A big beat for US Retail Sales, lifted the USD, Treasury Yields and global stock markets, with a raft of “soft landing” scenarios swirling and even talk of a “no landing”, a situation where inflation cools quickly, the economy grows steadily and unemployment remains low without having a knock-on effect for inflation. A real disparity in views now emerging. Goldman Sachs cut the chance of a US recession in the next 12 months to 25%, from 35%; US 2yr/10yr yield curve at -87bp as the 10yr hits a 7-week high. Overnight: Japan reported it’s largest ever trade deficit at $174 billion as imports surged due to high energy costs with exports unable to compensate. AUD lower after a slump in jobs (-11.5k vs +20k) & unemployment up (3.7% from 3.5%).

- FX – USD Index tested into 104.00 for a 28-day high. Back to 103.65 now. EUR tested the weekly low at 1.0670 before recovering 1.0700, JPY breached 134.00 (new 28-day high) & tardes at 133.86 now. Sterling declined from 1.2175 to once again bounce from below 1.2000 to trade at 1.2050 now. Nicola Sturgeon the First Minister of Scotland announced a shock resignation, that will likely strike a blow for Scottish independence and increase the chances of the Labour Party at next years general election.

- Stocks – The US markets rose into close after a weak open. (+0.11% to +0.92%) Movers – #ABNB +13.35% & COIN +17.5%, OXY & PXD both shed over -5.2%. US500 0.28% (11.47) 4147, holding the key 4100. US500 FUTS 4161 now.

- Commodities – USOil – Futures dropped to $77.20, 5-day lows, yesterday after a very large inventories build of 16.3m barrels vs. 2.4m barrels last week. Prices have recovered to $79.20 today. Gold – tested the support level at $1830 yesterday before recovering to $1840.

- Cryptocurrencies – BTC – Surged over +10% yesterday from $22.0k lows, to breach the key $24k resistance area and test to 24.9k highs.

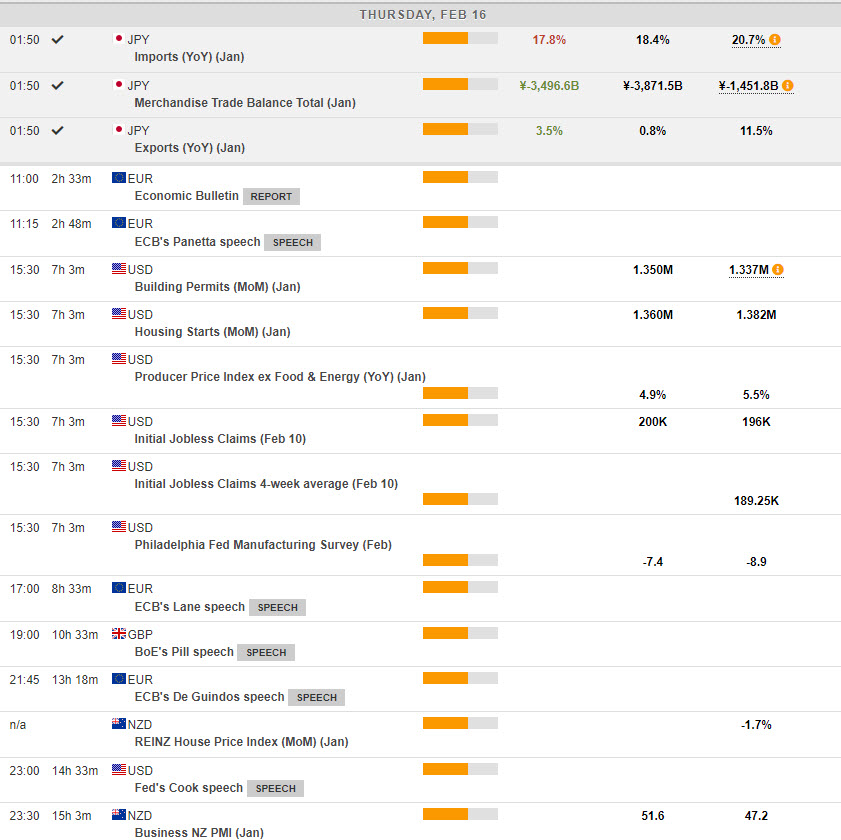

Today – US Building Permits/Housing Starts, Philly Fed, PPI, Weekly Claims. Speeches from Fed’s Bullard, Cook & Mester, ECB’s Lane, Panetta & de Guindos, BoE’s Pill. EARNINGS – Pernod Ricard (miss), Commerzbank, (+7.5%) Orange, Airbus, Standard Chartered (+2.11%), Nestle (in-line -0.49%) , Paramount & Dropbox.

Biggest FX Mover @ (07:30 GMT) USDJPY (-0.34%). Rallied to 134.35 yesterday but has dipped to 133.75 now. MA’s now flat, MACD histogram & signal line positive but declining, RSI 51.42, H1 ATR 0.196, Daily ATR 1.588.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.