FX News Today

FX Action: Dollar and Yen underperformance has been the main theme so far today, heading into the London interbank open. The Japanese currency shows a 0.3% decline versus the Dollar, a 0.4% loss to the Euro and Aussie, and a decline of 0.5% against the Pound and Loonie. USDJPY posted a four-session high of 111.48, EURJPY has logged a three-session peak, and AUDJPY a two-session high. EURUSD, meanwhile, recovered back above 1.1600 while the Cable has posted a six-week peak of 1.3060, extending the gains seen yesterday after EU chief negotiator Barnier said a Brexit deal could be done by early November. The mood in global markets is currently neither risk-off nor risk-on, with participants waiting on the decision by the Trump administration on whether to proceed with the earmarked tariff hikes on $200 bln worth of Chinese imports.

Asian Market Wrap: 10-year Treasury yields are down from overnight highs, but still up 0.4 bp on the day at 2.935%. 10-year JGB yields fell back 0.5 bp to 0.099%. With U.S. yields starting to eye the 3% mark again, a weaker Yen helped to underpin Japanese stock markets during the Asian session. Asian markets outside of Japan , however, struggled as investors wait for fresh news on the trade and tariff front. The MSCI Asia Pacific hovered near a one year low, the Hang Seng is down -0.40% and flirting with bear market territory, and the CSI 300 is down -0.03%. In contrast, the Nikkei rallied 1.15%, while ongoing tech sector concerns saw Topix underperforming registering a small 0.53% gain. The Kospi, which failed to surge on the first Trump-Kim summit, still doesn’t look too excited about the prospect of a second and is down -0.20%. While the EM world is looking calmer, Bloomberg has warned this may the eye of an intense storm as central banks start meeting with Argentina today, followed by Turkey and Russia on Thursday and Friday. US futures are moving higher while oil prices are little changed and trade at USD 67.58 per barrel.

Charts of the Day

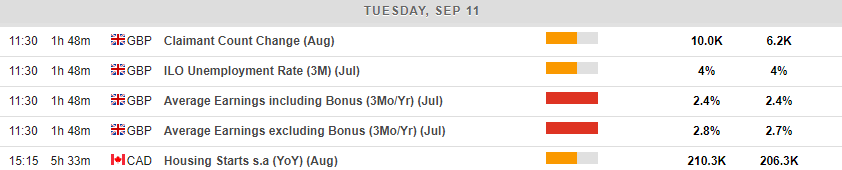

Main Macro Events Today

- UK Average Earnings – Expectations – Consensus forecast is that earnings will be slightly higher than last month, growing by 2.8%. Other labour market data, such as Claimant Count Rate, Claimant Change, as well as the ILO unemployment rate are also expected to come out at the same time. Consensus forecasts suggesting that there shouldn’t be much change in the unemployment rate, despite an increase in claimants.

- Canadian Housing Starts– Expectations – Expectations are that housing starts will be higher than July, with approximately 210k new houses starting.

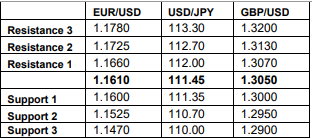

Support and Resistance Levels

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/09/11 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.