Investors implore a “wait & see” approach as FOMC minutes and Core PCE inflation data loom in the final half of the week.

Dollar

Midway through the week and the Dollar finds itself hovering just below a 15-day high, while investors eagerly await the FOMC minutes due on Wednesday afternoon. Factors driving the Dollar’s recent performance against its peers can be attributed to upbeat US data in the form of PMI data as well as the benefits of the safe-haven appeal the currency has amid the geopolitical uncertainties that have characterised the last two weeks. Chief among those is the US–China tensions as well as the escalating rhetoric coming from Russia, as they suspend their nuclear arms treaty with the US and pledge to continue their military campaign in Ukraine.

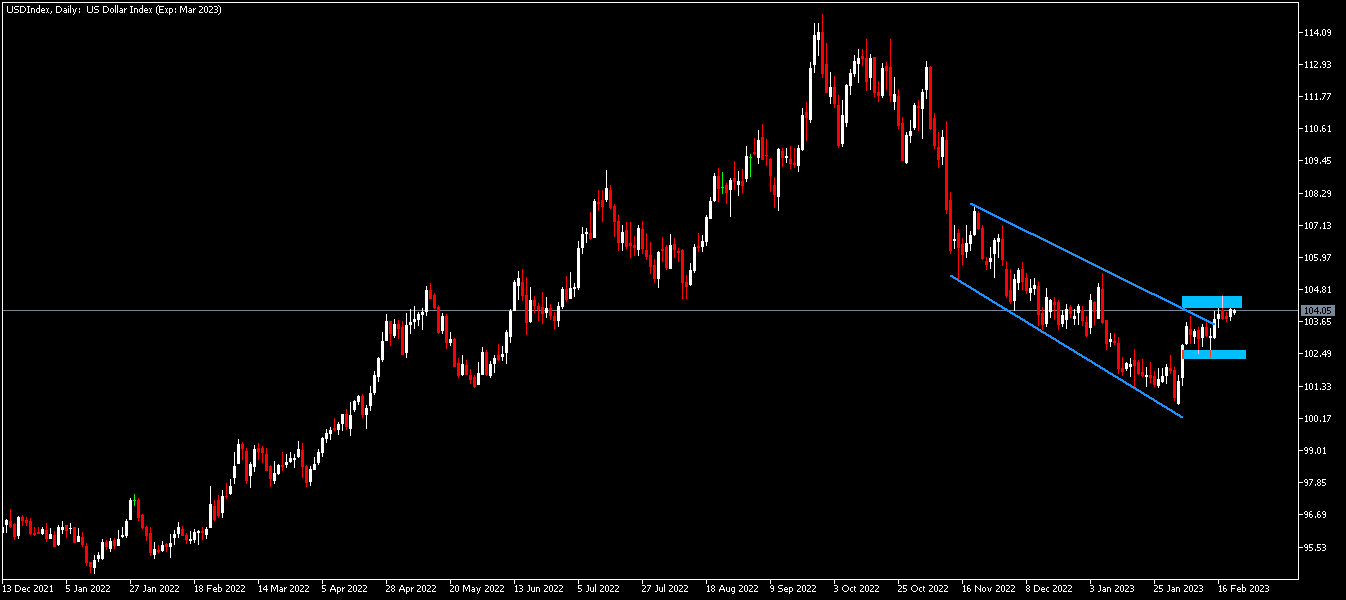

Technical Analysis (D1)

In terms of market structure, price briefly broke through the key 101.15 area where the previous higher-low was formed in June 2022. The nuance to be noted however, is that price came back above the key support area and is approaching this area in a corrective nature in the form of a descending channel which could turn out to be a potential reversal pattern if an impulsive break of structure exits the channel. Current price actions suggest that bulls are defending this area, as the formation of a potential bull-flag is currently on the cards.

Euro

The Euro rolls into the middle of the week remaining under some significant pressure from the Dollar for the third consecutive week this month. Factors driving this selling pressure in February can be linked mostly to the unexpected positive US data that has characterised the current month. This in turn has had the knock-on effect of supporting a sustained period of hawkish rhetoric from the FED in terms of their monetary policy, and this has pleased dollar-bulls to the detriment of the European currency. In as much as the ECB has also stepped up the hawkish rhetoric, with the deposit rate rumoured to be jumping from the current 2.5% to 3.75% by September, which would match the all-time high from 2001 when the ECB was still attempting to shore up the value of the newly launched Euro, it hasn’t done enough to please investors and effectively put a floor under the current trading price.

Technical Analysis (D1)

In terms of market structure, current price has briefly pierced the key the 1.092 area but retreated back below the resistance area. The way in which price approached this area in the form of an ascending channel gives bears the possibility of validating this reversal pattern and if defended by the bears, price could potentially reverse. Conversely if the bulls can sustain the pressure, price could break above the level and continue the uptrend if it invalidates the resistance area in an impulsive wave.

