Fiscal Policy refers to the collective actions a government takes with regards to its spending and income levels aiming to influence a nation’s economy. Government spending includes investment in important projects such as building and maintaining schools and roads, in addition to government employees wages, while government income is usually derived in the form of income and value added taxation.

Fiscal policy works best when the government is being proactive and not engaging in policy actions to satisfy voters at the expense of economic stability. This suggests that fiscal policy needs to be expansionary, i.e. increasing spending and/or lowering taxes when the economy is in a recession, and contractionary when the economy is booming. One policy usually necessitates the other: if a government carelessly spends funds during expansionary periods then its debt will increase by so much that it will not be able to borrow in order to spend in periods of contraction.

The main difference between fiscal and monetary policy is that the former’s effects are direct and do not rely on any channels of transmission to reach the consumer. For example, if the government decides to decrease taxation, this means that the public will have more money to spend which should increase private spending and assist in reviving the economy. This will also assist the inflation rate to remain close to the 2% level and not slide below it. Similarly, if the government decides to increase spending, the additional money will enter the pockets of the people and businesses who worked on the projects the government sought to undertake. Interestingly, higher government spending will actually aid government finances, at least to an extent, as it will mean more consumer spending, which suggests higher proceeds from value added and income taxes.

Overall, fiscal policy is more direct compared to monetary policy, given that its effects reach consumers and businesses much faster and do not rely on other institutions. However, fiscal policy usually takes longer to materialize its plans given its large dependency on long, usually bureaucratic, procedures for undertaking projects as well as because changes in tax rates have to pass through the Parliament and hence require much more time.

The effects of any fiscal policy are not the same for everyone, since a tax cut could affect only the middle or upper class. For example, the tax cuts proposed by the Trump administration were expected to be beneficial for the upper class but not so much for everyone else. Similarly, when the government decides to adjust its spending, such a policy may affect just a specific group of people: while building a school will benefit construction workers and improve the well-being of the community, spending more money on defence systems will only benefit particular companies and a specialized pool of experts and not do much for overall employment.

As expected, if fiscal policy is expansionary for longer than required, i.e. long after an economy is out of a recession, then inflationary pressures are likely to occur in the country. Note that increased government spending will increase demand for goods and services and hence place upwards pressure on the inflation rate. Thus, a looser fiscal stance may provide incentives for the Central Bank to raise interest rates faster than it would have otherwise. Such actions mark the interplay between fiscal and monetary policy. While, ideally, the two should be moving in tandem, there are times when governments, moved by the incentive to satisfy voters, may choose to spend more than they should, given that the economy is booming. At such times, monetary policy can choose whether to move to dominate fiscal policy or whether it should choose a more accommodative stance.

The idea behind dominance is that, during specific periods of time, monetary policy can influence the way fiscal policy moves and how it affects the economy, while in other periods of time the opposite will hold. Imagine for example that, at a given policy rate and in an economy which is booming, the government decides to increase spending. If spending continues to increase then government debt would rise and monetary policy would be faced with two options: either maintain the same policy rate so as not to increase debt repayments or increase the interest rate so that the cost of borrowing becomes higher and the government is forced to reconsider its spending policy. In the first option, monetary policy is accommodating fiscal policy, i.e. it assists it and may actually help it if it further lowers interest rates. In such a scenario, fiscal policy dominates monetary policy as the latter is forced to assist the former. In the second option, monetary policy dominates fiscal policy as it acts in such a way as to constrict it from maintaining its current level of expenditure and thus decrease inflation in the country.

Market Reactions to Fiscal Policy

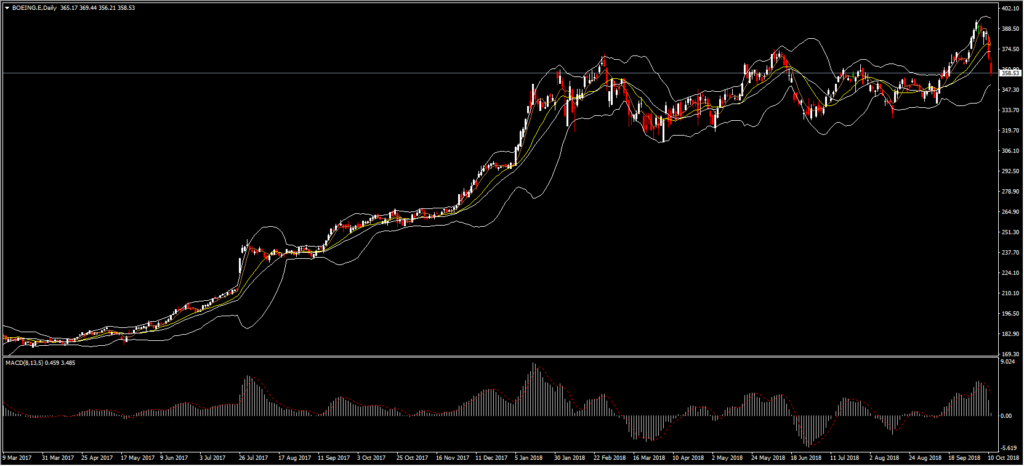

That said, the markets also react to fiscal policy. Still, the reaction is not as straightforward as it heavily depends on the type of policy pursued and its implementation. For example, stocks rose on December 21, 2017 following the above-mentioned US tax bill, with the US30 gaining 99 points. This development was correctly interpreted by the market as one which should increase company profits due to the reduction in the tax burden. Similarly, an increase in defence spending should boost the stock market performance of companies such as Boeing whose stock price has more than doubled since 2017. In contrast, austerity measures proposed by European governments during the sovereign debt crisis had a negative impact on the stock exchange as they have, expectedly, reduced demand in the economy and shrunk corporate profits.

Fiscal policy also has an effect on the currency market, albeit depending on the type and size of the intervention. The Trump tax cuts, for example, should have a positive effect on USD given hat they will overall boost the economy. Nonetheless, if deficit spending (i.e. spending more than the government receives) persists then debt sustainability issues may arise, given that the country’s debt burden is already too high. This is also the reason that the Euro plummeted on the eve of the sovereign debt crisis, as government spending was found to be unsustainable and tax increases as well as spending cuts were due. As such, fiscal policy is expected to have a similar impact on the FX market as on the stock market but with a twist: if the policy is expansionary then usually FX rates will also rise along with the stock market. However, FX rates and stock markets may also rise in the case that tax rises and spending cuts are viewed as having positive long-run effects and assist in debt sustainability.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/10/16 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.