GBPUSD, EURUSD and GBPJPY, H4 and Daily

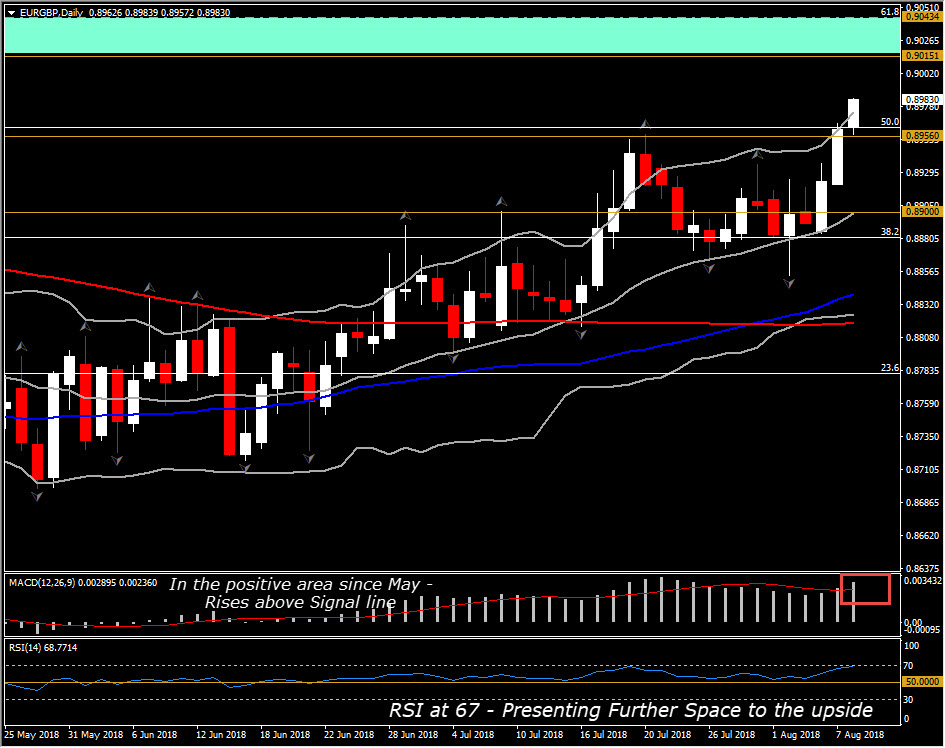

On August 2 I wrote: “Shifting attention to our Daily charts, we see that bullish picture is supported, as RSI holds above 50 since end of June, whilst MACD lines are slightly lower than signal line but they hold well above zero zone. The indicator’s performance along with the rebound from 20-DMA and the confirmation of the Golden Cross (50 DMA moving above 200 DMA) yesterday, suggested further strength ahead for EURGBP in the long term.

Hence, if the pair continues to move northwards above R2 at 0.8935, a decisive break of last week’s peak at 0.8956,which also coincides with the 50% Fibonacci retracement level set since August 2017 peak, could open the doors for 0.9015-0.9040 barrier (November 2017 peak – the 61.8% Fib. level). If EURGBP fails to extend gains, then we may see a test of S1 at 0.8870. The S1 coincides with 3 low fractals in the 4-hour chart but also the 23.6% Fib. level since the rebound in April 17. Hence on the break below this Support level, the next handles are coming at 50- and 200-DMA, at 0.8824 and 0.8816 respectively“.

This week, as Pound has come under new broad pressure, showing an average decline of nearly 0.7%, against all major currencies, EURGBP posted gains above Resistance at 0.8956. Hence as reported last week, a decisive break of last week’s peak at 0.8956,which also coincides with the 50% Fibonacci retracement level set since the August 2017 peak, could open the doors for 0.9015-0.9040 barrier ( November 2017 peak – the 61.8% Fib. level).

