FX News Today

Asian Market Wrap: Long yields continued to move higher during the Asian session, with 10-year Treasury yields up 0.5bp at 2.864% and 10-year JGB yields up 0.4 bp at 0.033%. Asian stock markets traded mixed, with Japanese bourses outperforming after returning from yesterday’s holiday as the Yen declined. Chinese Equities meanwhile sold off amid lingering trade jitters and with investors not convinced that earnings can compensate for the rise in protectionism. Markets are looking ahead to Fed Chairman Powell’s testimony to Congress. Nikkei is currently up 0.78%, while Hang Seng and CSI 300 are down -1.06% and -1.25%. US Stock Futures are narrowly mixed, and Oil prices are little changed at USD 67.99 per barrel.

FX Update: The Dollar majors have been holding narrow ranges for the most part, with EURUSD, USDJPY, Cable, AUDUSD, and other pairings, showing respective net changes of less than 0.2% on the day so far. EURUSD has been making time in the lower 1.1700s, and USDJPY in the lower 112.00s, after edging out a two-session high of 112.57. The Sterling has held up after the UK government scrapped through four parliamentary votes on its Customs Bill late yesterday, which was seen as a litmus test of the so-called Chequers plan (the Cabinet rubber-stamped plan laying out what it wants out of Brexit). There is another parliamentary vote today. While some hardline Brexiteers MPs are agitating for a no confidence vote in the prime minister, so far they are reported to lack sufficient support, and Boris Johnson, the Brexiteer with the most political weight, has remained on the side lines. Sterling market participants will be watching developments closely.

Charts of the Day

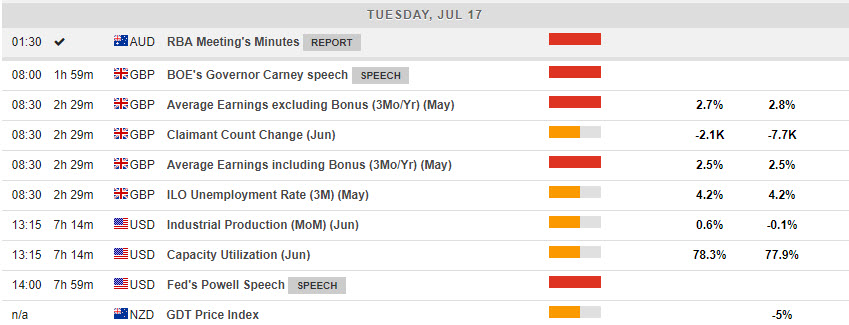

Main Macro Events Today

- BOE Gov Carney Speech

- UK Unemployment Rate and Average Earnings– Expectations – The Labor report is expected to show the unemployment rate remaining at 4.2%, and average household income also remaining unchanged at a rate of 2.5% y/y in the three months to June.

- US Industrial Production – Expectations – to rise 0.5%, rebounding from a 0.1% decline in May, based on the rise in hours-worked from the jobs report.

- Canadian Manufacturing – Expectations – to rise 0.5% after the 1.3% drop in April.

- Fed Chair Powell Testimony – Expectations – The Fed chief will likely be grilled on the impacts of trade, but he’ll have to take a wait and see approach there, while noting there are risks to the downside.

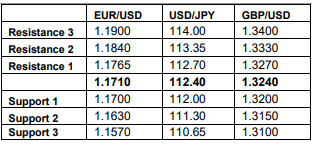

Support and Resistance levels

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/07/17 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.