The US annualized CPI climbed 8.2%, slightly lower than that recorded in the previous month (8.3%) as a result of falling gasoline prices. However, the core CPI which excluded prices of food and fuel rose at the fastest pace since 1982, to 6.6% (previously 6.3%). Despite the fact that US indices closed the day higher, according to Reuters, it was mainly due to technical support and investors covering short bets. In fact, market participants continued to anticipate a more aggressive rate hike by the Fed.

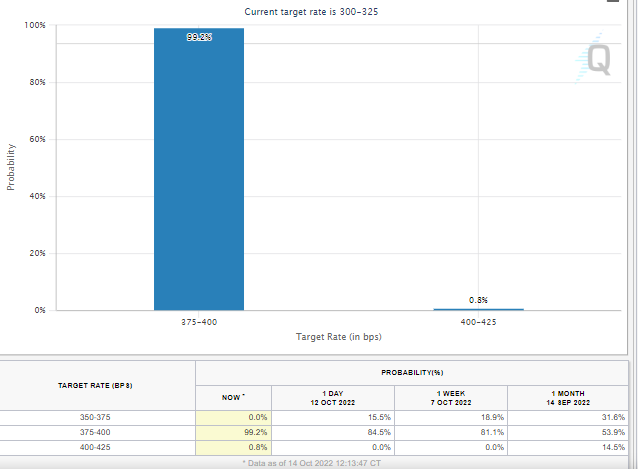

Fig 1:FedWatch Target Rate Probabilities :CME Group

According to FedWatch, the probability for the Fed hiking 75 bp in the FOMC November meeting is nearly 100%, a huge leap from a week ago (81.1%) – more suffering awaiting the stock market?

Ahead of the Fed’s meeting, we shall see more companies releasing their quarter earnings report. Among them, Netflix, one of the world’s leading entertainment services companies, shall reveal its Q3 2022 earnings report on 18th October (Tuesday), after market close.

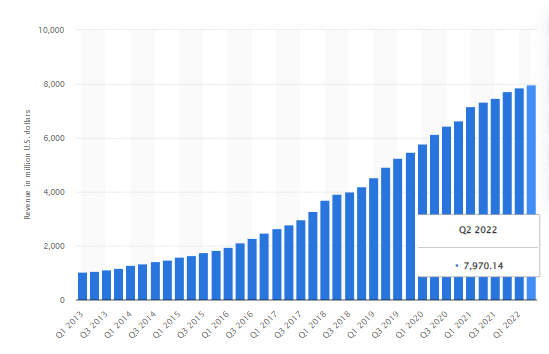

Fig 2:Netflix Revenue, Q1 2012 – Q2 2022 :Statista

Fig 2:Netflix Revenue, Q1 2012 – Q2 2022 :Statista

Despite revenue growth remaining in an uptrend for the past decade, the management of Netflix refers to recent sales as ‘slowing’ due to fierce competition among peers, account sharing between users, the strengthening of the Greenback and other factors such as the Russia-Ukraine war and the deteriorating economic growth.

Worse, Netflix,Inc. reported losses of 1.2 million subscribers in the first two quarters of 2022. In an attempt to reverse the situation, the company is going to introduce a new cheaper ad-supported tier starting this November (Countries include: Canada, Mexico (1st Nov), United States, United Kingdom, Australia, Brazil, France, Germany, Italy, Japan, Korea (3rd Nov), and Spain (10th Nov)). This move is intended to encourage more sign-ups for the company’s streaming service as a survey has shown that people are tolerant of advertisement if it means they would pay less for the service.

