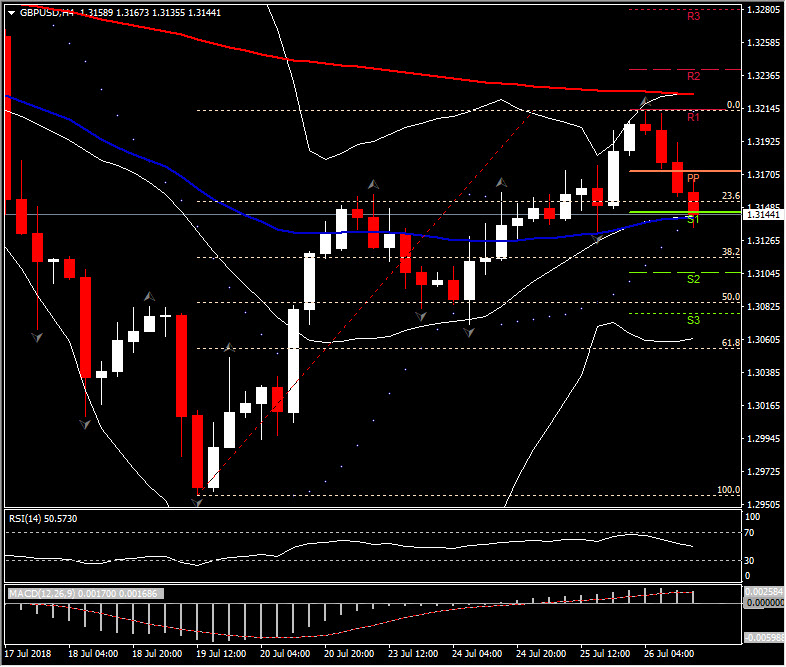

GBPUSD, H4

Cable has tracked EURUSD to intraday lows, while EURGBP has tipped modestly lower in the wake of the ECB guidance.

Cable printed an intraday low at 1.3122, extending the pullback from the 9-day high that was posted during Asian trade at 1.3213. Cable had been anticipated to cap out after rebounding from the 10-month low that was seen last Thursday at 1.2957. The pair would need to close above 1.3135 this week to break a run of 2 consecutive down weeks.

In the medium timeframe, the pair has been trading bearishly for 4 consecutive sessions, while it currently retesting the confluence of the 20 and 50-period MA at 1.3140. Hence a closing of the session below this area will confirm the continuation of the negative momentum.

Technically, momentum indicators along with 3 black crows imply that the bears are back in control intraday, and therefore the 50% Fib. level and Tuesday’s low are likely to be retested in the short term, at 1.3080 and 1.3070 level respectively. RSI crossed below neutral zone, while MACD decreased below its signal line. Immediate Resistance holds at 1.3160 and Daily Resistance at 1.3200.

Brexit-related uncertainties remain significant with many pundits reckoning that there is a possibility of the UK leaving the EU next March without agreeing on a new deal, though we think this unlikely (an extension to the negotiating timeframe would be more likely). This should maintain Sterling’s Brexit discount, which we estimate to be about 10-15% in trade-weighted terms. The BoE MPC August meeting is now looming, with the announcement due Thursday next week. Sterling money markets are discounting a near 80% probability for a 25 bp hike in the repo rate (according to Reuters), to 0.75%, which has long been our view, though such a move would likely be couched in cautious policy guidance given the sharpening risk of Brexit-related uncertainty. The latest Reuters poll of economists found the consensus is for BoE to push the repo rate to 1.0% by the end of 2019.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/07/31 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.