USDIndex, USA500 & CHF Daily

The new round of dovish tones from the central banks (FOMC, RBA and yesterday BOE) weighed on investor sentiment yesterday. There was a weak end to US equity trading, with all three major indices down close to 1% and the key Nikkei 225 has closed over 2% down for today.

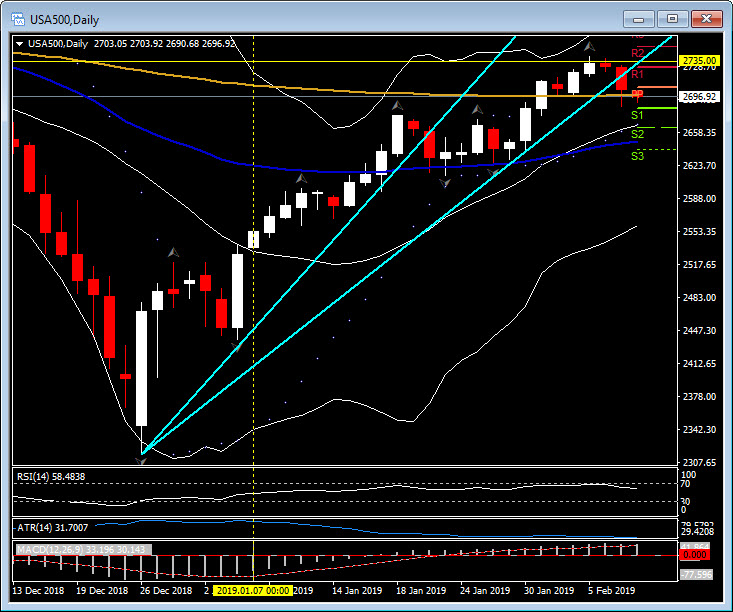

The USA500 has failed to break the 200-day simple moving average (2735) this week and is now trading back towards the 200-day exponential moving average, meaning today’s close will be interesting and one to watch.

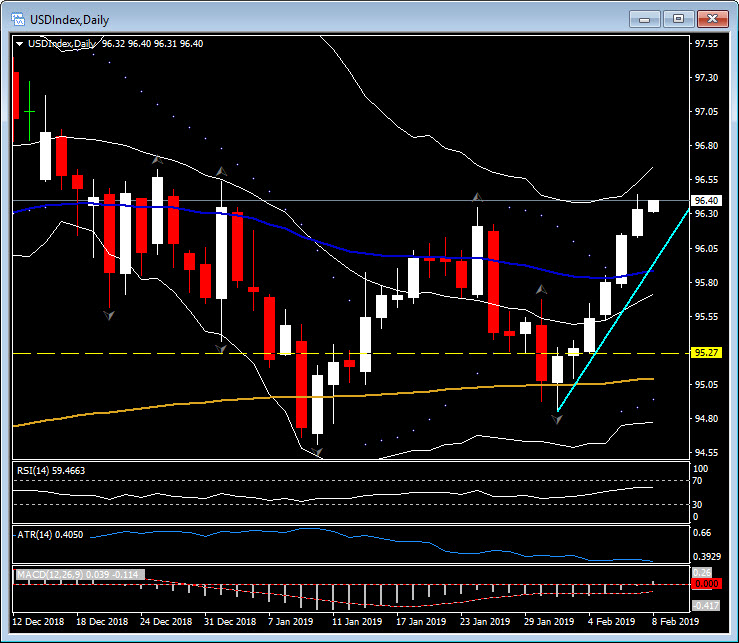

As the risk sentiment cools, the ripple out to the FX markets is beginning to show too; USD remains strongly bid with the USAIndex up over 1.1% this week. The 20-day moving average was breached Monday (February 4), the 50-day moving average and 96.00 level was broken on Wednesday (February 6), now resistance sits with R1 at 96.50, R2 and the upper Bollinger band at 96.5 and R3 96.80.

