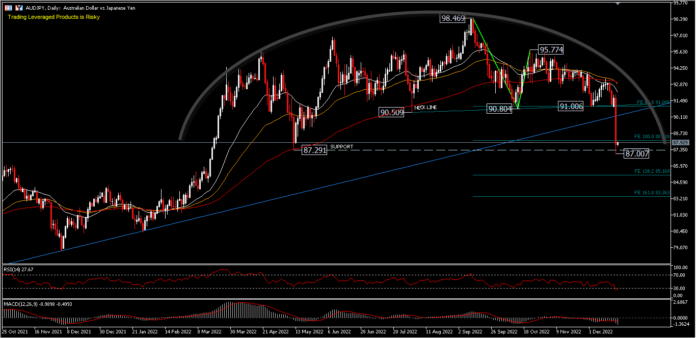

AUDJPY, Daily

The RBA appeared to fulfil market expectations by offering clues in the RBA minutes on when it will end its tightening cycle. According to the minutes, the central bank discussed ending tightening in December, but board members decided to raise rates for the third consecutive time by 25 basis points. Board members made the case for no adjustment for the first time since the tightening cycle began in May, which suggests that the cycle may be coming to an end. The minutes pointed out that no other central bank has stopped tightening yet and the members also recognised that the World Bank’s predictions show that it will take several years before inflation returns to the target range of 2% to 3%.

The minutes summarised that there is substantial uncertainty in the economic outlook and that rate hikes are not on a predetermined path. Furthermore, the market will wait for developments at least until the next interest rate meeting in February. The RBA continues to prioritise reducing inflation, and policymakers are aware of the harm that high inflation and rising interest rates inflict on consumers and firms. Although the RBA will pause for some time, after efforts to reduce inflation that looks like a bright spot. The risk of a wage-price spiral remains, if the RBA stops tightening too soon, which will make the fight against inflation much more challenging in the future.

Meanwhile, the BOJ unexpectedly widened its upper target range on 10-year JGB yields. The BOJ, as widely expected maintained the policy balance rate at -0.10%, but unexpectedly widened the target range of the 10-year yield to 0.50% from the previous upper bound of 0.25%.

BOJ Governor Kuroda said it was too early for the BOJ to consider an exit from easing or a policy review, and Tuesday’s measures focused on market functionality.

Technical Analysis

The AUDJPY pair formed a rounding top reversal pattern and broke the important 91.00 support and weakened more than 4%. A rounding top pattern can develop over days, weeks, months or even years, with longer time frames to complete forecasting longer trend changes. The main point of recognising a rounding top pattern is to anticipate a significant trend change from a trending up price to a trending down price.

The bears in Tuesday’s (20/12) trading recorded a low of 87.00 before closing at 87.75, slightly below the 87.29 support recorded in the last May trading. The downside movement is expected to continue as long as trading remains below the 90.50-96.00 resistance which is the neckline of the rounding top.

While the price is still held at the support level, further downside is projected for FE138.2 at 85.16 from 98.46-90.80 and 95.77 pullback. RSI at oversold level and MACD at steep selling zone.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.