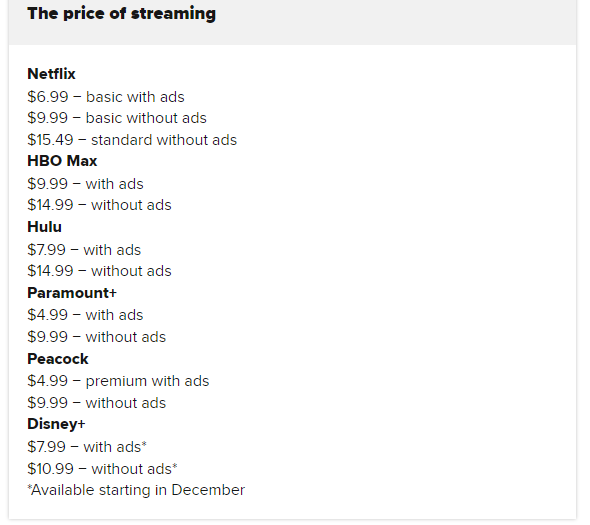

Fig 3:Streaming Price Offerings:Netflix & its Competitors : CNBC

Fig 3:Streaming Price Offerings:Netflix & its Competitors : CNBC

The Netflix basic plan with ads (an average of 4-5 mins of ads per hour) is set to be priced at $6.99, relatively cheap compared to its major competitors HBO Max ($9.99), Hulu ($7.99) and Disney+ ($7.99). Under this plan, the management expects to reach 40 million viewers by Q3 2023, with at least $3 advertising revenue gains a month from each user.

It is also worth noting that the effectiveness of the company’s strategy remains to be seen. While some may welcome the plan, there was also a survey recently that revealed 25% of users might cancel their subscription. On the other hand, the password sharing crackdown and heavy investment on foreign language series (which helped to capture a large audience base worldwide) are some of the tailwinds that could continue supporting company growth.

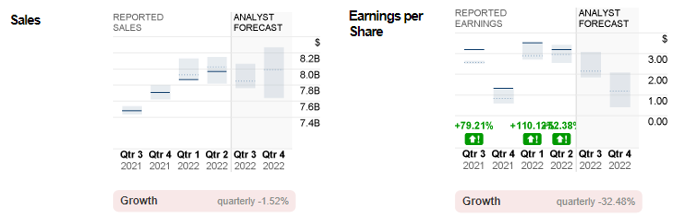

Fig 4:Netflix Sales & EPS versus Analyst Forecasts: money.cnn

The management expects to see net 1 million subscribers in the coming quarter. Sales is expected to hit $7.8B, slightly down 2.5% from the previous quarter, but up 4% from the same period last year. On the other hand, earnings per share (EPS) is expected down -32.5% to $2.16. In the same period last year, the company’s EPS was recorded at $3.19. In general, sentiment remains mixed as analysts rated a ‘Hold’ on the Netflix stock.

Technical Analysis:

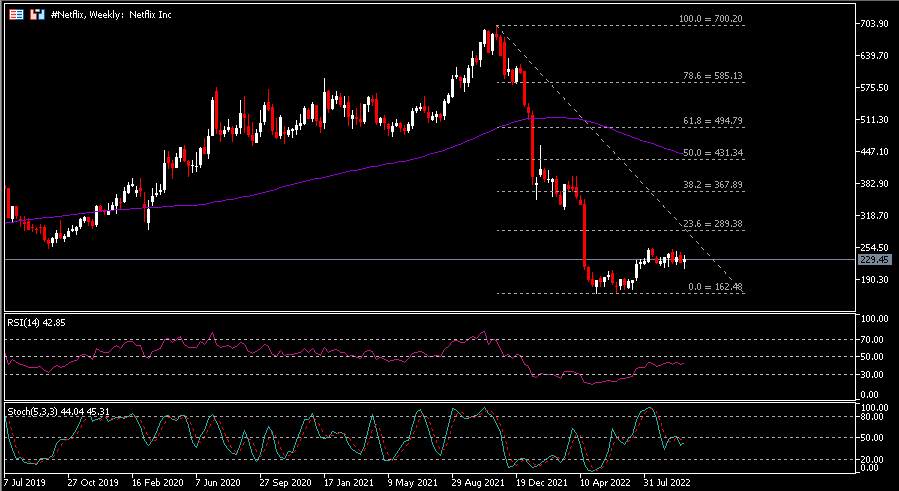

Fig 5:Netflix Historical Price : Google Finance

#Netflix (NFLX.s) share price last closed near $230, up over 40% from its recent lows at $162.48, a level not seen since August 2017. The company share price left its highest print in November last year, at $700.20. Obviously, it is now still below the median price target given by analysts ($250.50). The low and high price target are set at $157 and $399, respectively.

The median price target $250.50 shall serve as the first resistance threshold. Breaking above this level would provide an opportunity for the asset to challenge the next resistance at FR 23.6% ($290), then FR 38.2% ($370). The 100-week SMA coincides with FR 50.0%, at $430. On the other hand, $200 serves as minor support, followed by $162.50 and the low price target at $157. Regarding indicators, both RSI and Stochastics remain traded below 50.0.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.