The markets are usually calm in August, which makes them particularly volatile in a year like this, when there is a heavy climate at the global level (inflation, war and economic slowdown in the EU and China). Each statement can lead to a strong reaction, with USOIL no exception, as evidenced by the asset rising nearly 4% on Tuesday on fears of an impending OPEC+ production cut.

A sentiment not shared by Kazuhiko Saito, chief analyst at Fujitomi Securities: “Tuesday’s rally was excessive, as many investors knew that it would take several months for Iranian oil to reach the international market, even if an agreement to revive Tehran’s 2015 nuclear deal was done, meaning OPEC+ wouldn’t cut production as quickly.”

However, can we expect weaker oil? Nothing is less certain: “There is not much room for the market to decline due to the robust demand for heating oil for the winter,” he added.

Technical Analysis

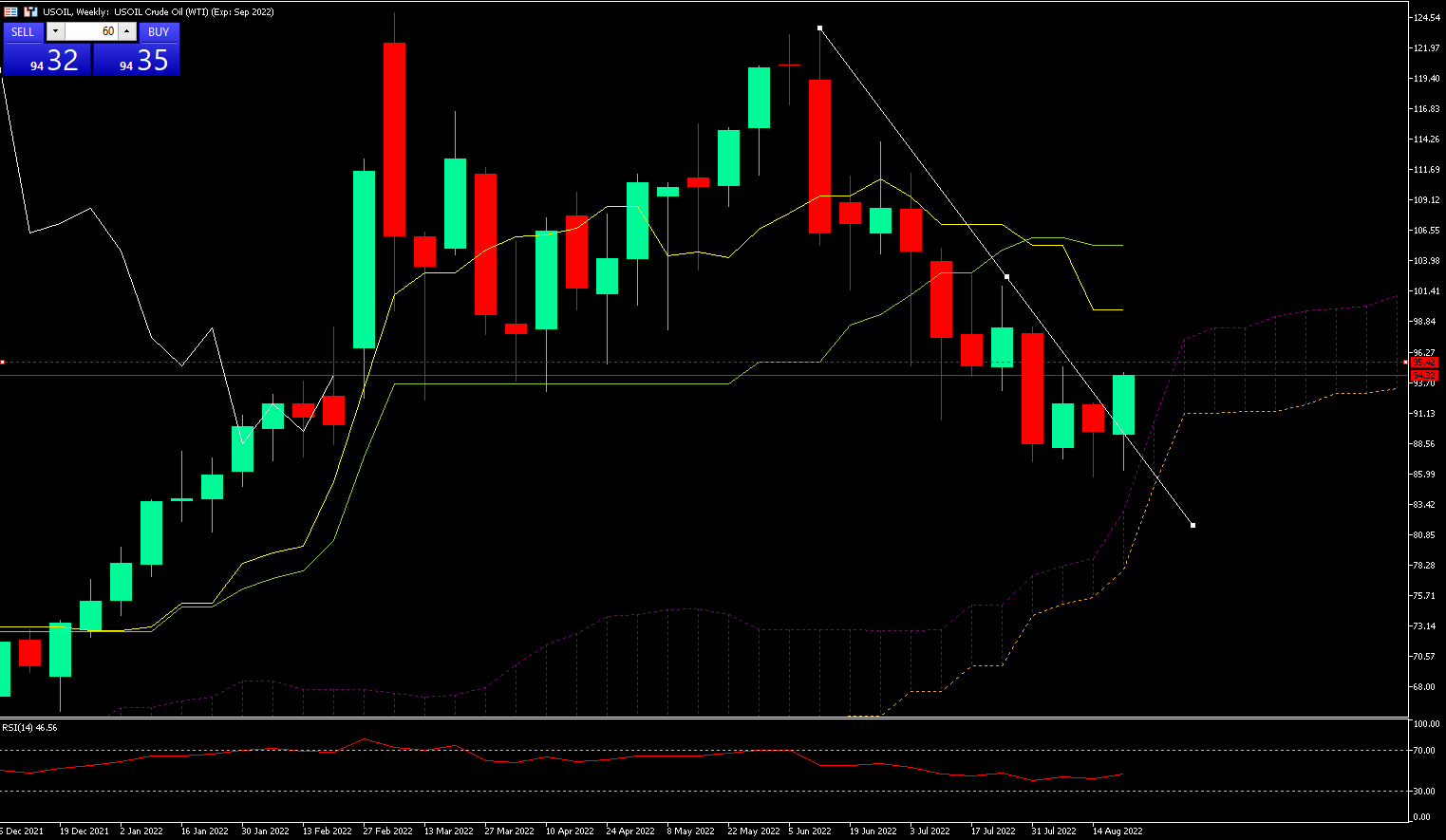

Since its peak reached on June 14 at the level of $123.66, USOIL began an inexorable decline until it reached $85.66 on August 16. It is currently around $94.94, and the price is expected to test its resistance zone at $95.42 in the weekly view.

From a daily perspective: (see below)

We can observe that the price has exceeded the Chikou Span (yellow line) and the Tenkan (green line) finding a support which will allow it to consider breaking its resistance to reach $96.15 and then $99.19. In the event of failure, a return to the $85.66 zone is envisaged.

The next few days will be crucial, starting with the Jackson Hole Symposium, which will begin tomorrow (August 25) and which will clearly indicate the resolutions taken by the Fed.

Click here to access our Economic Calendar

Kader Djellouli

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.