Meta Platforms (formerly known as Facebook, Inc.) shall report its earnings result for Q3 2022 on 26th October (Wednesday), after market close. The technology conglomerate with market cap over $340B which is based in California, US, engages in connecting people and communities as well as helping businesses to grow through its Family of Apps (FOA) including Facebook, WhatsApp, Instagram, Messenger etc. Last year, the company announced that it is working on the development of augmented and virtual reality related consumer hardware, software and content (these are grouped under Reality Labs (RL)), hoping to expand beyond 2D screens into the future of digital connection, namely the Metaverse.

Netflix was the first FAANG member that brought out satisfying results to the public. This week, the rest of the members (Amazon, Apple, Google (Alphabet)) including Meta shall also release their quarterly financial results.

Last Friday, Wall Street Journal reporter Nick Timiraos stated in his latest article that the Fed may ease its pace of interest rate hikes (possibly 50 bp) in December, after raising interest rates by 75 bp in November – a sign for the US stocks market to reverse its recent sell-off? As of market close, the US indices soared higher: USA500 at 3764, USA100 at 11335, USA30 at 31151.

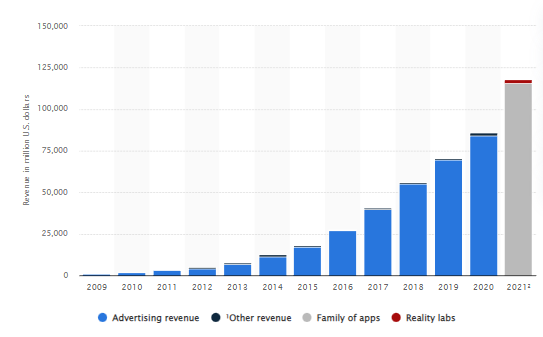

Fig 1:Meta Annual Revenue (in million USD), 2009-2021. Source:Statista

Fig 1:Meta Annual Revenue (in million USD), 2009-2021. Source:Statista

Last year, Meta continued to rack in most of its revenue through advertisement from the FOA segment, which accounted to about $115.66B, while the RL generated approximately $2.27B. This is the first ever record that the company’s annual revenue has surpassed the $100B threshold. The gains were over $31B (or +37%) compared to those in 2020.

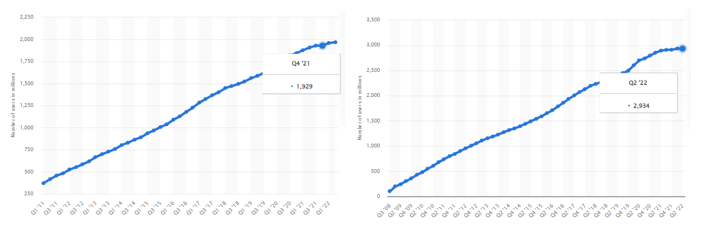

Fig. 2:Facebook DAU vs MAU Source:Statista

According to a statistic released in January this year, Facebook topped the chart as the most popular social network worldwide. Nonetheless, it is also worth noting that the platform saw its first historical drop in daily active users (DAU) in Q4 2021, from 1.930B (q/q) to 1.929B (q/q). Also, monthly active users (MAU) in the latest quarter report dropped to 2.934B (previously 2.936B). These stats unveiled the fact that the growth of active users has been gradually slowing, due to reasons such as intense competition (for eg. TikTok, YouTube), recessionary fears, surging cost which led to advertisers cut on spending, Apple privacy changes etc.

Despite experiencing a $2.81B loss on its virtual reality division in the previous quarter, Meta is determined to continue spending heavily on the technologies for its ultimate vision, the Metaverse. The company raised the price of its Meta Quest 2 VR headset beginning August this year due to rising inflationary cost, however, the management cited that it is still the cheapest VR compared to its peers. In addition, there are rumors that Meta has sold over ten million VR devices, a preliminary goal set by Mark Zuckerberg back in 2018. However, in this case, it is not just numbers alone that matters. In fact, an enthusiastic user base is the most critical element in keeping the VR ecosystem alive, according to the management.

