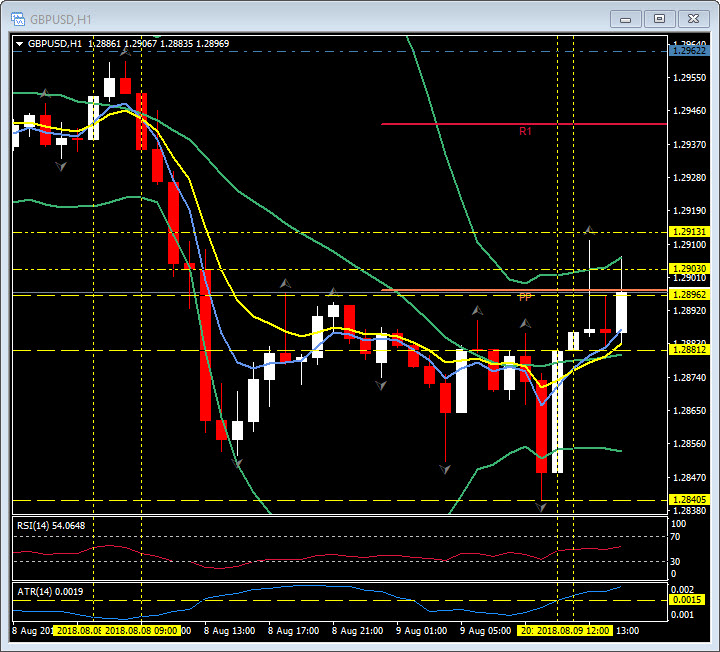

GBPUSD, H1

US PPI was flat in July, with the core rate 0.1% higher, a little softer than forecast. There were no revisions to June where the headline and ex-food and energy component were each up 0.3%. On a 12-month basis, PPI slowed to a 3.3% y/y pace versus 3.4% y/y (the latter was the highest since November 2011), while the core also cooled to 2.7% y/y from 2.8% y/y (was highest since September 2011). Goods prices were 0.1% higher last month, the same as in June, with food dipping 0.1% versus -1.1%, and energy falling 0.5% compared to the prior 0.8% gain. Services costs declined 0.1% after June’s 0.4% gain. A soft number for PPI but Initial claims remain at multi-decade lows. US initial jobless claims dropped 6k to 213k in the week ended August 4, following the 2k increase to 219k (revised from 218k) in the July 28 week. That brought the 4-week moving average down to 214.25k from 214.75k (revised from 214.5k). Continuing claims rose 29k to 1,755k in the week ended July 28 after dropping 21k to 1,726k (revised from 1,724k) previously.

The Greenback gave up some of its gains with USDJPY back to 111.00 and GBPUSD reclaiming 1.2900.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/08/09 15:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Head Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.