USDIndex rallied to 106.50 to start the week amid fears of a dramatic slowdown China, along with an increasing likelihood of a recession in Europe. The PBoC’s 10 bp rate cut added to fears of a meaningful slowing in activity there, dashing hopes of a pick-up as covid restrictions were eased. US Yields dropped, while US Stocks posted a modest rally. Nikkei index closed almost flat, with energy-related stocks weighing the most. ASX rose 0.6% as upbeat earnings and record dividend from global miner BHP Group buoyed the mining sub-index. UK ILO unemployment remained steady at 3.8% in the three months to June – as expected. Commodities and Oil prices have been pressured by pick-up in risk aversion and concern that China’s recovery may be faltering.

- USDIndex climbed back over the 106.00 level after weaker than expected data out of China weighed on investor sentiment globally, and left the USD looking like the cleanest shirt in the basket. The buck held firm despite the steep drop in the Empire State index and a further slide in the NAHB housing index.

- Equities – USA500 rose 0.40% (4,303), coming off its 4th straight weekly gain, the best stretch this year. The USA100 was 0.62% higher (13,700), and the USA30 was up 0.45% (33,924).

- Yields – 2-year at 3.199% and 10-year at 2.788%, with the curve holding around -42 bps.

- Oil – fell over -4% to a low of $86.75, Copper is off over -2% to $359.20, as the USD strength exacerbated the weakness in key commodities.

- Gold – fell -1.27% to $1772.72.

- Bitcoin steady bellow 24500.

- FX Markets – EURUSD down to 1.0160, USDJPY steady at 133.35 and Cable slumped to 1.2040.

Today – ZEW Economic Sentiment from Germany and Europe. US Housing Starts and Building Permits and Canadian Inflation.

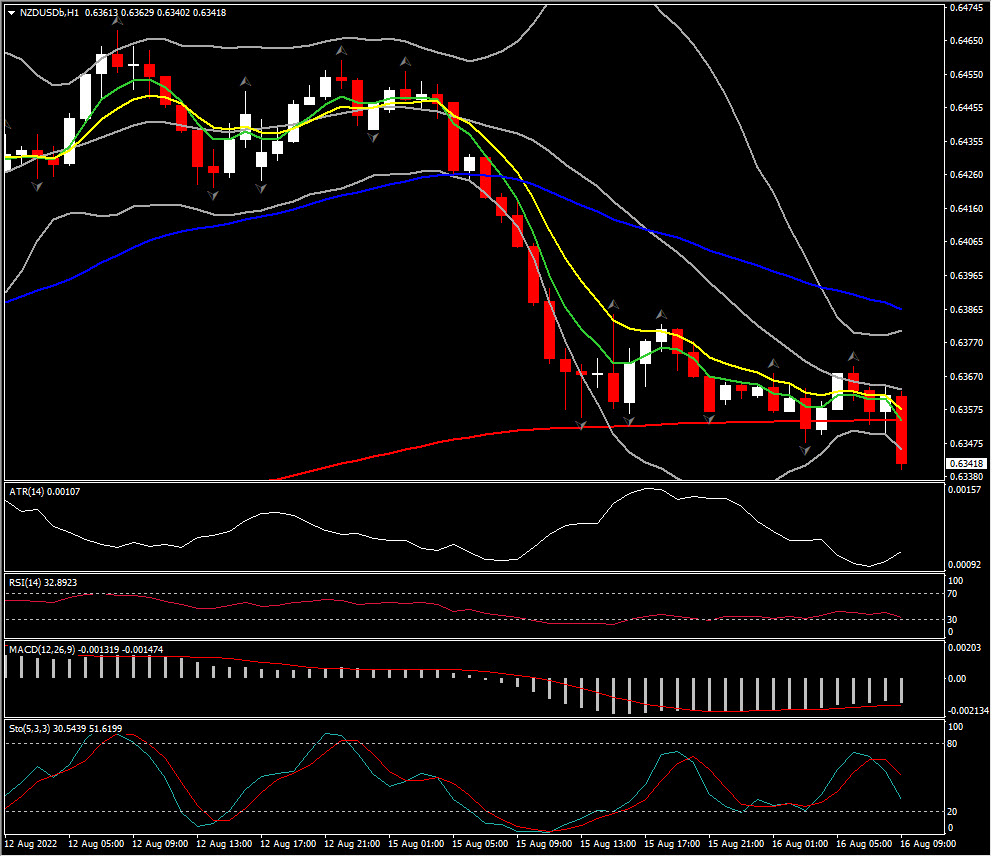

Biggest FX Mover @ (06:30 GMT) NZDUSD (+0.70%) retreating from 2 1/2 month peak (0.6467), currently to 0.6340. MAs aligning lower, RSI 32.66 & falling, Stochastic also down, but MACD lines flattened below 0. H1 ATR 0.00107, Daily ATR 0.00776.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.