USOil and XAUUSD, H1

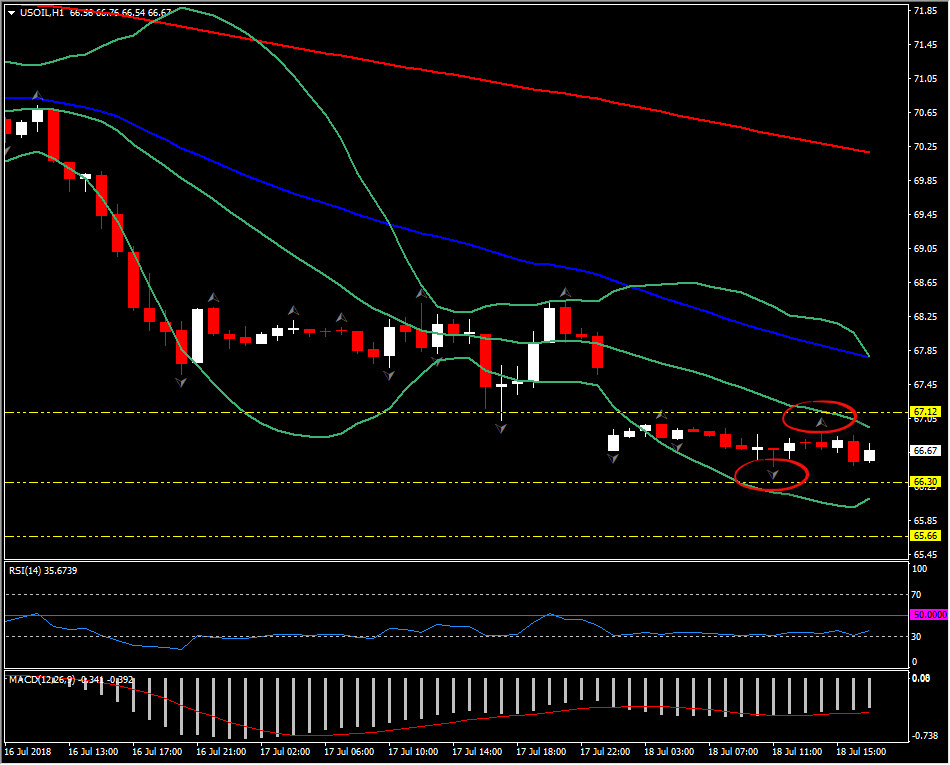

USDCAD topped at 3-week highs of 1.3259 at the North American open, since pulling back to 1.3228 lows. Commodity price weakness, specifically Oil and Gold, have supported the pairing of late. WTI crude remains near 1month lows, trading in the mid-$66 range. USDCAD support now comes in at 1.3196, the 20-day moving average, with resistance up at the psychological level of 1.3300.

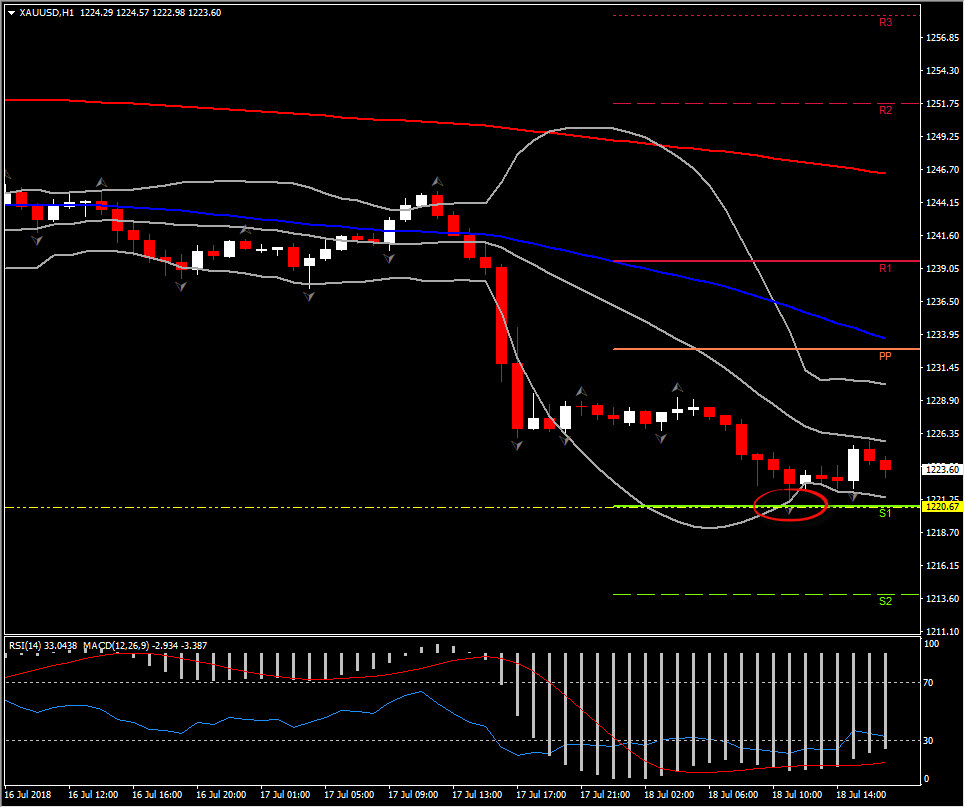

Meanwhile, Gold hit fresh 1-year lows of $1,220.90 in London morning trade, as the USDIndex touched 3-week highs. Dollar sterngth as a result of Fed Chair Powell’s upbeat testimony on Tuesday, ignoring the big housing miss, has continued to weigh on Gold prices. The contract has printed seven consecutive lower daily lows, and is on track to test the July 10, 2017 low of $1,209.60 and even lower at the round $1,200.00 level.

The June housing starts report was weak with a 12.3% plunge for starts and a 2.2% decline in permits. The weakness in housing starts was led by multi- family units, but a big drop for single-family units as well. The solid Q4-Q1 stretch for starts and permits weakened sharply in Q2, with a 15.7% decline in starts and a 12% decline in permits. We saw a 0.5% decline for starts under construction that leaves a tepid 1% gain in Q2. Completions were unchanged from May, and we saw a 5% gain in Q2, after solid 26% and 20% readings in Q1 and Q4 respectively.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/07/19 15:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.