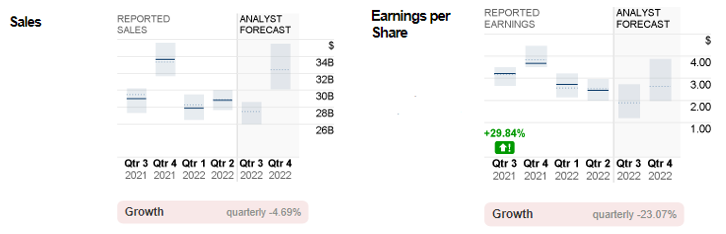

Fig 3:Meta Platforms Reported Sales and Earnings per Share versus Analyst Forecast. Source: CNN Business

Consensus estimates for reported sales of Meta Platforms, Inc. in the coming quarter stood at $27.5B, down -4.51% from the previous quarter and down -5.17% compared to same period last year. EPS is expected to hit $1.89, also down -23.17% from previous quarter and down -41.30% from the same period last year.

Technical Analysis:

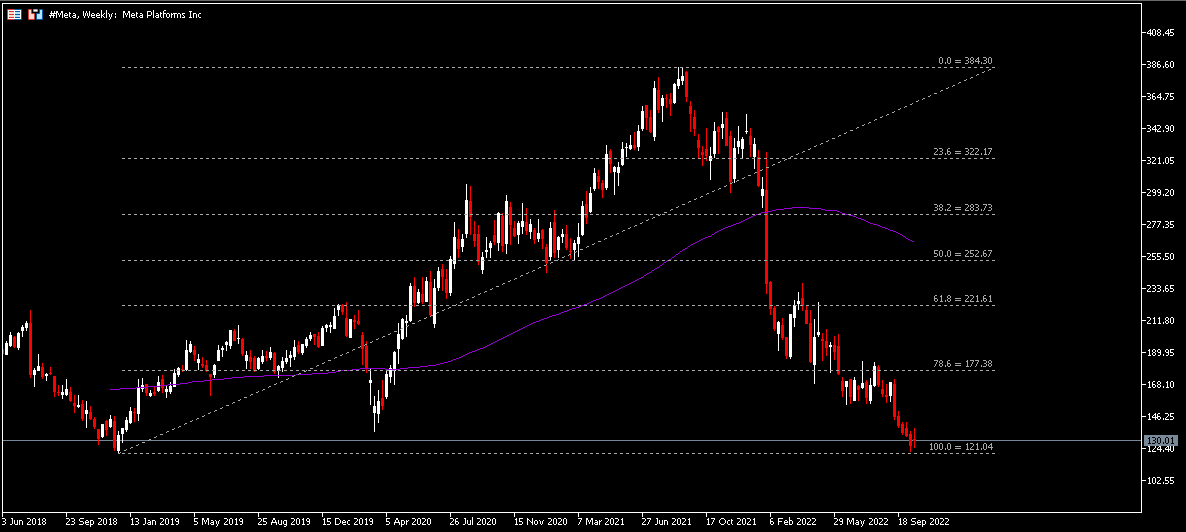

Fig 4:Meta Platforms Historical Price. Source:Google Finance

Fig 4:Meta Platforms Historical Price. Source:Google Finance

The #Meta (META.s) share price last closed at $130, slightly above the lows of the year that was formed in the previous week, at $122.50 (this was the lowest level since December 2018 ($121.04)). In February this year, the company suffered its record one-day loss ever (-26%), with over $230B market value being wiped off (also a record one-day market cap loss for a US company), following concerns over the company’s growth trajectory.

Technically, the sharp plunge marked the day #Meta shares entered into the bear territory, and remains until today. The low estimate of analysts, $150, serves as the nearest resistance to focus, followed by $177 (FR 78.6%) and $222 (FR 61.8%). On the other hand, the lows of December 2018, $121.04, serves as the nearest support. Breaking below this level may open up more room for the bears to test the next support at the lows seen in December 2016, $115.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.