Pound

The Pound heads into the middle of the week finding some interest from buyers as price finds support from the key 1.20 level. Factors driving this renewed buying interest in the British Pound can be firmly linked to better-than-expected UK PMI prints. The data suggested that UK business activity rose more than expected in February, and as a result it raised investors’ hopes that the country may avoid a steep economic downturn. The net effect of the above ascertains a further 25 basis points rate hike from the BoE at their next policy meeting. Looking ahead, investors will be keeping an eye on the release of the FOMC minutes, which could give the Pound its next directional bias in relation to the Dollar.

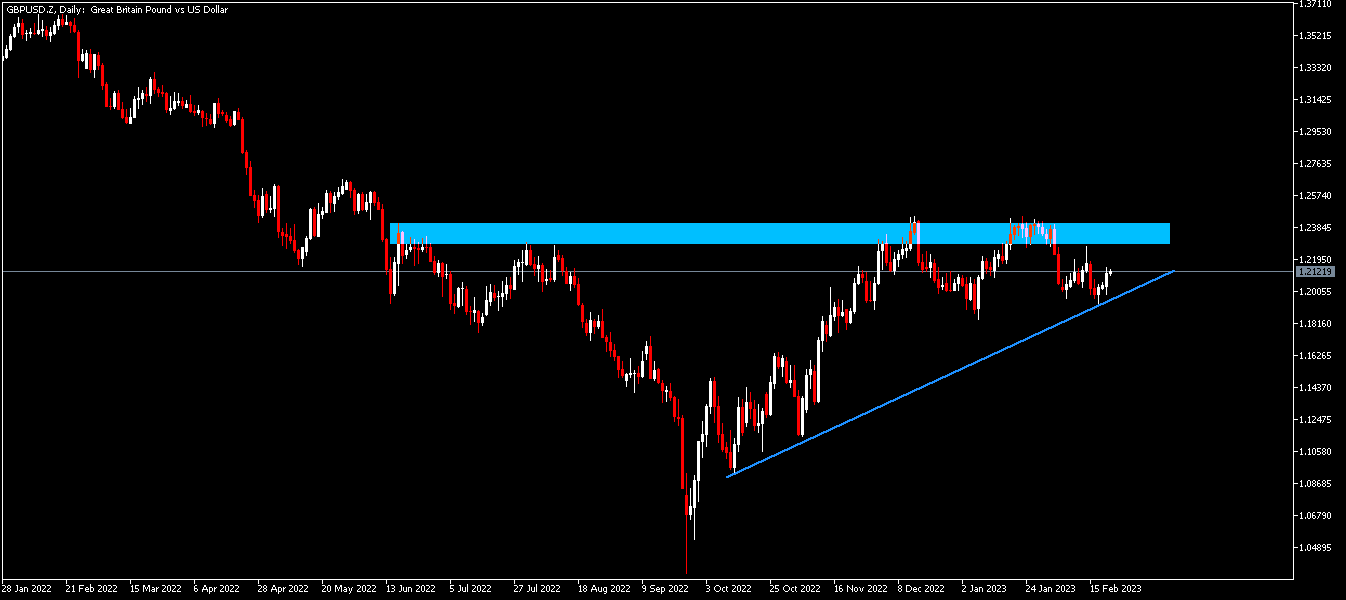

Technical Analysis (D1)

In terms of market structure, the downtrend has been broken and the bulls have been in control of the narrative since then, moving price to test the key 1.244 level and has since pulled back forming a potential bearish double top. As price retests this peak formation again, two scenarios present themselves. Namely, if the area is defended by sellers it could result in the potential reversal pattern being validated. Conversely, if buyers break above the area, price will continue to remain bullish in the near term.

Gold

Gold heads into the middle of the week finding some form of support at the $1 817 level to snap a two-week downtrend. Factors driving this reprieve can be linked to the caution exercised by traders ahead of the release of key economic data in the form of the FOMC minutes expected by Wednesday afternoon. How the yellow metal could react to the minutes has nuances. If the minutes reveal an overly hawkish rhetoric which moves away from the priced in 25 basis point rate hike to a 50, Gold could continue its downtrend. However, traders could also choose to look at the minutes as slightly outdated and prefer to pay more attention to Friday’s Core PCE inflation data from the US for directional bias as it forms a part of the FED’s preferred inflation gauge.

Technical Analysis (D1)

In terms of market structure, current price action has slightly breached a significant resistance at the $ 1 949 area creating a new high before retreating back into the range. If sellers can defend this area and maintain the impulsive break of structure, price could continue to move below the new high and validate the potential reversal pattern forming in the form of an ascending channel. However if buyers maintain their interest, price could break above and remain bullish towards the $1 998 level, which represents the previous lower-high.

Click here to access our Economic Calendar

Ofentse Waisi

Financial Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.