Last week, Australia released its first monthly CPI report. October’s results showed that the Consumer Price Index fell to 6.9% y/y vs expectations of 7.4% y/y, down from September’s reading of 7.3% y/y. The main reason for the decline was lower food prices. However, is this drop in inflation enough to make the RBA halt rate hikes?

The Committee said it will do whatever it takes to bring down inflation and 6.9% still seems too high for them to stop the rate hike cycle. The RBA started to weaken their hawkish stance in the last two months, raising rates by only 25 basis points and bringing the official cash rate to 2.85%.

The Reserve Bank of Australia will meet on Tuesday this week. However, there are questions as to whether the RBA will raise rates by 25bps or leave them unchanged. At the last meeting, the board said that further rate hikes would be necessary as inflation was still overvalued. It also said that it sees inflation peaking at around 8% this year, compared to the previous forecast of 7.75%. However, the market currently expects the rate hike to still be at 25 basis points next week. Besides, attention will also be on Australia’s third quarter GDP trade balance figures.

Technical Review

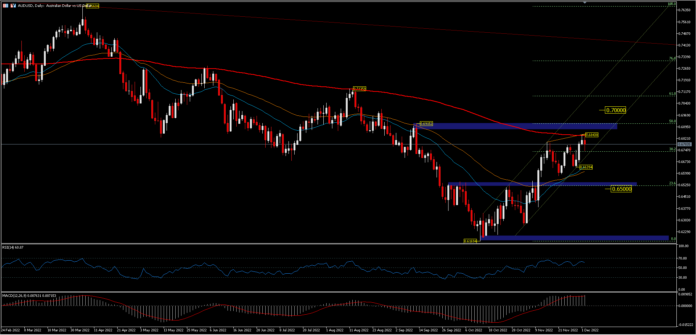

AUDUSD traded higher by 6% in November 2022, to follow up the mid-October rebound of 0.6169 as an interim low. As far as we can see, the AUDUSD pair has capitalised on the Dollar’s weakness to move higher above the 38.2%FR level of 0.7660 and 0.6169 price drawdown, although concerns over the growth of its trading partner China remains a negative sentiment for the AUD. Attempts to resume December’s gains are temporarily held at the 200-day EMA at 0.6843. However, further Dollar weakness could bring the pair to test the 50.0%FR (0.6915) or the 0.7000 psychological mark. As long as the price is still trading below 0.7135 the bearish outlook for the pair is yet to shift.

While on the downside, support around 0.6500 looks strong enough to contain the downside. RSI is seen sloping below the overbought zone, signal lines and MACD histogram are aligned above the buy zone.

AUDUSD climbed higher to 0.6843 last week, but quickly lost momentum and pulled back. This week’s initial bias is neutral and the short-term outlook will remain bullish if 0.6639 support holds. A break of 0.6843 will target 0.6915 and higher to the 0.7000 round-figure. However, a strong break of 0.6639 support will confirm a short-term top and turn the bias back to the downside. A divergence bias is evident on the RSI and MACD, but these indications could be ruled out, if China extends easing and the RBA delivers a positive surprise in terms of rates and hawkish guidance, thus lifting the pair. Support levels above 0.6500 are seen to hold the downside if the RBA rate expectations disappoint.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.