The ECB and BoE both hiked rates by 50 basis points last week. The BoE seems to be inching closer to peak rates, while Lagarde left the ECB on course for another half point hike in March, and most likely additional moves thereafter. Growth is looking better than feared on both sides of the channel. But, the UK is still the under-performer among G7 countries, and long term growth potential has eroded markedly — also thanks to Brexit.

The S&P Global Eurozone Manufacturing PMI was confirmed at 48.8 in the final reading for January. The headline remains in negative territory, but at a 5-month high. The manufacturing output index rose to a 7-month high of 48.9. The data for January was surprisingly strong, and the PMI report flagged that stockpiles of finished goods declined for the first time since May of last year. Order books continued to drag lower, but business optimism about the year ahead surged higher over the past three months, which is promising.

The Services PMI is already back in expansion territory, and hit a 6-month high of 50.8, which helped to lift the S&P Global Eurozone Composite PMI to 50.3. The latter was a tad higher than the preliminary reading of 50.2, and a marked improvement versus the 49.3 in December. Input cost inflation continued its downward trend, although output prices increased at a slightly faster clip, indicating that companies are still passing on the rise in cost pressures as demand starts to recover. Sentiment hasn’t fully bounced back from the shock of Russia’s invasion of Ukraine, but the data still suggest that the Eurozone will manage to escape recession, with the recovery likely to gather steam over the coming months.

That confidence is improving is also due to the fact that gas prices have come down, and that it seems increasingly unlikely that the Eurozone will run out of gas. The decline in energy prices has helped inflation, and Eurozone HICP undershot expectations at 8.5% y/y in the preliminary reading for January. The marked correction from the 9.2% y/y gain at the end of last year largely reflects a drop in Italy’s headline rate, which in turn was due to a -10.9% y/y dip in regulated energy prices that contrasted sharply with the 70.2% y/y jump at the end of last year. December numbers were already held back by a one-off government payment to help German consumers with the rise in energy prices, highlighting that government support measures are distorting the headline reading at the moment.

Due to a change in base year, the release of the German inflation number for January was delayed, which means the initial Eurozone report is hardly reliable. In any case, the numbers are not a sign that overall inflation pressures are easing. Indeed, core inflation in the Eurozone held steady at 5.2% y/y. Excluding just energy prices, the index was up 7.3% y/y, versus 7.2% y/y in December. Food price inflation in particular continues to rise, but prices for non-energy industrial goods were up 6.9% y/y at the start of the year. Pass-through effects will increasingly be felt as demand stabilizes, and against that background the deceleration in headline inflation is not enough to see the ECB halting the tightening cycle.

Indeed, Eurozone producer price inflation actually slowed less than anticipated in December of 2022, and Eurozone consumer inflation expectations are still showing the headline rate at 3% in three year’s time. This is a clear decline from the 5% expected for this year, but it highlights that the ECB still has some work to do when it comes to bringing down consumer expectations. Against the background of a relatively tight labor market, the survey flags the risk of substantial wage pressures this year and next.

The official Eurozone unemployment rate unexpectedly ticked up to 6.6% at the end of 2022, from 6.5% y/y in November. This is still a pretty low number, especially considering the influx of refugees from Ukraine, which have immediate access to the labor market across the EU. Eurozone retail sales contracted -2.7% m/m in December. The spending patterns are changing with Black Friday sales increasingly important, and consumers are bringing forward Christmas-related spending to save money. This may distort the numbers over the November/December period, but it is still clear that consumption was hit by the jump in prices and concern about the erosion of disposable income.

The economic situation looks better than expected, and core inflation remains stubbornly high. Against this background the ECB‘s 50 basis point rate hike last week was hardly a surprise. The initial statement stressed that rates will have to rise significantly at a steady pace, and that the Governing Council expects to raise rates by another 50 basis points in March. “It will then evaluate the subsequent path of monetary policy”. Lagarde did manage to confuse markets when she tried to square the commitment to a 50 basis point hike in March with the focus on “data dependency”, but the hawks have been out since then to squash any notion that peak rates may already be reached next month. Clearly, the updated set of forecasts that will be available at the next meeting may still change the picture. However, in the central scenario we continue to see another 50 basis point hike in March, followed by two more 25 basis point moves at subsequent meetings, with the ECB expected to remain on hold through the second half of the year.

