Dollar continues its surge, breaking six-week highs on its way towards the 109.00 key level.

Dollar

The Dollar begins the week on the front foot, continuing its gains for four straight trading sessions. When we consider the decreasing risk sentiment in the market, coupled with investors still trying to assess and price in the hawkish comments gathered from the FOMC minutes last week, the Dollar is likely to revisit the key 109.00 level while we wait for the pendulum to swing either side of the 50bps or 75bps probabilities heading into September.

In terms of market structure, price has confirmed the bullish continuation pattern (falling wedge) by printing out a subsequent impulsive wave after bouncing from the 104.44 support level. The first target for this structure is the peak formation around the 109.00 area and price is still on track to test the target area as pre-empted in last week’s analysis.

Euro

The Euro kicked off the week with bears largely still driving price since the 1.03710 peak formation area which confirmed the high of a key technical level on the 10th of August 2022. Consequently, the European currency hit levels below parity in the trading session on Monday morning and is set to potentially break below, considering the fundamental outlook in the near & long term centred around the increasing energy crisis, geopolitical concerns, recession fears, and the key differences between the FED and ECB.

In terms of market structure, price has confirmed the bearish continuation pattern (rising wedge) by printing out a subsequent impulsive wave after bouncing from the 1.03710 resistance level. The first target for this structure is the peak formation around the 0.99529 area and price is still on track to test the target area as pre-empted in last week’s analysis.

Pound

Sterling kicked off Monday morning adding onto its losses from last week in a big 300pip move to the downside against the Dollar. This continued pressure can be attributed to a soaring Dollar, largely driven by safe-haven in-flows amid a risk-averse market environment in the beginning of the week. One of the other key driving factors is the rising cost of energy in the UK, with consumers having to fork out 50% more than what they paid last year.

Until the government reaches some sort of an arrangement with energy providers, this will undoubtedly be one of the issues the market will be keeping tabs on, because of the knock-on effect high energy prices have on the economy.

In terms of market structure, current price action has confirmed the formation of the bearish continuation pattern (bull flag) that formed outside of the larger structure (rising channel), by yielding an impulsive wave that hit the predetermined target at the peak formation at the 1.17910 area.

Henceforth price could print out a continuation pattern and break below the low formed on 14 July 2022 or print out a reversal pattern and move back up into the current support range. The former is more likely but both possibilities exist, especially because there is buy sensitivity against bearish momentum at this key support level.

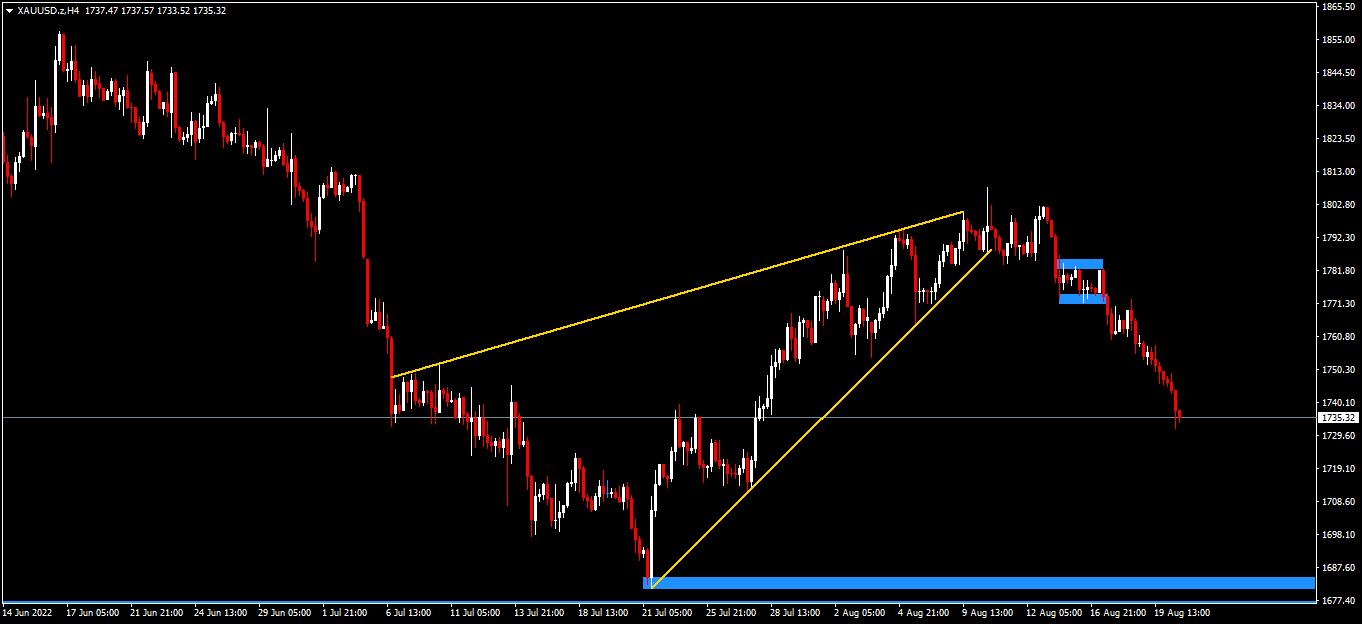

Gold

Gold heads into the new week adding onto losses from last week for 6 consecutive trading days. One of the key drivers is dollar demand amid a risk-averse market inundated by FED monetary policy, as well as other central banks fighting inflation by raising interest rates that negatively affect the price of gold. Linked to the risk aversion is also the rising energy costs in Europe and Asia, that are being driven by the maintenance of the Russian gas pipeline which supplies a substantial portion of energy to the regions.

In terms of market structure, price has moved correctively since around the 20th of July 2022 from $1 680 towards the $1 805 area in the form of a bearish continuation pattern (rising wedge). Price has confirmed this pattern by printing out a bear flag outside the major structure and subsequently printing out an impulsive wave.

Henceforth, sellers could stay in control and hit the target for this sell-side scenario around the $1 680 level, but smaller corrective structures may form in the interim and need to be accounted for until a key structural level is hit and creates a reversal pattern.

Click here to access our Economic Calendar

Ofentse Waisi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.