We’ve been adamant that when it comes to trading the news, what matters is the difference between expectations and actual data. As we have already shown, exchange rates should react to any sort of data surprise, either positive or negative. If no surprises are recorded, then we would expect no change in the exchange rate. For example, the June CPI figure came out on June 12, 12:30 GMT, almost exactly as predicted, with only a small change in the YoY figure. As you may see from the figure above, no significant changes have been recorded in the exchange rate.

In contrast, on September 13, all CPI measures were less than expected. Economic theory would suggest that the USD would appreciate, given that, again, in theory, investors would have to correct their previous, worse than expected projection. However, the reaction was negative for the USD, as it registered a large drop in value. How is that possible?

Was anything wrong with the data release? From what we can tell, not really. Furthermore, previous data releases should have supported an appreciation of the USD. Average Hourly Earnings actually came out higher than expected at 2.9% YoY, compared to expectations of 2.7%. At the time of the announcement, the USD gained approximately 50 pips. Following this response, the market should have revised its perceptions about future inflation upward, given that there should be a positive relationship between inflation and wages. According to theory, lower actual inflation compared to higher predicted inflation should appreciate the USD. This didn’t happen though.

Why did the USD depreciate when theory suggested that it should have appreaciated?

In reality, the answer is that, often more times than we expect, markets do not abide by economic theory. The reason is that Economics teaches using a system of beliefs which, by definition, cannot abide to changing market conditions. Remember that inflation occurs because production cannot keep up with changes in demand, as it is more or less fixed in the short-run. As such, inflation would increase if demand increases and vice versa. Thus, the higher consumption and spending is, the higher the inflation rate will be. Too much inflation can be bad but there has really been no research pointing out whether a 2% level of inflation is worse than a 3% level of inflation. Thus, markets can interpret lower inflation as a sign that growth does not move as fast as it was expected. Naturally, this does not abide to the inflation differential story which dictates that the higher the inflation rate, the more the exchange rate would depreciate.

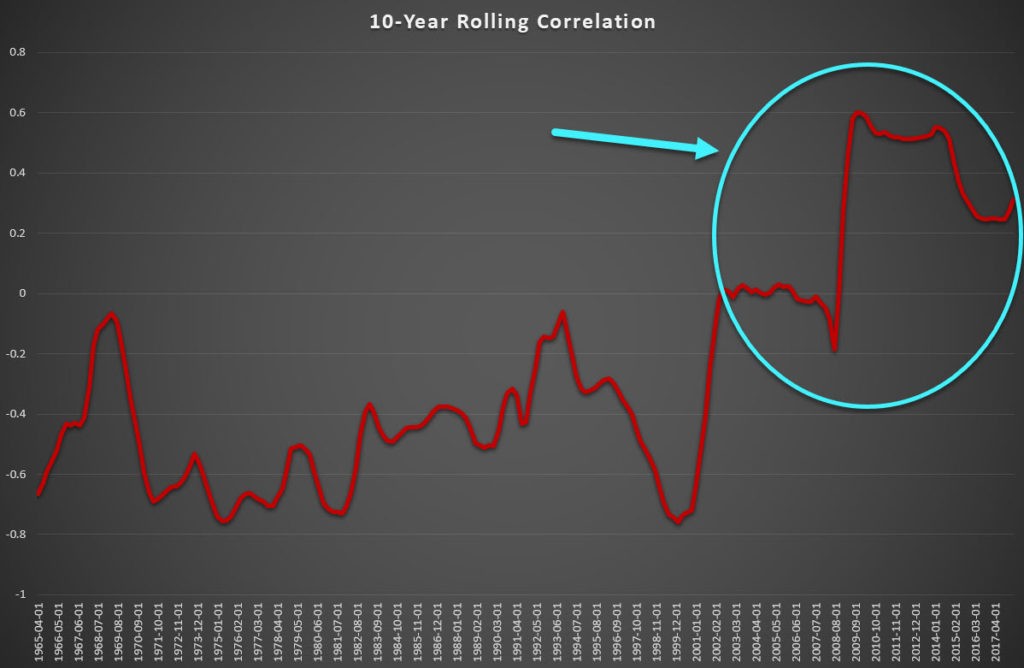

The market reaction could be linked to a more psychological reason: in the aftermath of the 2008 financial crisis, the inflation rate was very closely linked with growth, much more than ever before. Using a 10-year rolling correlation, the following graph suggests that the relationship between growth and inflation has actually changed, moving from negative to positive since the early 2000s and especially since 2009. Why does this happen? Is it just a reaction to inflation stability, good central bank policies and, more so, the economic rebound since the Global Financial Crisis? Most importantly, will this positive relationship persist or will it return to negative in the future?

Source: Author calculations using FRED data.

Truthfully, we cannot answer that question; in fact, nobody can. It is up to the traders to monitor the market and the evolving relationships between variables and try to reach their own conclusions. Economics can provide a good starting point for understanding how markets work, but we also need to understand that this does not necessarily mean that what it dictates is valid all the time. Practical experience, skin in the game, is the only way traders can be successful in adjusting their strategy when market patterns change. In Keynes’s words “When facts change, I change my mind. What do you do?”

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/09/18 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.