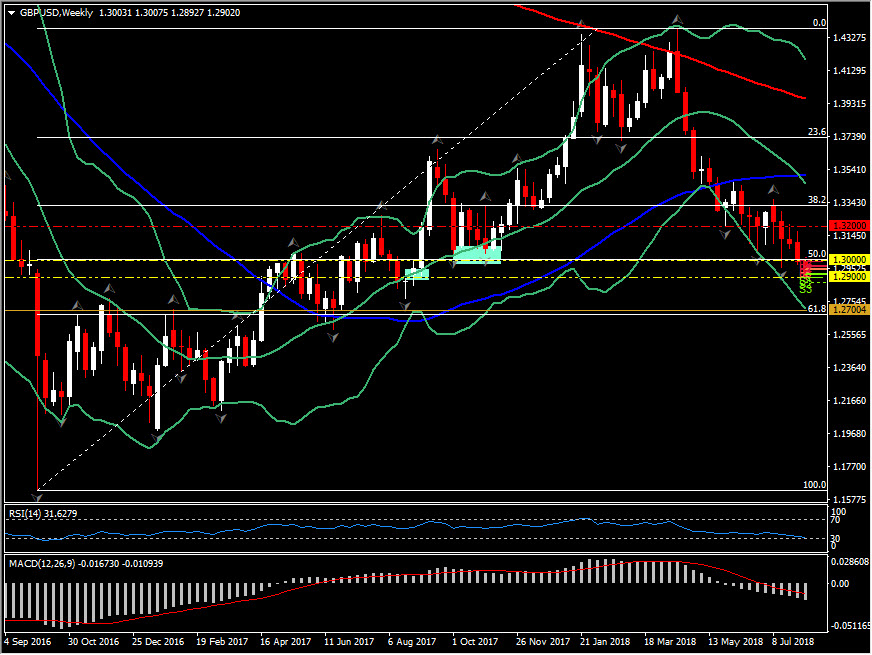

Cable has remained heavy, failing to sustain recovery gains above 1.2950 after printing a fresh 11-month low at 1.2901 yesterday, while today it is moving below the round key level at 1.2900. This is now the fifth consecutive week of declines, which is the latest down phase in a bear trend that’s been evolving since mid April from levels near 1.4400. The most recent losses reflect a market asking for a bigger Brexit discount in Sterling, which we estimate to have been 10-15% in trade-weighted terms since the vote to leave the EU in June 2016. The discount took another ratchet after a senior government member said over the weekend that the odds for a no-deal Brexit are now higher than the odds are for achieving a new deal.

This comes with Prime Minister May’s government having become firmly stuck between a rock and a hard place, with most EU leaders backing the European Commission in rejecting much of the British government’s Brexit plan while a sizeable minority of May’s Tory party think that the plan concedes too much to the EU. This raises the possibility for there being another referendum, while both the EU and UK have issued contingency-planning advice for a no-deal scenario (though officials have stressed that this is nothing more than a tactical consideration at this stage).

Hence Cable continues to be in a trend following mode, with markets keeping an eye on Brexit developments. The August 2017 low at 1.2774, which coincides with 61.8% Fib. level since the 2016 bottom, provides a downside way-point. Also interesting is the fact that all intraday (H1 and H4)but also long term momentum indicators strongly support that the pair has not reached an oversold level yet. All of them present RSI slightly above or on 30 level, while MACD lines increase below signal line within the negative area, suggesting that there is further steam to the downside.

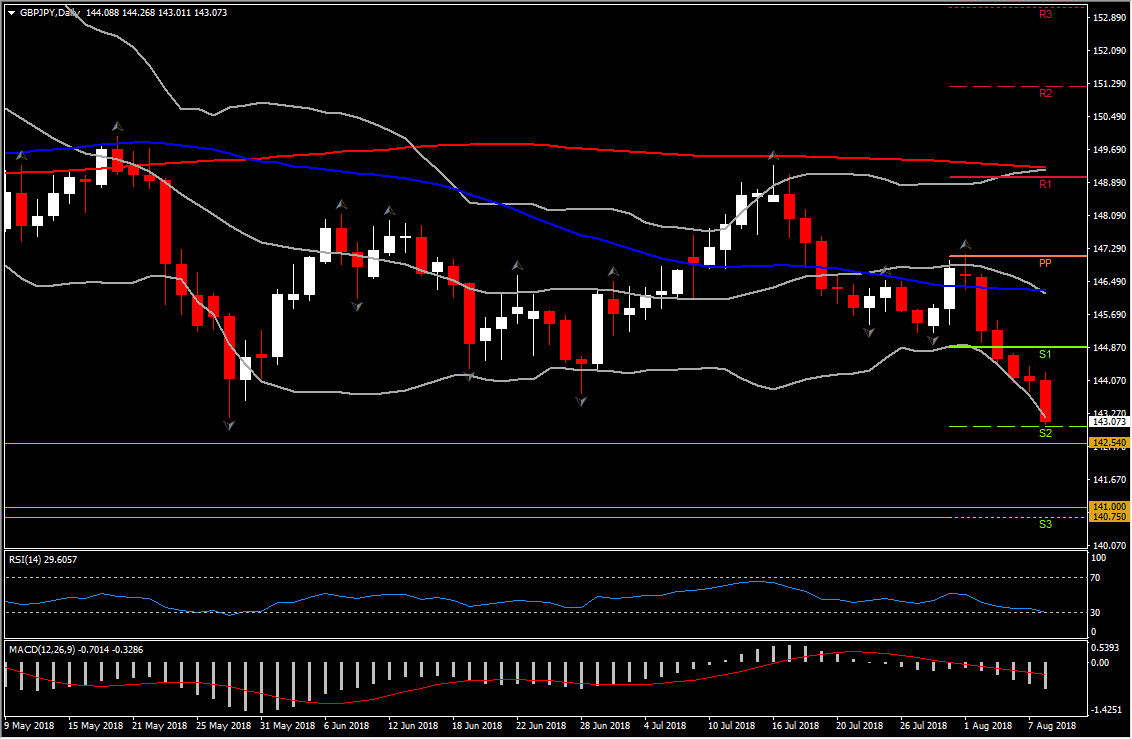

Nevertheless, another cross that has been sold-off quite aggressively so far today is GBPJPY, with declines of nearly 0.7% or more on the day. GBPJPY posted a fresh year low at 143.01. Next Support level holds at the September 2017 low at 142.54 and the 140.75-141.00 area.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/08/08 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.