Despite inflation, Visa is benefiting from consumers’ thirst for freedom as they continue to fuel strong demand for travel, one of its main sources of revenue. Analysts say returns from business travel, and cross-border holiday planning are benefiting the firm. Moshe Katri, an analyst at Wedbush Securities, said: “So far, despite the macroeconomic situation, you continue to see a pretty stable consumer.” Visa’s monthly data shows sustained cross-border payment volume. She added: “In short, the sky is not falling, at least not yet.”

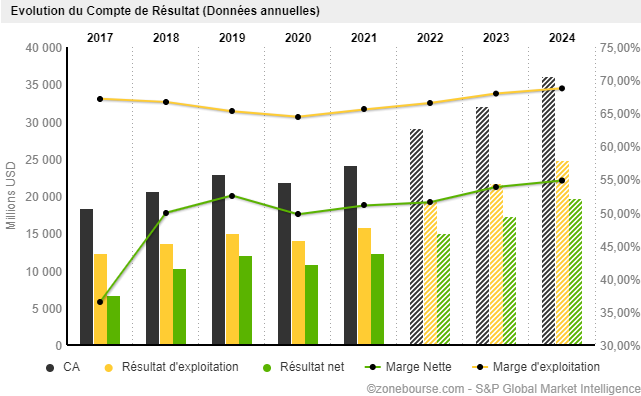

Source: zonebourse

According to Squaremouth.com, US travellers are spending 35% more in the fall this year than in 2021. Card companies tend to make more money when prices rise, because they charge a percentage of transactions, based on the value of the Dollar. The darkening economic outlook has not yet slowed consumer spending, according to the US banking giants, which reported results earlier this month. But high inflation could weigh on consumer spending, if accompanied by higher interest rates. Market participants continue to anticipate a continued aggressive rate hike by the Fed. According to CME Group 91.7% of market participants expect a 75bp hike in November. (See below)

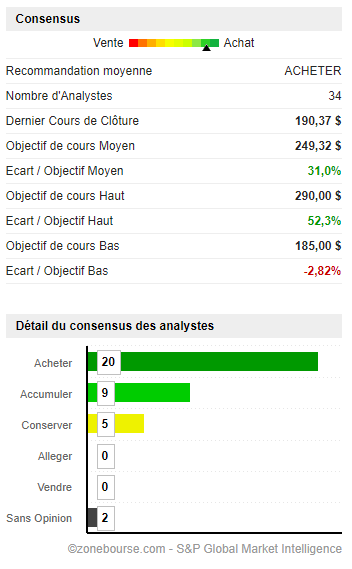

It would appear that the future of the group is bright; out of 34 analysts (financial institutions) 20 are Buy, 9 are Accumulate and 5 are Hold.

Source: zonebourse

The firm is preparing to launch a new product, Visa Ready Creator Commerce, which is designed to put the world’s most important financial institutions on the map. It will connect partners within the ecosystem and provide creator platforms with tools to enable faster payments, tips and donations.

Vanessa Colella, Visa’s vice president and global head of digital innovation and partnerships, said: “Creators are redefining and expanding the small business ecosystem” and continued: “We want to leverage the scale and reach of our network to help this community thrive. The Visa Ready Creator Commerce programme will serve to build a connective layer between platforms and technological innovations to provide the creator economy with modern financial tools. The creator economy is one of the fastest growing small business sectors. Over 50 million artists, musicians and creators publish content that provides them with a full or partial source of income. Social commerce, which includes the work done by creators, is expected to reach $1.2 trillion by 2025.

By committing to creators Visa seems to be ignoring the current slump and only a decline in consumer spending could darken their future prospects.

Technical Analysis

Visa’s share price is currently at $190.36, below its cloud but above its Kijun (green line) and Chikou Span (yellow line) indicating an attempted bullish reversal. The Lagging Span (white line) needs to break and to move above the price action in order to confirm a potential uptrend. The first resistance for the price is to break above $190.98, and then in a second phase to break above $199.81. Conversely, if the attempt weakens, the price could fall to $184.32 and then retreat to its October low of $174.69.

Click here to access our Economic Calendar

Kader Djellouli

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.