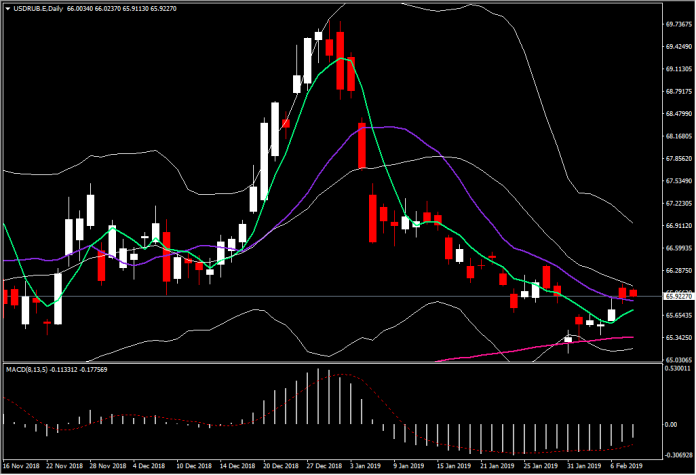

The Russian currency has gained 5.7% against the Dollar thus far this year, following a large depreciation in December, resulting from an anticipation of more Western sanctions. The Ruble regained its strength in January though as the continuation of the US government shutdown and expectations of a global slowdown made the currency look more attractive. Most importantly, expectations of higher growth in the country came true as Russia grew by 2.3% in 2018, compared to forecasts of 1.8% growth. Not least, the 5.5% interest rate differential also assisted in attracting foreign money to gain from the carry trade and thus pull the rate higher.

The positive carry trade potential would mean that someone in a short position would be able to earn a 99-pip positive overnight swap rate. Over January 2019, this would have amounted to approximately 2,200 pips, increasing the investor’s profit to 6.1%, in just one month. To put that in perspective, a trader shorting one standard lot of $100,000 would earn $6,100 in January.

As with all things in life, things are not as simple as they seem. In this case, the caveat relates to the state of the Russian economy. In particular, the Russian economy appears to be following the rest of the world in a global slowdown, as a Reuters poll of economists suggested a consensus forecast of 1.4% in 2019, compared to 1.7% in 2018. High inflation and lending rates are expected to take their toll on the Russian economy, despite the improvement a value added tax reduction could potentially have. Most importantly, Russian Central Bank’s decision to purchase foreign currency in order to increase its reserves is likely to have a strong effect on the Ruble.

Overall, the above suggests that the Ruble has the potential for carry trade gains over the year but also has the potential for a currency depreciation which could eclipse any profits from the interest rate differential. Naturally, the possibility for rate increases in the case that inflation rises more than expected also holds which would also provide a boost to the currency. However, the situation for the Russian economy will, out of all things, highly depend on the price of Oil and this is what potential traders need to focus upon.

Click here to access the Economic Calendar

Dr Nektarios Michail

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.