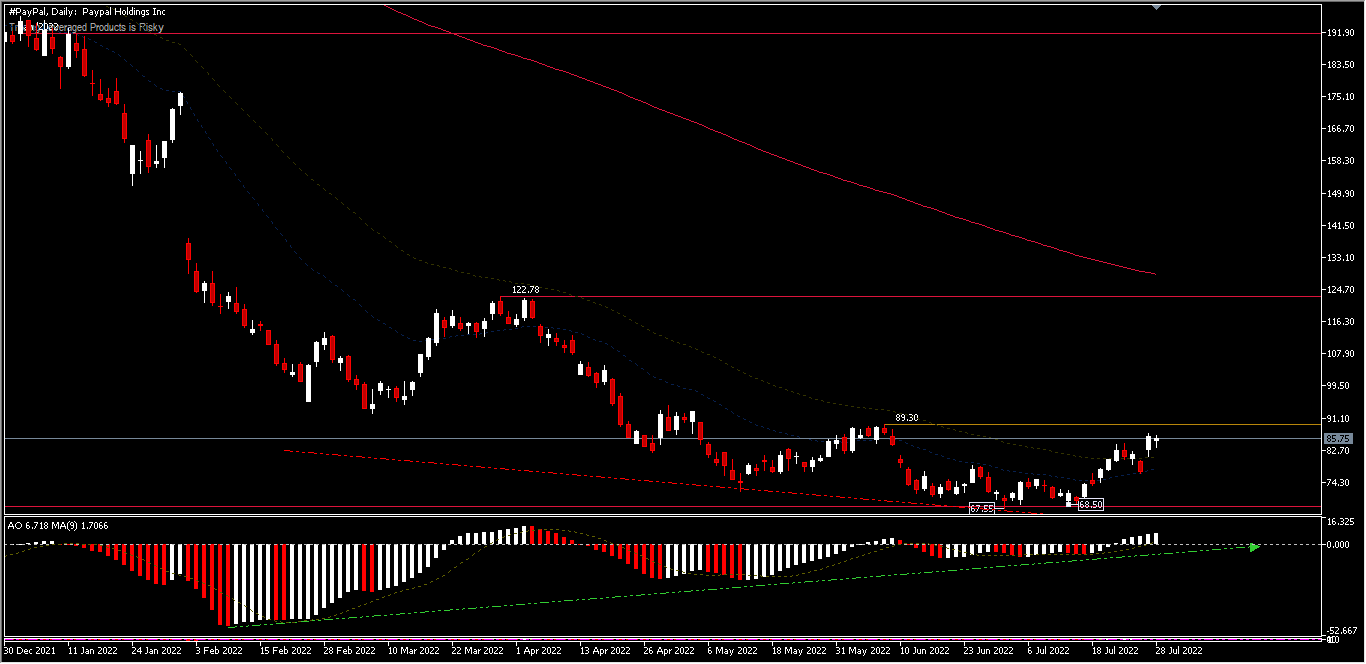

#Paypal prices have slumped more than -72% in the last 12 months, due to macroeconomic challenges. The decline matched the December 2017 low (68.11) at the end of June, recording a low of 67.55. And in July, it also recorded a low of 68.50 and formed a double bottom before rebounding upwards.

The current price position is below the 89.30 resistance. A break of this level will confirm the ongoing rebound. The impetus from a better-than-expected earnings report could pump up the upside to test the 122.78 resistance and the 200-day EMA. The price is currently above the 26-day and 52-day EMAs with daily oscillations in the buy zone and bullish divergence clearly visible. Given the end of the month, some short term liquidation is also possible, if the minor resistance at 89.30 is not broken.

In addition, several equity research analysts recently issued reports on PayPal’s price projections.

Equity analysts at Oppenheimer lowered their Q2 2022 earnings per share estimate for PayPal. They forecast that the credit service provider would post earnings per share of $0.50 for the quarter, down from their previous estimate of $0.56, and outperform with a target price of $101.00 on the stock. The consensus estimate for PayPal’s current full-year earnings is $2.56 per share. In addition to Oppenheimer, Morgan Stanley lowered its price target from $137.00 to $129.00 and assigned the company an “overweight” rating. Barclays lowered its target price from $200.00 to $125.00. Truist Financial lowered its target price from $85.00 to $80.00 and assigned a “hold” rating to PayPal. Based on data from MarketBeat, PayPal has a consensus rating of “Moderate Buy” and a median target price of $143.12.² TipRanks, based on 22 Wall Street analysts offering 12-month price targets for Paypal Holdings in the last 3 months, gives an average price target of $106.11 with a forecast high of $145.00 and a forecast low of $75.00. The average price target represents a 24.66% change from the last price of $85.12.³

.¹). Zack ²). Marketbeat ³).Tipranks

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.