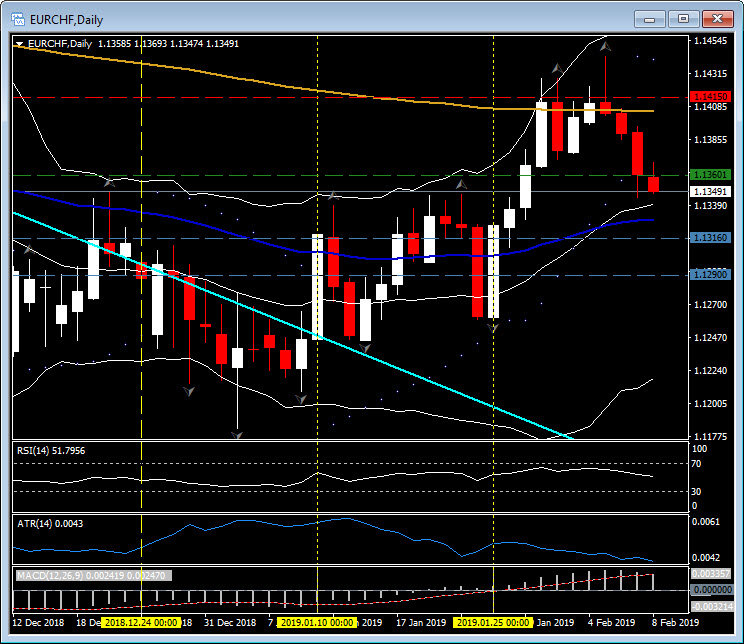

Another FX mover this week has been the Swiss Franc (Swissy), and although the USDCHF has regained the psychological 1.00 handle at parity the CHF is gaining versus both the EUR and CAD. EURCHF, like the USA500, has rejected the key 200-day moving average (1.1415) this week and turned significantly lower yesterday, to close at 1.1360. A 44-pip (ATR) move would take the pair down to S2 at 1.1316, and a 50% retracement of the January 24 and 25 candles would take the pair to S3 and 1.1290. Key resistance to a further move lower is S1 and the 20-day moving average at 1.1340. A move back over R1 at 1.1390 and then 1.1400 would negate the move lower.

Another FX mover this week has been the Swiss Franc (Swissy), and although the USDCHF has regained the psychological 1.00 handle at parity the CHF is gaining versus both the EUR and CAD. EURCHF, like the USA500, has rejected the key 200-day moving average (1.1415) this week and turned significantly lower yesterday, to close at 1.1360. A 44-pip (ATR) move would take the pair down to S2 at 1.1316, and a 50% retracement of the January 24 and 25 candles would take the pair to S3 and 1.1290. Key resistance to a further move lower is S1 and the 20-day moving average at 1.1340. A move back over R1 at 1.1390 and then 1.1400 would negate the move lower.

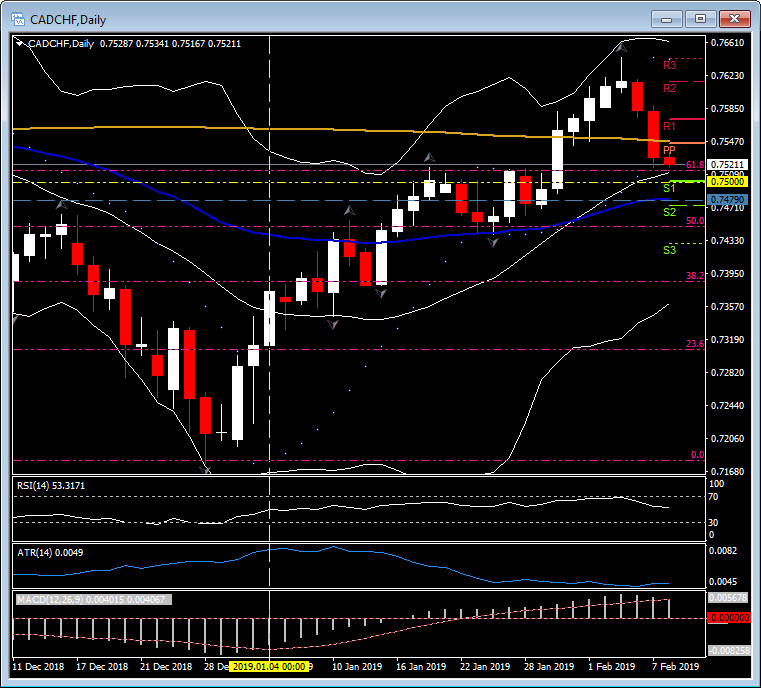

CADCHF also breached the 200-day simple moving average (0.7550) yesterday, suggesting further moves down may be possible from yesterdays close at 0.7528. The ATR for this pair is 49 pips and that would move it below the 61.8 Fibonacci level, the 20-day moving average and the strong support area (S1) at 0.7500. 0.7479 is the 50-day moving average and S2, below this area is the 50.0 Fibonacci level at 0.7450 and S3 at 0.7332. A hold of the 0.7500 support area and the key resistance to the upside remains the 200-day moving average at 0.7550.

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.