FX News Today

European Fixed Income Outlook: 10-year Bund yields are down -2.0 bp at 0.352% as of 06:09 GMT, versus declines of -1.8 bp and -1.1 bp in Treasury and JGB yields. Bonds are supported by a fresh rise in risk aversion that put pressure on stock markets during the Asian session. European stock futures are heading south in tandem with US futures. The spiral of tariffs is weighing on the global outlook and in Europe Brexit concerns, and now also worries that European banks could be hit by the fallout from the crisis in Turkey and the slide in the Lira, are underpinning the flight to safety. The FT reported that the ECB’s supervisory arm has raised concerns about the exposure of some banks. The calendar is picking up today, with the focus on UK GDP numbers for the second quarter. The UK and France also released production numbers for June and, Sweden and Norway have inflation data.

FX Update: The Dollar has rallied strongly into the London interbank open, driving EURUSD to a 13-month low of 1.1448, Cable to fresh one-year lows under 1.2800 and AUDUSD to three-week lows. The Greenback has also posted gains against most other currencies, most notably the Turkish Lira, which has tumbled to fresh record lows. As the Turkish Lira continues to slide, raising concerns at the ECB’s Single Supervisory Mechanism is raising concerns about the exposure of some of the Eurozone’s biggest lenders to Turkey, including BBVA, UniCredit and BNP Paribas, according to an FT report, citing two people familiar with the matter. The risk is that Turkish borrowers may not be hedged against the plunge in the Lira and may begin to default on foreign currency loans. Turkish Treasury and Finance Ministry said yesterday that banks and non-financial corporations face no FX or liquidity risk.

USDJPY has lifted out of a two-week low, while Yen crosses have traded lower, partly driven by flagging global equity markets and partly in the wake of above-forecast Japanese Q2 GDP data, which rose 0.5% q/q, above the median forecast for a 0.3% q/q rise. USDJPY has lifted toward 111.0 after earlier printing a two-week low at 110.67. The Dollar’s ascent has been concomitant with a bout of risk aversion on investor concerns about an escalating trade war, and the impact of US sanctions on Turkey and Iran. Beijing today doubled down in the face of domestic criticism about its stance in the trade spat with the US.

Charts of the Day

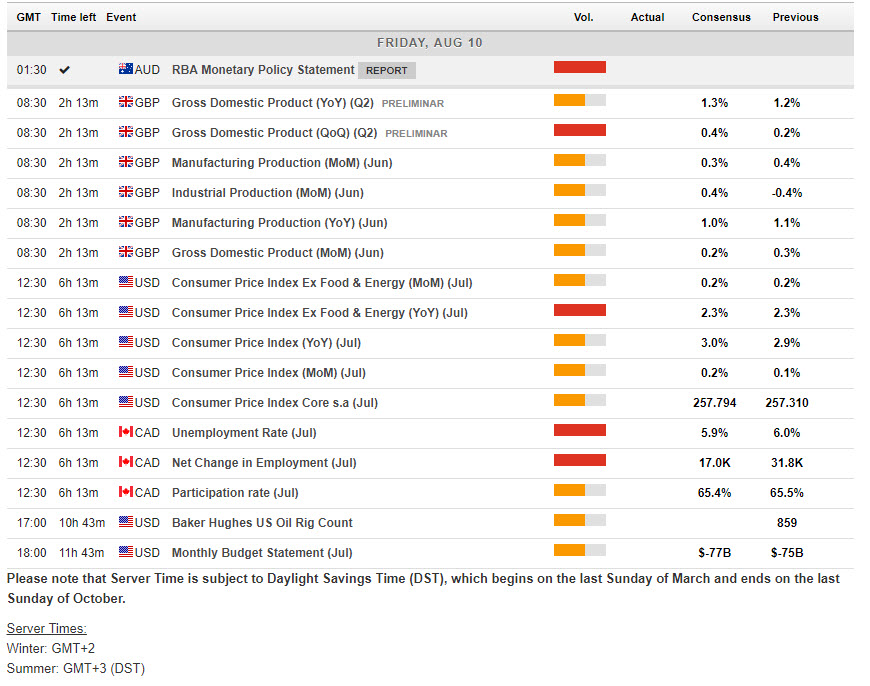

Main Macro Events Today

- UK GDP – Expectations – GDP should come in at 0.4% q/q and to 1.3% y/y from respective Q1 figures of 0.3% q/q and 1.2% y/y.

- UK Manufacturing and Industrial Production – Expectations –The Industrial production is expected to rise by 0.4% m/m in June, rebounding from the 0.4% contraction of May, with the y/y figure seen at 0.8% after 0.8% y/y growth in May. The Manufacturing production is anticipated at 1.0% y/y from 1.1% seen in May.

- US CPI and Core CPI – A 0.2% increase in the July headline CPI is expected, following a benign 0.1% gain in June. The y/y headline index should be 2.9% in July, steady from June. The core index should also hold steady at 2.3%.

- Canadian Unemployment data – A 15.0k gain is expected in total jobs during July following the 31.8k gain in June. The unemployment rate is seen slipping to 5.9% after perking up to 6.0% in June from the 40-year low 5.8% in May as more people looked for work in June.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/08/14 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.