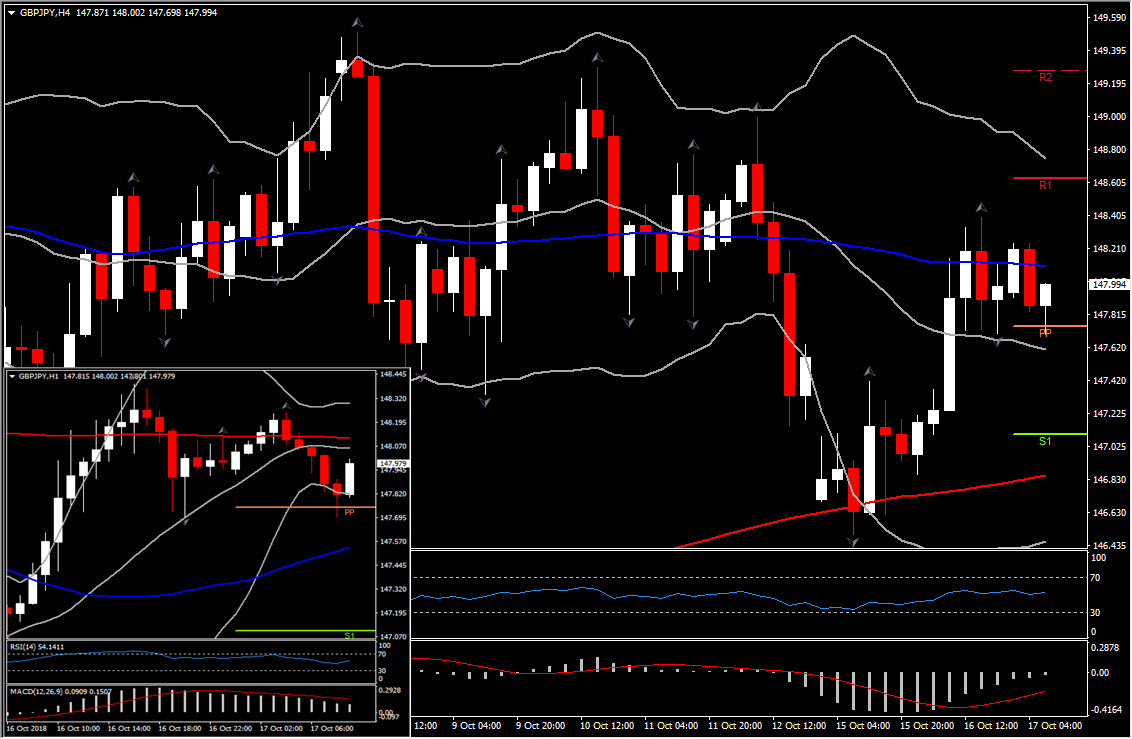

GBPJPY, H4

The EU summit in Brussels will put the focus firmly on Brexit, although the president of the European Council, Tusk, said yesterday that there are “no grounds for optimism” with regards to reaching a breakthrough in negotiations at this juncture.

Initially today’s EU-27 summit (held in form of a working dinner) was scheduled to sign the exit deal and a political declaration outlining the long-time relationship between the EU and the UK, but with talks put on hold and without an agreement on the Irish border, EU officials now will have to decide whether sufficient progress has been made to schedule another summit for November. Prime Minister May has accepted an invitation to address EU-27 leaders, although these meetings are never the place for official negotiations, which are held in the run up to councils and led by chief negotiator Barnier, who will brief EU-27 leaders on the progress and state of play today. Unofficially, some suggest December, rather than November, may be a more realistic date for the signing of a final deal (if officials can square the circle on the Irish border), which then has to be rushed through parliaments before the official Brexit day at the end of March next year). There has been some optimistic noise on the side of the EU and some commentators have suggested that part of the public breakdown of talks this week is UK posturing aimed at the home audience and designed to bring Prime Minister May in a better position to push through a deal against hard line Brexiteers. Still, the risk of a no-deal Brexit remains uncomfortably high.

Meanwhile, the Sterling has settled lower after printing respective 3-session highs versus the Dollar and Euro yesterday. The Cable is near 1.3160-70, down from yesterday’s peak at 1.3227, supported however from the 20-period SMA in the 4-hour chart.

GBPJPY, on the other hand, has remained below the two currencies’ respective highs from yesterday, although also running higher during the Tokyo AM session. The weakness in the Yen has been concomitant with an improvement in risk appetite, although Chinese markets remained out in the cold and posted losses. Interestingly, despite the 51 pips decline, it holds support at the PP level at 147.74 for 6 consecutive 4-hour candles. If we zoom in into the 1-hour chart, we notice a rebound from PP level, and improvement on momentum indicators, suggesting rising bullish bias in the near term.

But as today’s meeting is crucial, the risk for the Pound remains. In the medium term however Pound crosses remain in track with an uptrend since mid-August.

Resistance levels: 148.20, 148.48, 148.90

Support levels: 147.74, 147.50, 147.00

Nevertheless, Brexit risks will not be the only event to cloud over the outlook today. The rising yields, US-Sino trade tensions and Italy’s confrontation course to Brussels, all continue to weigh on the market.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/10/17 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.