FX News Today

- Asian stock markets rallied driven by MSCI and weighted on Bonds.

- The announcement MSCI Inc. that it will increase the weight of Chinese stocks in its global benchmarks also underpinned bourses.

- The strong manufacturing PMI reading out of China, following on the heels of better than feared US GDP readings yesterday, helped to underpin risk appetite.

- The Yen has weakened concomitantly with rising stock markets in Asia.

- German January retail sales much stronger than expected at 3.3% m/m.

- Eurozone HICP inflation seen ticking up to 1.5% y/y from 1.4%.

- EURUSD dropped back from 3-week highs to mid 1.13s.

- USDJPY rallied to 10-week high of 111.80.

- Gold slide on better US GDP, higher yields and stronger Dollar.

Charts of the Day

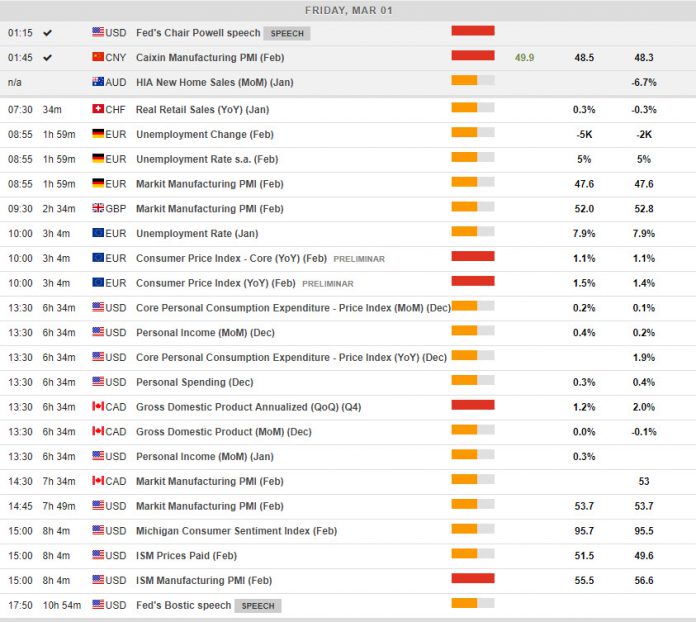

Main Macro Events Today

- EU Final Manufacturing PMI – They are expected to confirm the overall Eurozone reading at 49.2, which would leave it in contraction territory.

- EU CPI and core – The overall Eurozone HICP is seen ticking up to 1.5% y/y from 1.4%, while core inflation is likely to hold at just 1.1% y/y.

- German jobless numbers – Jobless data is seen rising 1K (median -3K), which should leave the jobless rate at a record low of 5.0%

- Canadian Q4 GDP – GDP for the last quarter of 2018 is expected to slow to a 1.0% pace (q/q, saar) in January from the 2.0% rate of expansion in Q3, reflecting the hit from the oil price plunge during the quarter.

- Canadian December GDP – It is seen coming in flat (0.0%) after the 0.1% decline in November, reflecting the drag on the economy from the oil producing sector.

- US December personal income – It is projected rising 0.5% after a 0.2% rise in November, reflecting strength in December aggregate income.

- US PCE – A -0.3% decline is seen in real PCE in December, following a 0.3% increase in November. Core PCE Price Index is anticipated at 0.2% m/m from 0.1% m/m.

- US ISM Manufacturing PMI – The February ISM is expected to slip to 55.0 in February, but from a robust 56.6 reading in January.

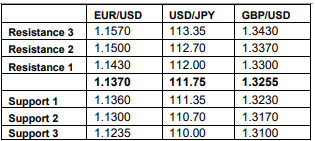

Support and Resistance

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.