- USDIndex – Slipped again from 111.50 to 111.25 ahead of the expected 75bp from the FED later today. It’s ALL about the tone and any reference to slowing rates (IMHO I don’t think he will be that clear). Strong JOLTS (jobs still hot) and PMI data had lifted the USD earlier from 110.50 and added to the conundrum for the FED. US Stocks closed lower (NASDAQ -0.89%) underperformed. 10-yr yields flirted under 4.0% but hold this key level.

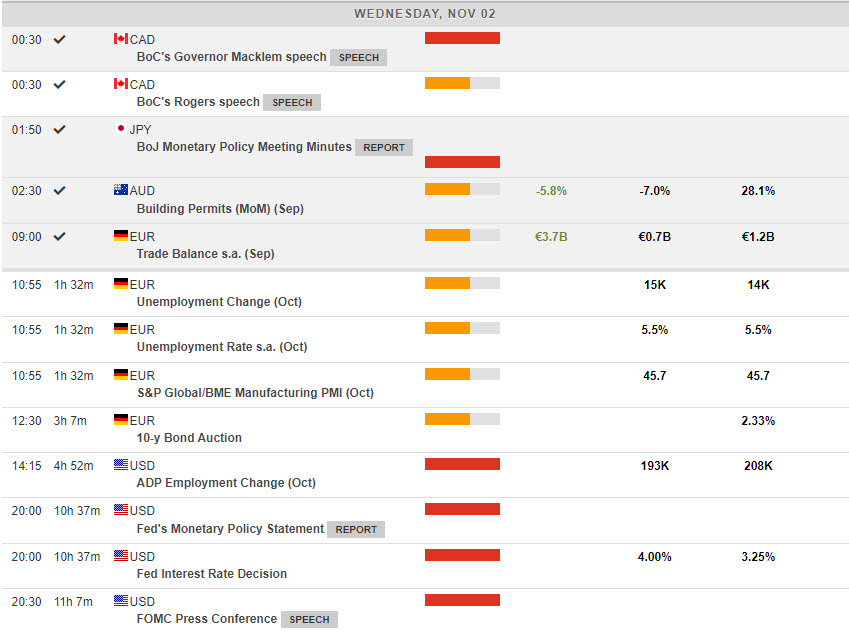

- Overnight – Kuroda & Suzuki – talked up the JPY (weak Yen not good for economy , FX rates set by markets, but still no need to change easing policy). Macklem – “difficult” to move to 2% inflation. -ve UK Shop Inflation higher, but +ve German Trade balance more than tripled.

- EUR – dropped below 0.9900, to 0.9872 again.

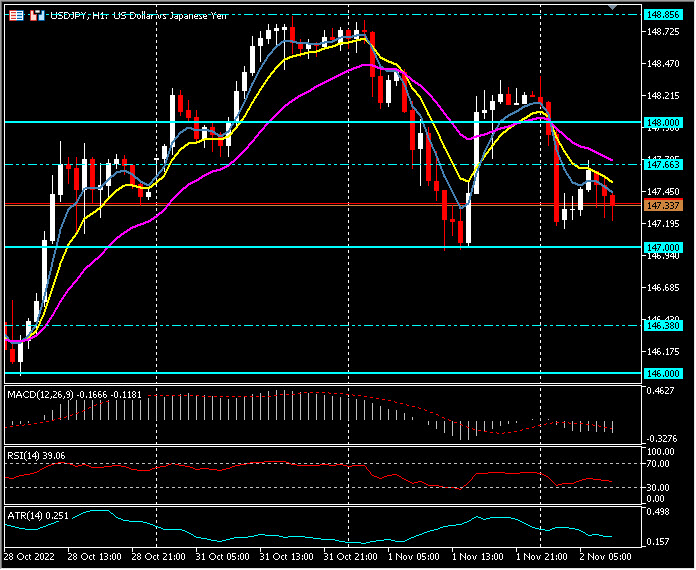

- JPY – tested down to 147.00 rallied to 148.00 and now trades at 147.35 following Kuroda and Suzuki comments

- GBP – Sterling dived to 1.1440 yesterday, before recovering the key 1.1500 level today. The Bank of England started Quantitative Tightening yesterday – the first ever sale of some of its UK government bonds QE Portfolio. £750 million of bonds maturing between 2026 and 2029 were sold. It’s not the amount but the sentiment that counts!

- Stocks – Wall Street were lower with big moves for Tech stocks (AMZN -5.5%, GOOG -4.39%) in particular. UBER Revved up +12%. US500 closed -15.08 (-0.41%) at 3856, FUTS trades at 3870 now.

- USOil – rallied from $86.25 lows yesterday to test the $90.00 zone earlier. Inventory draw-downs added to the bid.

- Gold – weaker USD helped a rally to $1655 yesterday and hold $1650 today.

- BTC – continues to rotate around $20.5k, above the key 20K and significantly above the $19k support.

Today – EZ Manu. PMI, FOMC Policy Announcement & Press Conference, EARNINGS GSK, Maersk, Osram, Vestas Wind & Qualcomm.

Biggest FX Mover @ (06:30 GMT) USDJPY (-0.74%) Dipped from 148.00 to 147.35 now following Kuroda and Suzuki comments. MAs aligned lower, MACD histogram & signal line negative & falling, RSI 39.05 & falling, H1 ATR 0.251, Daily ATR 1.94.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.