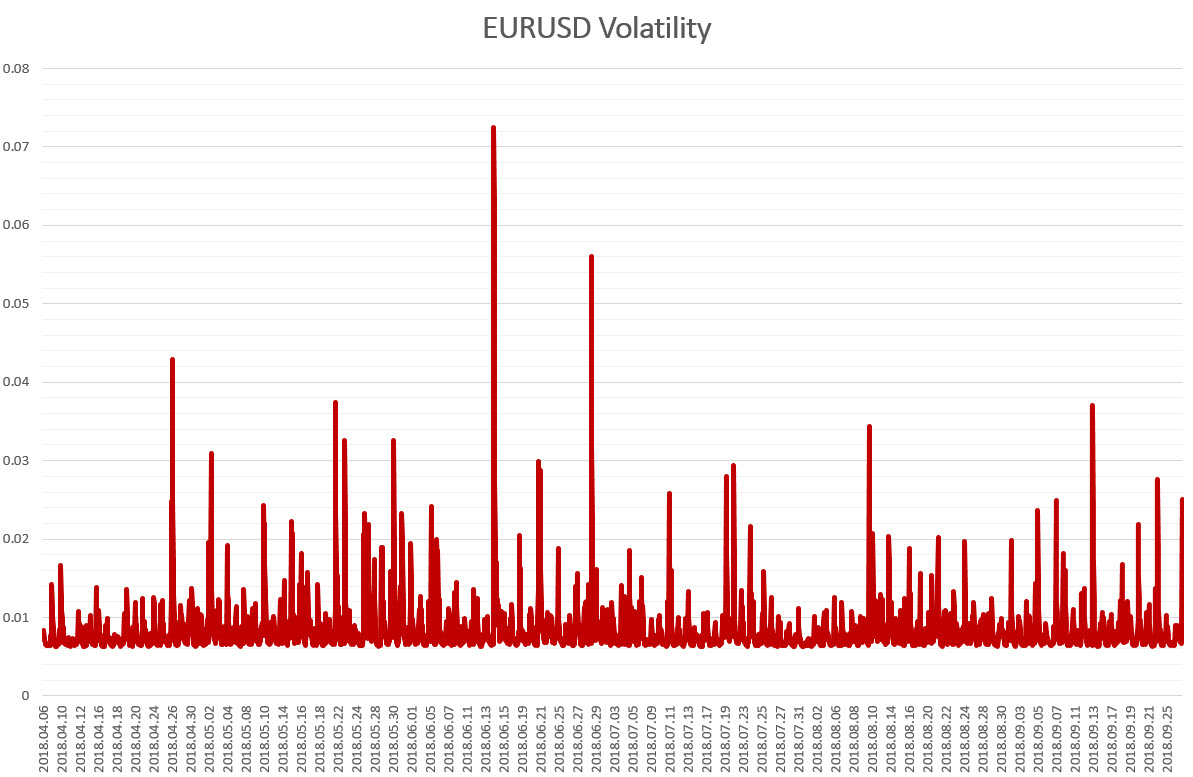

In financial markets, volatility is important, not only as a way of viewing the riskiness of an asset but because it creates investment opportunities and possibilities for profits – although, as always, care needs to be taken that volatility does not hurt our capital. Hence, it is a good idea to understand when volatility will rise in order to be able to either protect or profit from it. Here at HotForex, we have done exactly that and this paper presents the most volatile events of the past six months (April-September 2018) in the EURUSD pair, and how these have affected currency returns.*

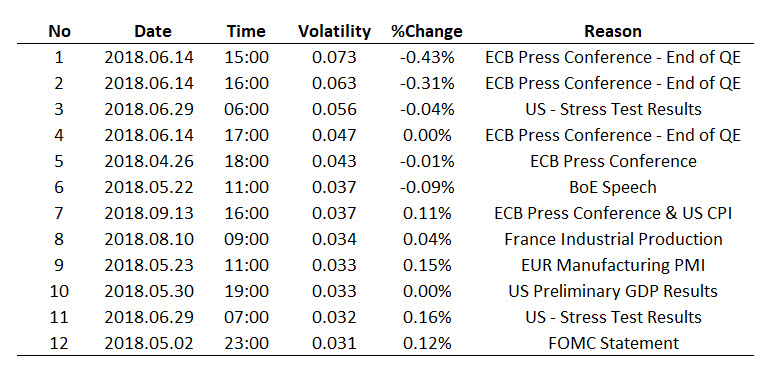

As the figure above shows, there are some days in which volatility spikes up and others when the markets are relatively calm. One would expect that days with many data releases would be related with higher volatility in the markets, however, the following table examines the top 12 days in volatility and reaches a different conclusion. As the reader may observe, the events with the highest volatility were ones involving Central Bank statements, either with regards to specific policy events (e.g. End of QE or Stress Tests) or just ad-hoc speeches such as the BoE Speech in May. In total, 9 out of 12 events were related with such issues while only 3 events were associated with data releases.

Overall, it appears that events related to monetary policy developments and the views of Central Bankers have a stronger effect than data releases. This is the case because, usually, Central Bankers possess more information on how the economy is evolving and their view of the economy is usually more educated than those of other market participants. In addition, events such as QE and Stress Test results weigh heavily on the financial sector and are thus justified in entering the list. The effect of the events on the exchange rate naturally depends on the type. For example, the Euro declined at the ECB announcement that QE would end, but registered mixed returns on the publication of US Stress Test results.

Surprisingly, events which were expected to cause more volatility, such as inflation, NFP, and trade balance data releases are not included. This could likely be attributed to the fact that such events often cause less volatility because they are usually better forecasted than speeches and conferences in which the information provided is, in many instances, unpredicted. As such, the most important conclusion to be reached from the presentation of major volatility events is that, most of the time, volatility occurs unexpectedly and not from data releases. Careful traders should be able to either not lose much money when such events occur or be able to benefit from such volatility and place their bets in a way that unexpected events aid them in achieving their targets.

*Conditional volatility was estimated using a GARCH(1,1) model on the hourly returns of the EURUSD pair, with data ranging from April 06, 2018 16:00 to September 27, 2018 10:00. Using a lag of the returns made no difference to the results as it was statistically insignificant. ARCH and GARCH terms were significant at the 1% level. Results available upon request.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/09/25 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.