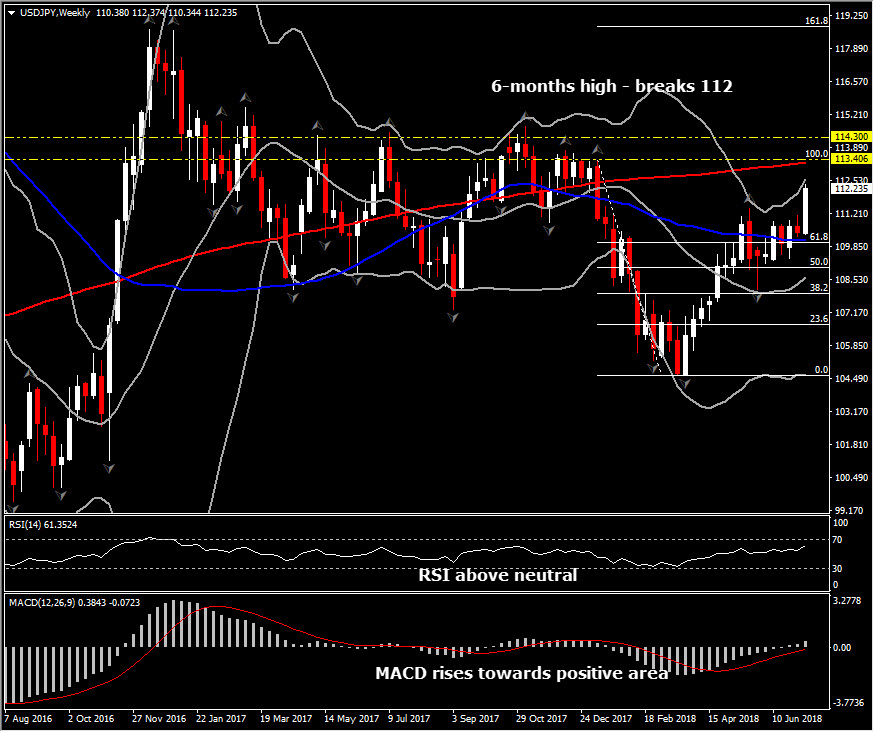

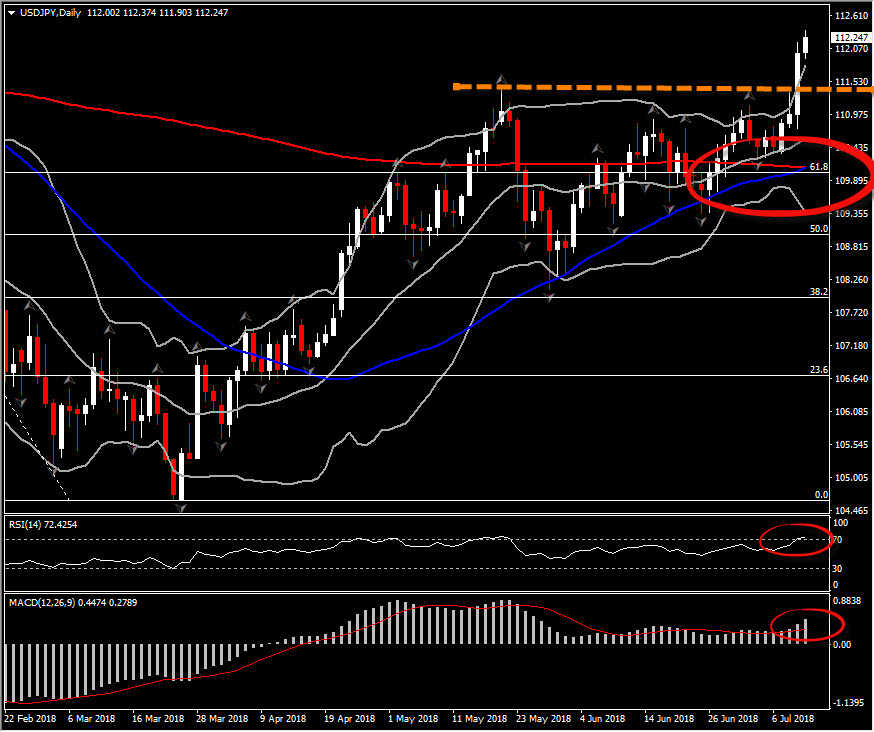

USDJPY, Daily and Weekly

The Yen has weakened amid a risk appetite revival in global asset markets amid a de-escalation in trade tensions, with both Washington and Beijing signalling a willingness to re-start bilateral negotiations. USDJPY rallied to a six-month high of 112.38 after breaking above the May high at 111.39. EURJPY lifted into three-week high terrain, and AUDJPY reversed most of the outsized losses the cross had seen yesterday (following Trump’s threat to slap tariffs on a further $200 bln worth of Chinese imports).

The Yen’s weakness reflects a unwinding in the currency’s built-in safe haven premium, which has allowed market participants to re-focus on bullish fundamentals of USDJPY (with the Fed on a tightening course while BoJ remains fully committed to maintaining ultra-accommodative monetary policy). Emerging market currencies rebounded as higher beta assets and currencies found fresh demand.

USDJPY rebounded from 61.8% Fibonacci retracement level since the peak of 2018 at 113.37. The Resistance comes at the confluence of the 200-Week SMA and January’s peak, within 113.24 – 113.37, while the next Resistance is set to 114.30. Support remains between the 61.8% Fib. level and the latest 3 consecutive daily upper fractals, at 110.00-111.40. Nevertheless, a crossing of the 50-day MA above 200-day MA would provide further confirmation to the upside for USDJPY.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/07/12 15:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.