Gold jumped to start 2023 with strong gains, as the positive momentum from December carried over into the new year. Last year’s headwinds, particularly the strengthening Dollar and Yields are starting to reverse, so 2023 is likely to be more friendly to the yellow metal.

According to data released by the US Bureau of Labor Statistics, US consumer prices fell to 6.5% in December from November’s 7.1%, giving hope that the US Fed’s strategy to tame inflation is working and the US Fed will also take a softer policy in its rate hike approach. Slowing inflation means less aggressive rate hikes by the Fed. As per the CME Fed surveillance tool, the probability of a 25-bps hike at the February FOMC meeting has risen to 92.7 per cent.

Weakening Dollar, recession fears and geopolitical uncertainty could boost demand. The global economy is likely to go through tough times, as a result of the Ukraine war, cost of living crisis and slowdown in major economies. In addition, China’s economic growth, which is likely to pick up this year due to a number of easing measures, could fuel demand for the yellow metal. Following a sharp rise in central bank demand for Gold in the third quarter of 2022, the outlook for official sector demand for the yellow metal is likely to hold in 2023 as well.

Concerns over weaker global economic growth and geopolitical tensions will continue to make Gold valuable as a hedge against uncertainty. During the first three quarters of last year, the World Gold Council reported official sector purchases of 673 tonnes, higher than any full year since 1967. Added to that was a total of 62 tonnes purchased in November and December from the PBOC. Part of that demand was fuelled by a handful of central banks looking to reduce their dollar exposure. This de-dollarisation and general appetite for gold will ensure another year of official sector gold purchases that are likely to be stronger.

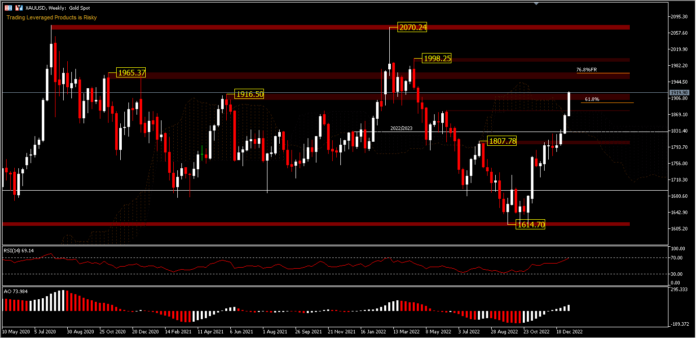

Technical Review

Speculative technical buying seems to be the main driver for Gold at the moment, led by continued demand from hedge funds that turned net buyers in early November, as the triple bottom signalled a change from the prevailing strategy of selling Gold at signs of strength.

In the short-term, Gold looks increasingly in need of a correction with the risk underpinned by lower physical demand; while traders get used to higher prices. XAUUSD hasn’t shown any fading rally momentum since early November, and January’s surge has seen that gap widen, but with RSI signalling overbought conditions, a correction towards the downside for price neutralisation can’t be ruled out.

XAUUSD, Daily

Last week, XAUUSD recorded a high of 1,921.87 adding more than +5% gains since January this year. The price is seen at a resistance level seen since June 2021. Further upside is likely to test the 76.8% retracement level around 1,964.00 price along with the past resistance zones seen around November 2020 and January 2021. While on the downside, the main foothold is at 1,879.00 resistance which is now support and a strong level is seen at 1,807.78, or at least back to the January 2023 opening price around 1,825.00, in case of a strong correction.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.