Last time I talked about correlations, we examined the basic currency pairs which had either a strong positive or a strong negative correlation. Today, we extend the analysis to cover correlations between commodity prices and FX pairs.

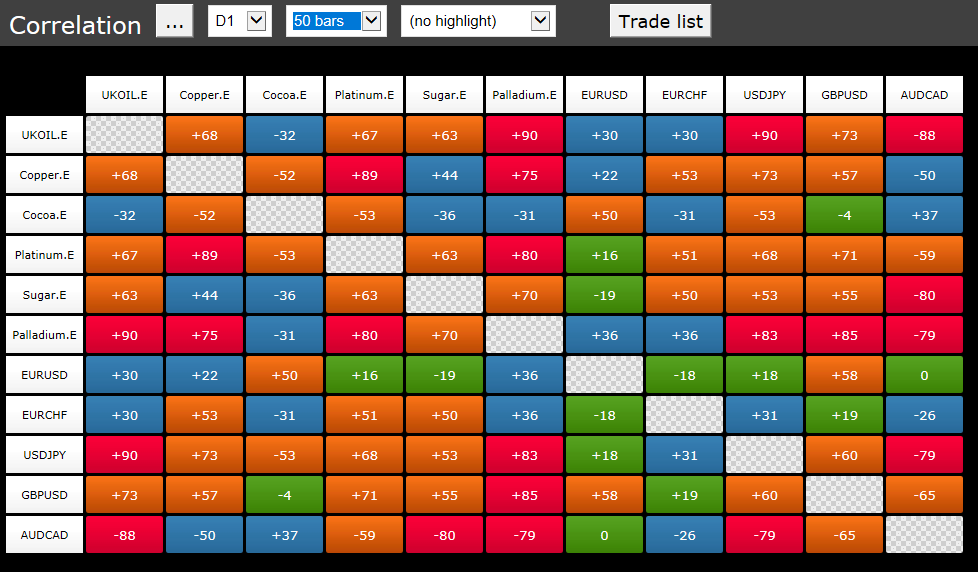

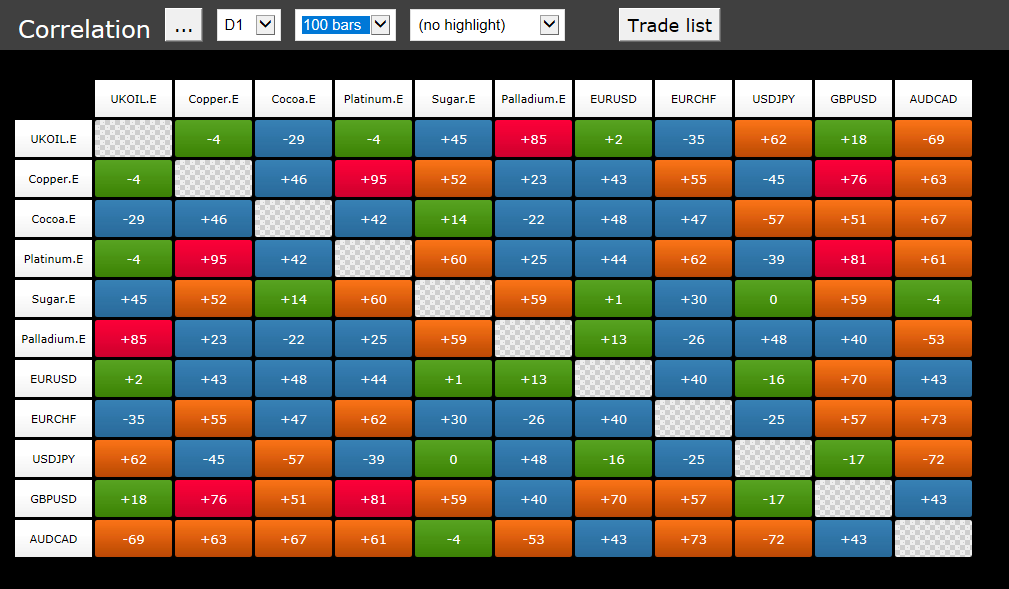

To begin with, we use the basic commodities offered by our platform: Copper, Cocoa, Platinum, Sugar, and Palladium. For the FX pairs, we employ EURUSD, EURCHF, USDJPY, GBPUSD, and AUDCAD. Same as in the previous post, we will use the Correlation Matrix Premium Tool offered by HotForex. The results for the 50-observation sample can be found in the Chart above, while the 100-observation sample is at the end of the post.

As the results suggest, Palladium is highly correlated with many of the currencies: an 85% correlation is observed with GBPUSD, while an 83% correlation is found with USDJPY. This provides an interesting point for thought, given that if the change in GBPUSD or USDJPY would originate from a change in Dollar prospects, then their relationship should have been negative given that the Dollar is the denominator in the first and the numerator in the second pair. As such, Palladium can be viewed as having a positive relationship with the UK economy and a negative relationship with the Japanese economy. In contrast, Palladium has a negative relationship with AUDCAD, at -79%, which is supported by the fact that Canada is a major producer of the commodity, hence any increase in the price of Palladium would positively affect the CAD. Palladium’s relationship with these currencies also holds when we increase the number of observations to 100, albeit to a smaller extent.

Interestingly, the most important relationship Palladium holds is with the price of Oil, registering 85% in the 100-observation sample and 90% in the 50-observation sample. The reasons behind the existence of the relationship have more to do with the usage of both commodities. Palladium is mainly used in car catalysts, most of which use just Oil as fuel. When the global economy is on the rise both Oil consumption and automobile production increases, hence leading to a rise in the price of both commodities.

Platinum also appears to have a positive relationship with GBPUSD, suggesting at as platinum prices rise the UK economy should benefit. The relationship stands at 71% in the 50-observation range and at 81% in the 100-observation range. Given that the metal is also used for catalysts, the relationship is not surprising given that the vast majority of demand for the automotive industry comes from Western Europe. The UK economy is the one most prone to commodity prices, as it appears that Copper also has a positive relationship with it, albeit to a lesser extent.

Overall, correlation analysis has suggested that commodities and FX pairs tend to co-move in some cases. However, traders should be careful when selecting the pair they wish to trade, so that the correlation does not turn against them. In the next post on correlation analysis, we will see which trading strategies traders can use to exploit this relationship.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/10/23 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.