FX News Today

Asian Market Wrap: Long yields moved higher as risk appetite improved. The 10-year Treasury yield is up 0.9 bp at 2.858% and the 10-year JGB yield is up 0.3 bp at 0.032%. Asian stock markets meanwhile recovered from yesterday’s slump, with Chinese markets outperforming as trade jitters abated somewhat as Chinese and U.S. officials reportedly flagged the prospect of returning to talks, with China’s Vice Minister of Commerce calling for bilateral negotiations to resolve the conflict. BoK’s decision to leave the 7-day repo rate unchanged at 1.50%, as expected had little impact. Nikkei and Topix are up 0.54% and 1.23% respectively, with a weaker Yen underpinning gains. The Hang Seng gained 1.00% and the CSI 300 is up 2.57%. US Futures are moving higher and the WTI Future is up from a low of EUR 70.60, but at USD 70.80 still considerably below recent levels.

German June HICP confirmed at 2.1% y/y, as expected. There were no real surprises in the data, which confirmed that higher energy prices are a key reason for the overshoot in the headline rate above ECB’s target. Heating oil prices rose 30.3% y/y, after 24.3% y/y in the previous month and petrol price inflation accelerated to 11.3% y/y from 8.2% y/y. Still, with the labour market looking tight and companies facing capacity constraints the room for a second round of effects to emerge is clearly larger than it was a year ago, which may explain why some at the ECB are nervous about markets pushing out rate hike expectations too far back.

Charts of the Day

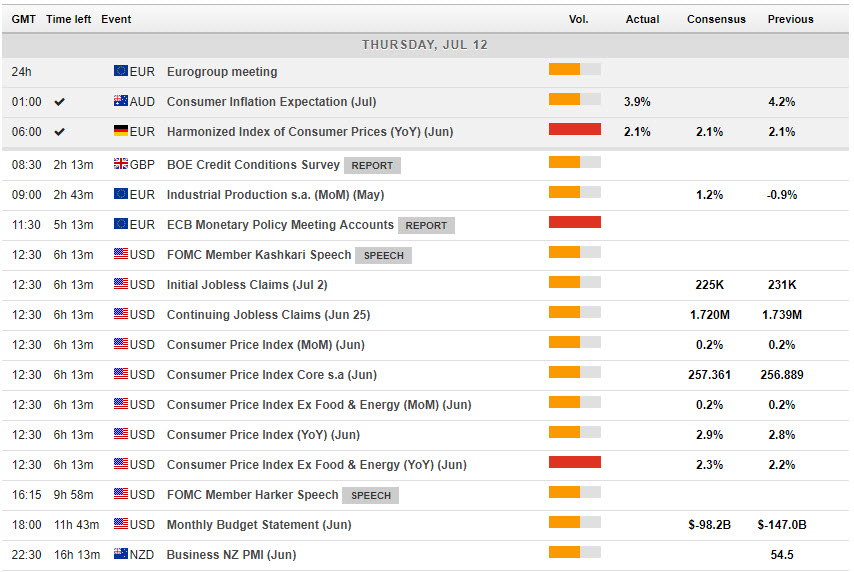

Main Macro Events Today

- BOE Credit Conditions Survey

- ECB Monetary Policy Meeting Accounts

- US CPI and Core – Expectations – forecast to rise 0.2% in June, following a similar gain in May. Core prices are estimated to rise 0.2% as well, the same as in May.

- US Jobless claims – Expectations – estimated to fall 18k to 213k in the week ended July 7, reflecting an expected early-July drop related to auto retooling

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/07/12 15:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.