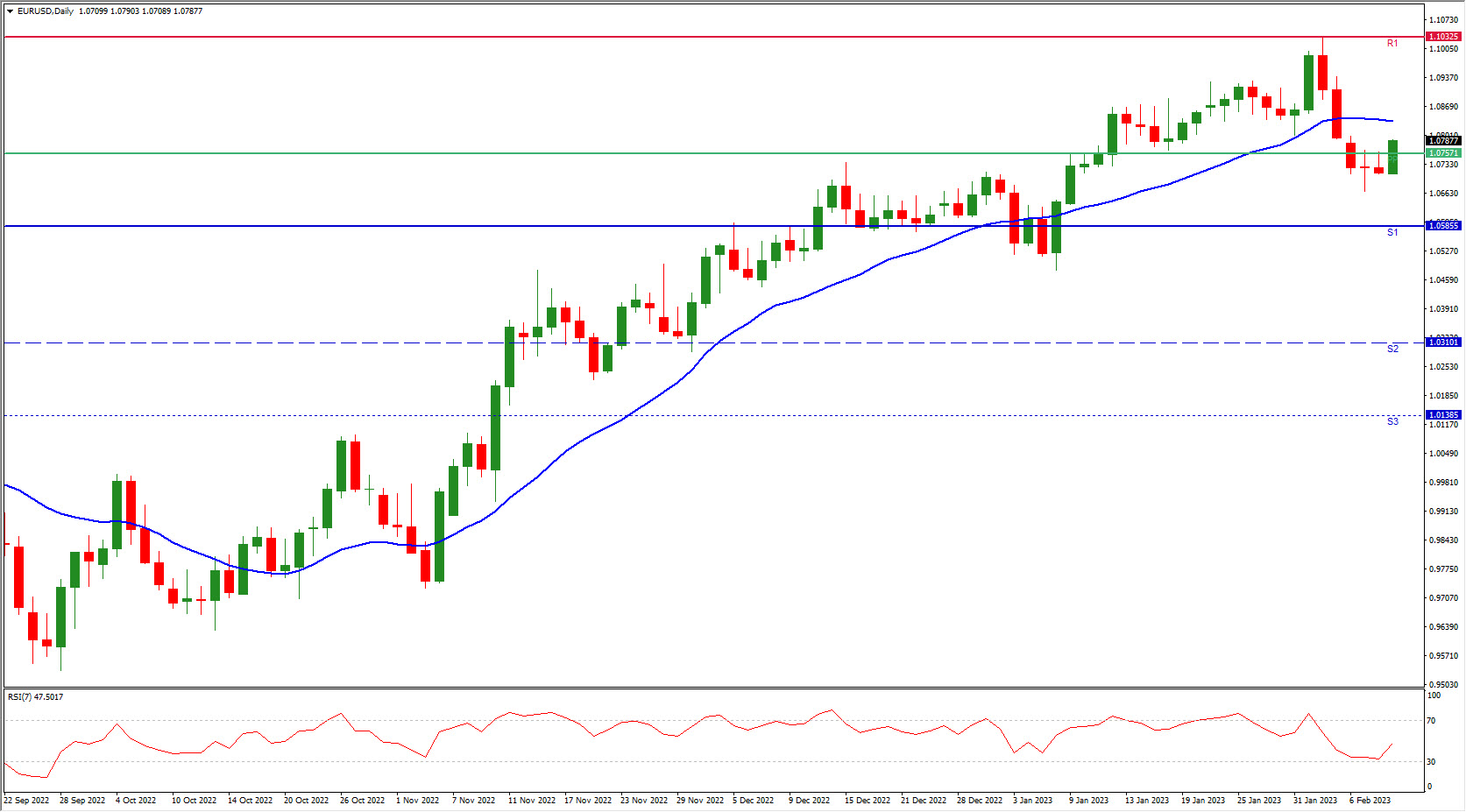

EURUSD has corrected lower as the dollar bounced following the better than expected US jobs report last Friday. The ECB’s 50 basis point move last week didn’t really help the EUR much, as investors read a dovish message into Lagarde’s comments. This may have proved wrong, but Fed expectations remain the main driving factor for the pair.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.