A blockbuster NFP on Friday (571k new jobs vs 185k) & strong Services PMI (55.2 vs 50.5) has lifted the Dollar and Yields, sinking Stocks and Gold (the 3 mth Gold rally is over). YEN is weakest this morning with key “Dove” Amamiya (current deputy) a possible to take the reins at BOJ after Kuroda. The JPY is weakest & AUD strongest. USDTRY hit 18.85 following the fatal Earthquake.

- The USD Index continued to rally from 8-mth lows on Thursday at 100.65 to breach 103.00 today – Markets expecting a continued Hawkish tones from FedSpeak this week (Powell Tuesday) and 25 bp hikes in March and May.

- EUR – sank below 1.0800 after posting 10-mth highs (and many Bank’s Q1 target) over 1.1000 on Thursday. Back to 1.0785 now.

- JPY – Rallied to test 132.40 earlier, following the BOJ rumours before cooling to 131.60

- GBP – Sterling weakened again to 1.2025 on Friday as the UK100 hit a new all-time high on the weaker Pound. Inching higher today at 1.2060.

- Stocks – The US markets sank on Friday (-1.59% to -0.38%) US500 –1.04%, (-43.28) 4136, holding the key 4100 and gaining +1.6% for the week. (NASDAQ +3.3%) US500 FUTS trade softer at 4128. F -7.61%, AMZN -8.43%, APPL +2.44%.

- Goldman Sachs has raised their target for the S&P500 to 4000 in 3 months (from 3600).

- USOil – Futures -3.28% on Friday to close at $73.39 from close to $78.00. Back to $73.85 now.

- Gold – Tanked into $1860 on Friday before recovering to key resistance at $1880 now.

- BTC – Dropped from $23.7k highs ahead of NFP on Friday to $22.7k today.

Today – EZ Retail Sales, Speeches from BoE’s Mann & Pill.

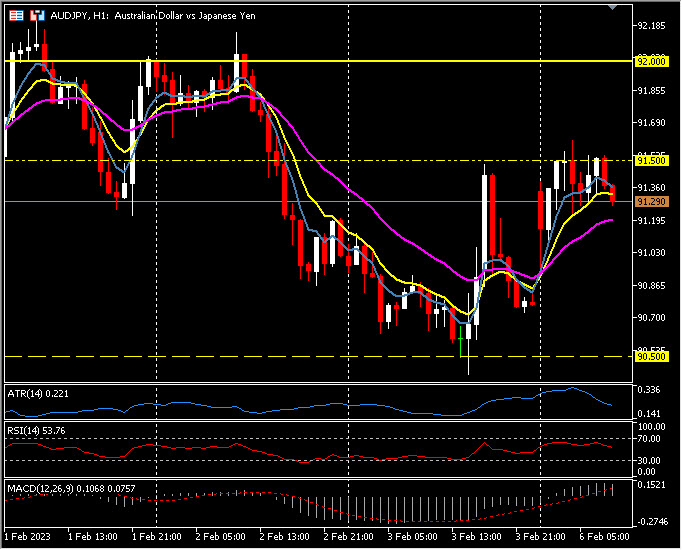

Biggest FX Mover @ (07:30 GMT) AUDJPY (+0.73%). Rallied a whole big number from under 90.50 on Friday to 91.50 today. MAs aligned higher, MACD histogram & signal line positive & rising. RSI 53.76 & neutral, H1 ATR 0.221, Daily ATR 1.257.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.