FX News Today

Asian Market Wrap: 10-year Treasury yields are down -0.2 bp at 3.177%, JGB yields also corrected -0.2 bp and are at 0.1405. The trend higher in bond yields continues to be littered with setbacks, as each move higher triggers another wave of risk aversion in stock markets. Asian bourses struggled after a weak close on Wall Street yesterday. Earnings misses from several US industrial firms added to a cautious tone and Topix and Nikkei lost -1.11% and -1.16% so far. The Hang Seng is down -0.08% while Chinese markets managed to shrug off the deceleration in Q3 GDP growth to the lowest rate since early 2009 with the help of some verbal intervention by regulators who tried to assure markets that financial risks will be kept under control. The MSCI Asia Pacific Index is still heading for the worst three-week slide since early 2016 according to Bloomberg. U.S. futures are slightly higher though after yesterday’s dip, oil prices are also up from lows, although at USD 68.86 the front end Nymex future remains clearly below the highs seen earlier in the week.

European Fixed Income Outlook: Bund yields are down -0.5 bp at 0.409% in opening trade, thus continuing yesterday’s slide, as risk aversion lingers and Italian bonds continue to underperform. Treasuries remained supported through most of the Asian session as stock markets remained pressured. The US 10-year is now up 0.4 bp at 3.183%, still holding below recent highs, as the gradual path higher in yields continues to be interrupted by setbacks as stock markets struggle to find a new equilibrium amid heightened uncertainty and with central banks remaining on course to phase out stimulus. Italian budget woes and Brexit concerns remain in focus. Data releases include UK public finance data as well as Eurozone BoP and current account data.

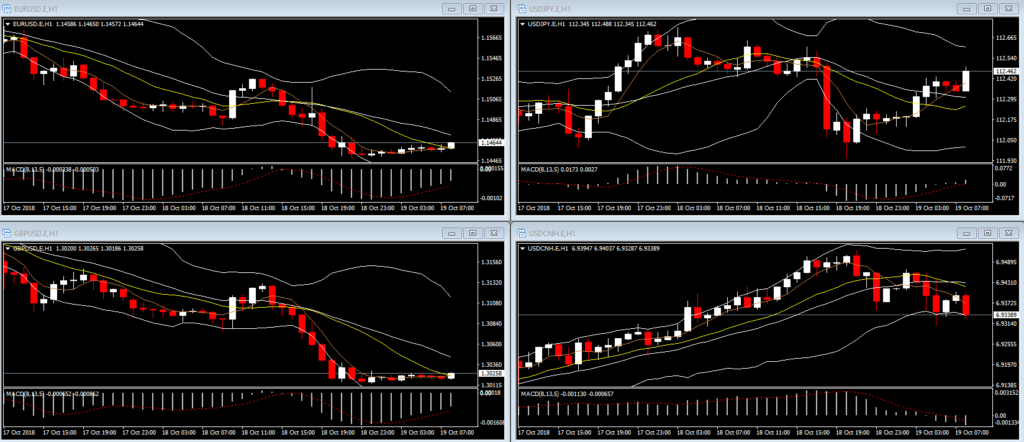

Charts of the Day

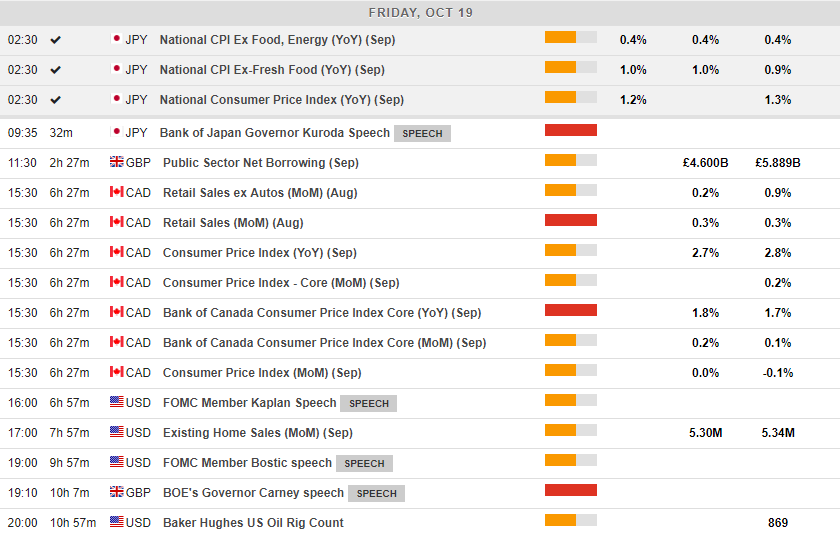

Main Macro Events Today

- Canadian Retail Sales ex Autos – Expectations – Retail Sales are expected to have grown by 0.2% in August, compared to 0.9% in July.

- Bank of Canada Core CPI – Expectations – BoC inflation is expected to have increased to 1.8% y/y in September, compared to 1.7% y/y in August, providing support to the expected hike in the interest rates next week.

- US Home Sales – Expectations – Home sales are expected to have amounted to 5.3 million in September, close to the 5.34 million August number.

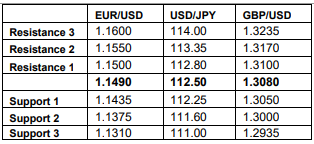

Support and Resistance Levels

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/10/23 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.