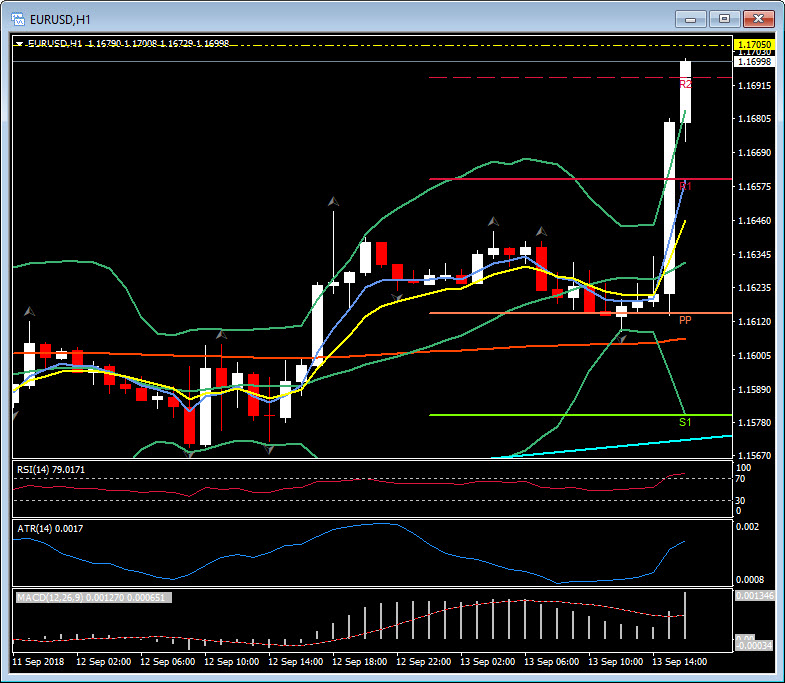

EURUSD, H1

Today’s US August CPI revealed a surprisingly soft core price rise, alongside the expected headline gain. Headline CPI rose 0.2% (rounded from 0.223%) with a 0.1% (0.082%) core consumer gain. The y/y increase of 2.7% in the headline index was down from 2.9% in July and June, and the 2.2% y/y core reading was down from 2.4% in July. Core gains reverted back to a softer path, with the average over the past six month at 0.16%. This data report is in line with expectations of a pull-back in headline y/y inflation that extends into Q4. Expectations are for a 0.1% September CPI gains for the headline and a 0.2% gain for the core with a 0.6% energy down-tick that should leave a 2.4% y/y headline rise, down from 2.7% in August. The core should be 2.2% y/y, steady from August. The core y/y price gain should be 2.0%, as also seen in July and May. An unwind of hard comparisons should allow a September drop-back for the headline y/y pace to 2.0%, while the core y/y rate slips to 1.9%. Both measures look poised to sustain these rates through Q4.

The Dollar weakened, with EURUSD shooting up to 1.1687 and looking to test the two-week high at 1.1705, following the downside miss in US CPI, along with risk-on conditions as US-China trade talks are set to restart, and as NAFTA negotiations with Canada remain upbeat. The CPI miss has also put pressure on the expectations for a December rate hike. Fed funds futures are fractionally higher following the CPI data and this brings into question a December tightening. The near-term contracts are flat as the market is basically fully priced for a 25 bp hike at the upcoming September 25-26 FOMC meeting. Chances for another move in December are running about 60-40, and that would be a fourth tightening this year, as suggested by the dot plot. The futures are sceptical that the FOMC will tighten three times in 2019, with a 25 bp hike expected by the end of Q2.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/09/18 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Head Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.