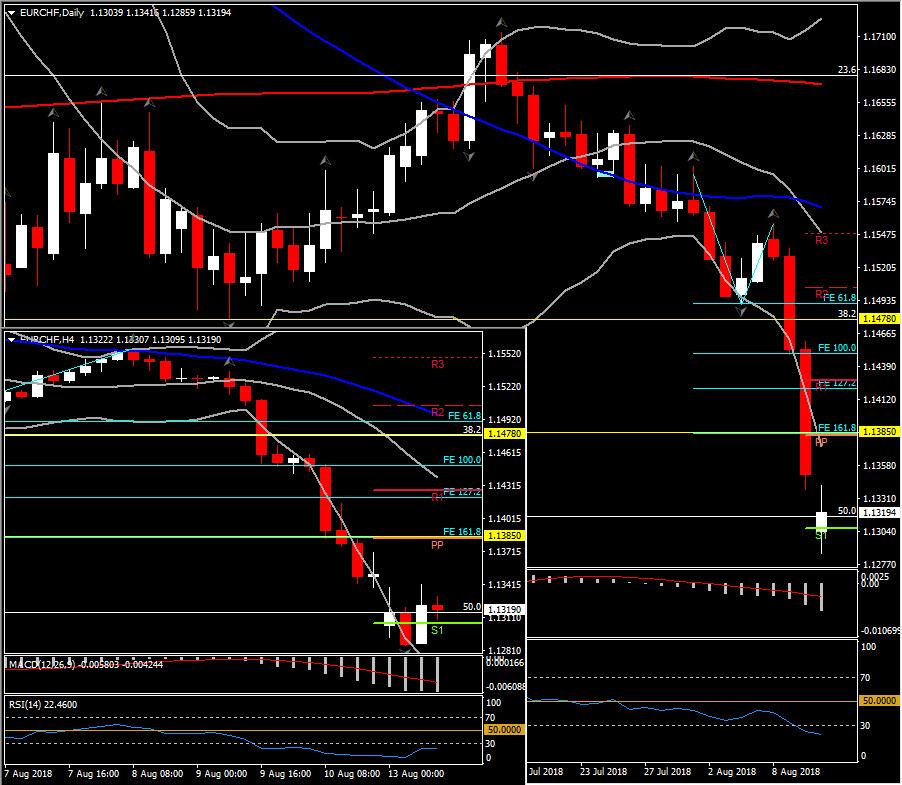

CADCHF and EURCHF, H4 and Daily

The deepening turmoil in Turkish markets has seen the Euro come under pressure, due to the exposure of European Banks, which in turn has driven the Swiss Franc higher. The Swiss Franc has made a rare re-emergence as a safe haven currency, which has driven EURCHF down by 0.5%, while it posted more than 50% losses since 2017’s rally from 1.0630 low up to 1.2000 peak (50.0% Fibonacci retracement level). Last week, EURCHF fell below 1.1350 for the first time since August last year, which will be displeasing to SNB.

EURCHF has been pulled lower by EURUSD, with the cross now down for a fourth consecutive session, logging a one-year low at 1.1287. The down move has breached the May low (at 1.1368) and in doing so it broke the base of a broadly sideways range that had been unfolding since August 2017. The low today is the new nadir of a retreat from the 2-month high that was posted in mid July at 1.1714.

So far today, EURCHF consolidates around S1 at 1.1306, after opening outside the lower Bollinger Bands pattern. By zooming in a lower timeframe, we could notice that it is consolidating for 4 consecutive 4-hour sessions within 1.1285-1.1340 area, holding immediate Support at 1.1285. Hence a drop below this area could suggest a swift from the current neutral mode to the continuation of the sharp decline seen since July 16, and therefore a retest of last August low at 1.1258. That level could confirm further downside pressure, probably towards next Support at 61.8% Fib. level at 1.1150.

The technical picture meanwhile, continues to support that the bearish momentum still holds and has not run out of steam yet, despite the intraday consolidation. The 20-Day SMA crossed below 50-day MA. The daily RSI is at 22, and daily MACD oscillator slipped below its trigger line, suggesting that there is more space to the downside in the near future while momentum is too weak to provide a sustained move higher.

In the event of an upside reversal, the confluence of PP level and the FE 161.8 set from the upside correction seen last Wednesday, at 1.1385 is the nearby Resistance, which if it breaks could suggest the retest of the 38.2 Fibonacci retracement and 2-month Support, which coincides at 1.1478.

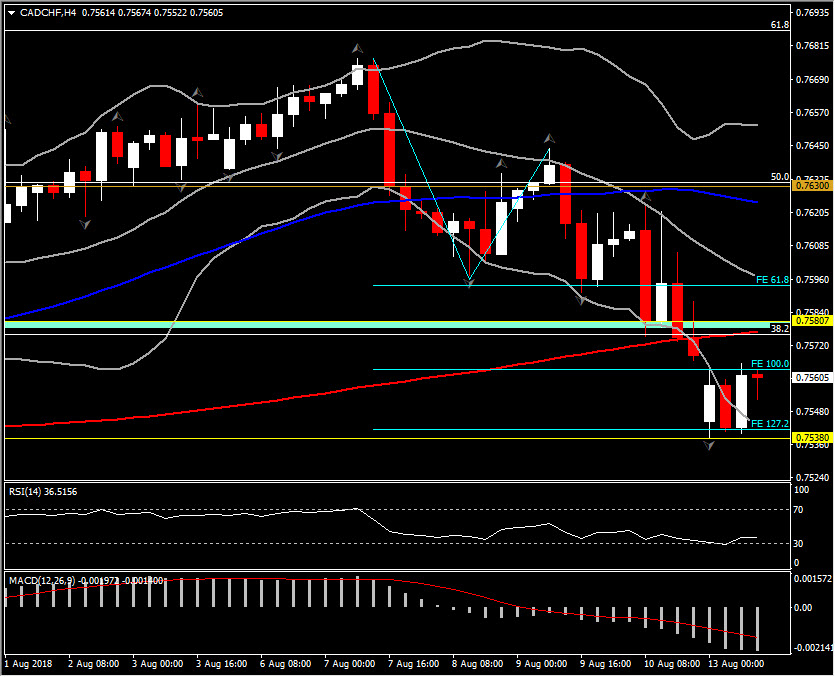

Other Swiss crosses have seen similar price actions. Political and Brexit-related uncertainty have been keeping the Pound under pressure and therefore GBPCHF hit a 10-month low at 1.1249 on Friday. On the other hand, CADCHF posted 3-week lows at 0.7538 before rebounding today up to 50-day SMA at 0.7564. A closing, today, above the 50-day MA but more precisely at the confluence of the midway since Friday’s decline and the 38.2% Fib level could imply to a reversal to the upside. This upwards movement is likely to test next Resistance at the 50.0% Fib. level at 0.7630. Support levels come at: 0.7538 and 0.7520.

Any sure signs of progress on the NAFTA front would likely spark a rebound in the Canadian Dollar, as the uncertainty about the re-negotiation has seen a discount being built into the currency.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/08/12 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.