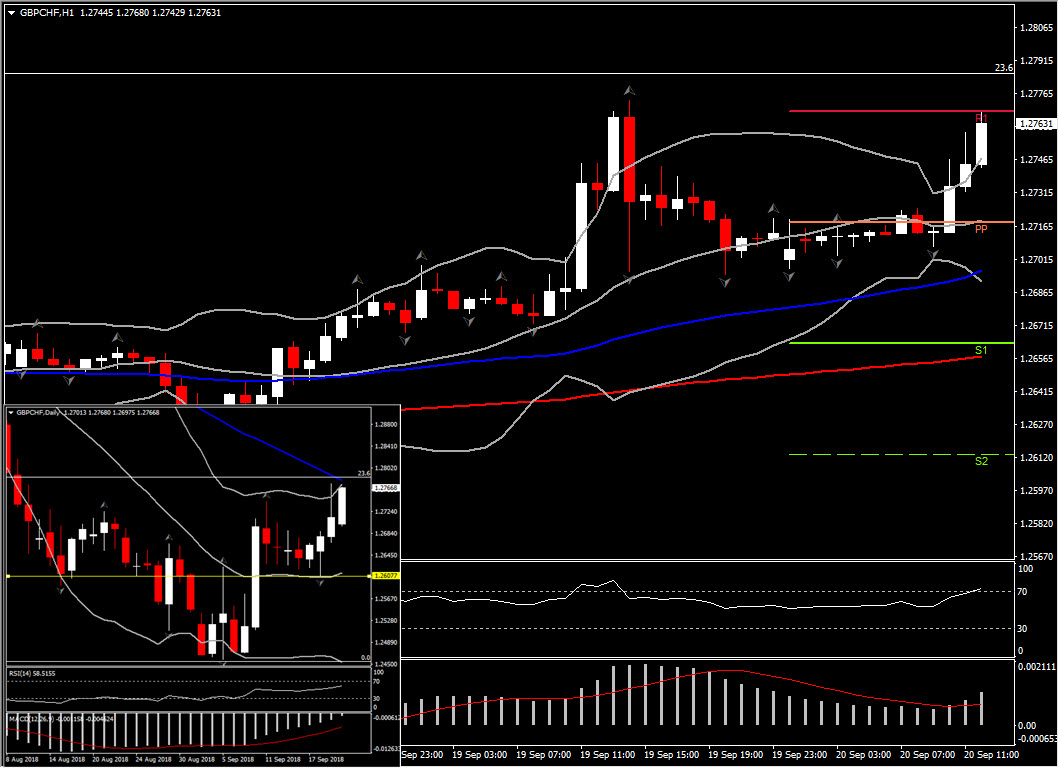

GBPCHF, H1

UK August retail sales beat forecasts, rising 0.3% m/m and confounding the median forecast for a 0.2% m/m contraction. The y/y figure showed an expansion of 3.3%, well up on the median forecast for 2.4% growth. The data still marks a deceleration from the strong July figures of 0.7% m/m and 3.5% y/y. The breakdown showed increases across all sectors except food, clothing and petrol. Growth rates of 2.8% in non-food stores and a 4.5% expansion in sales at household goods stores in particular paced the headline retail sales gains, underpinned by sunnier and warmer weather compared to the previous year. The underlying trend was strong, rising 2.0% in the three months to August versus the previous three months.

Overall, the strength of the data fits with rising real wages and record-level employment in the UK, with good weather an added factor. Sterling rallied in the immediate wake of the data release, which follows yesterday’s hotter than expected inflation data, before the move quickly lost puff, with Brexit uncertainty reining in market reaction to fundamentals.

As expected, GBPCHF jumped just over 45 pips to a 1.2758 high following SNB’s policy announcement and guidance and the UK retail sales. SNB remained steadfastly dovish and explicit about the “highly valued” Franc, which it sees as still being at risk of further safe-haven driven appreciation. Follow-through Franc selling has been lacklustre. However, with the currency having already come under pressure yesterday in anticipation of SNB’s decision, EURCHF and GBPCHF have so far left today’s bottom and are currently retesting yesterday’s peak.

The backdrop of risk-on sentiment in global equity markets has also been conducive of a weaker Swiss currency. The Franc has in recent months been intermittently in demand as a safe haven currency (particularly when the Turkish Lira and/or Italian assets have been under pressure), even though a long Franc position has been made an expensive carry by the SNB given the -0.75% deposit rate. While strong Swiss GDP data for Q2 questioned the need for the SNB’s loose monetary policy, benign inflation (SNB trimmed inflation projections) and the risk of further currency appreciation is keeping SNB in dovish mode, at least until the time when the ECB starts tightening.

GBPCHF has so far printed 2 strong bullish hourly candles, while it continues northwards just a breath away from yesterday’s high at 1.2773. In the shorter-term picture, positive momentum is strongly holding today, with immediate Resistance at 1.2779- 1.2785, which is the 50-day SMA and the 23.6% Fibonacci retracement level of the decline from April 18. A spike above this area would take the pair closer to the 38.2% Fibonacci mark and the round 1.2900 level, while intraday could suggest a retest of R2 and R3 at 1.2820 and 1.2873.

Short-term momentum indicators such as H1 and H4 suggest that the pair has not yet reached overbought level. RSI in the hourly chart just crossed 70 barrier, whilst the MACD oscillator is increasing above signal line indicating further positive momentum. The daily picture presents a possible swing of the outlook from negative to positive in the near future.

To the downside, GBPCHF would need to reach 1.2700 to fully reverse the gains that were seen today. In the long term Support level is at the confluence of latest down daily fractal and 20-day SMA at 1.2605. A break of the latter could suggest the continuation of the decline seen since April.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/09/20 15:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.