FX News Today

- The main focus is the eagerly awaited Fed announcement tomorrow, with the US central bank expected to turn down the to just one rate hike this year, and the USD remains in “wait n see mode” ahead of FED tomorrow.

- Central banks in Indonesia, the Philippines and Thailand hold policy meetings this week and are expected to stay on hold as well.

- In the RBA minutes, the outlook for the Aussie economy was mentioned as having “significant uncertainties’, as house prices cooled significantly more than expected too.

- However, while the prospect of ongoing support from central banks and governments helped stock markets to move higher across Asia yesterday, today’s trading saw a broad correction, with Chinese indices, which outperformed Monday, underperforming today.

- The Shanghai Comp lost -0.63%, the CSI 300 was down -0.82%, while the Hang Seng had declined -0.23%. Topix and Nikkei closed with losses of -0.21% and -0.08% respectively and the ASX was down -0.09% in the end.

- US futures are posting fractional gains, while European futures are down. The front end WTI future meanwhile is trading at USD 58.98 per barrel, after touching a high of USD 59.14 overnight.

Charts of the Day

Technician’s Corner

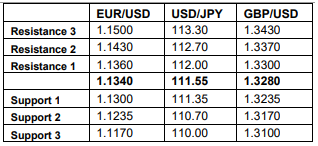

- EURUSD traded up and down yesterday, ranging around the 1.1345 Resistance level, breaking through it early today. Still below yesterday’s peak, MAs suggest the Euro will strengthen, supported by the MACD, while Stochastics suggest that it is overvalued.

- GBPUSD is consolidating in the upper 1.32 area, moving on a sideways channel, still below end-February highs. MACD and Stochastics are showing down signals.

- USDJPY has continued its downwards trend breaking through the 200HMA yesterday, reaching as low as 111.18, with Resistance standing at 111.40 and Support at 111.08.

- XAUUSD continues to trade above the $1300 mark, in a slight upwards trend, even though Stochastics and MACD show signs of regression. Data releases and any Brexit developments today could affect it.

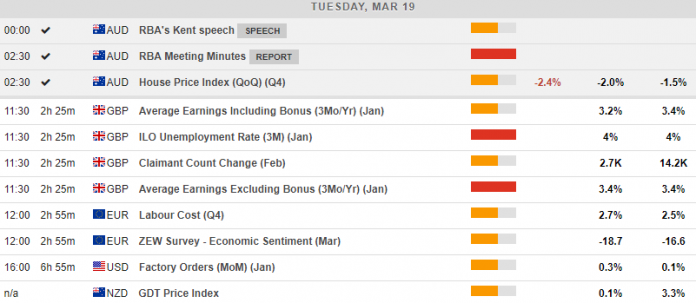

Main Macro Events Today

- Average Earnings ex Bonus and Unemployment Rate (GBP, GMT 09:30) – Average Earnings in the UK are expected to have stood at 3.4% in the three months to January, the same growth rate as the previous time. The ILO unemployment rate is expected to remain at 4%.

- Economic Sentiment (EUR, GMT 10:00) – March’s economic sentiment index is expected to stand at -18.7, a decline from the -16.6 observed in February.

- Factory Orders (USD, GMT 14:00) – Factory orders are expected to have grown by 0.3% in January, compared to 0.1% in December.

Support and Resistance

Click here to access the Economic Calendar

Dr Nektarios Michail

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.