Fed Chair Powell’s Monetary Policy Report and testimony supported widespread expectations for a higher for longer policy stance, as has been the official position since early this year. But Powell came out swinging, like with his Jackson Hole comments, noting that the pace of tightening may be sped up. The markets were surprised, and we saw immediate bearish reactions in bonds and stocks, with Treasury yields spiking and Wall Street slumping. The USDIndex, on the other hand, firmed. A decision regarding an up-shift back to a half point rate hike pace on March 22 is not a done deal. Powell stressed it depends crucially on the “totality” of upcoming data in Friday’s nonfarm payrolls, and the following CPI release on March 14.

Though the FOMC’s mantra for several months has been higher for longer, it is only recently that the markets have taken that message seriously. Another signal to that extent was sent again, and like Jackson Hole, Chair Powell boosted the possibility of a more aggressive pace, back to a 50 basis point hike after the February step-down to a 25 basis point move.

It unlikely the Fed would want to backtrack so quickly, as it implies a policy error on the prior decision to temper the pace. But it appears that recent robust data, including the 517k nonfarm payroll surge, still tight jobless claims, strength in retail sales, and the upward revisions in CPI, have given the Fed hawks plenty of ammo.

The hawks have long favored front-loading rate hikes, and several officials (voters and nonvoters) noted they argued for another 50 basis points last month. We now project a half point boost to a 5.125% mid-band rate, along with quarter point hikes in May to 5.375%, and in June to 5.625%.

The overall outlook is in line with the shift up in implied Fed funds futures. They jumped in response to Powell’s opening remarks, and now reflect about a 56% probability of a 50 basis point March increase to a 5.125% mid-rate, versus only about 25% probability before the testimony. There is approximately a 90% risk for a 5.25% to 5.5.% rate in May, versus 40% previously, and a 70% risk for 5.5% to 5.75% in June, versus 30%. A terminal rate of 5.613% is seen for September, and a 5.478% rate is priced in for December.

The Fed Chair stressed that upcoming data will be crucial for the upcoming policy decision. The two key reports are February nonfarm payrolls (March 10) and CPI (March 14). The totality of data means not only will we have to see significant slowing in job growth in Friday’s report, but meaningful downward revisions to the prior months. A 240k increase in February nonfarm payrolls following gains of 517k in January are anticipated, 260k in December, and 290k in November. We anticipate the workweek falling to 34.5 from 34.5 from 34.7, and an uptick in the unemployment rate to 3.5% from 3.4%. Yet, none of these should be sufficient to assuage Fed fears over the still-tight labor market. Powell noted the jobless rate is still historically low. We further expect a 0.3% hourly earnings gain, the same as in January, which would boost the y/y rate to 4.7% from 4.4%. On top of the disappointing upward revision in Q4 unit labor costs to 3.2% and the downward bump to productivity to 1.7%, such numbers will not sit well.

Concurrently, CPI is expected at 0.4% for both the headline and the core in February, after respective January increases of 0.5% and 0.4%. CPI gasoline prices likely climbed 2% last month. We expect dissipating upward pressure on core prices through 2023 as disruptions from global supply chain bottlenecks and the war in Ukraine subside. However, Powell also warned that his “super core” measure, services excluding housing, remains elevated and there has been little progress in bringing it down. As-expected February CPI figures would result in a deceleration in the y/y headline pace to a still-hot 6.1%, three times the 2% goal, from 6.4% in January. We expect the core y/y gain to slow to 5.4% from 5.6% in January. For February PCE y/y chain price gains, the Fed’s favorite metric, we expect respective increases of 5.2% and 4.7%, versus prior 40-year and 39-year highs in 2022 of a respective 7.0% in June and 5.5% in February.

Though a sharp moderation is forecasted in y/y gains for all the inflation gauges through 2023, it is not happening fast enough, which will keep the pressure on the FOMC to continue tightening monetary conditions. Chair Powell stressed, as others on the FOMC have, that they are committed to bringing inflation down to the 2% target. Additionally, they are not considering changing that goal. He said the credibility of the FOMC’s 2% inflation target “really anchors” inflation expectations, so it is very important that the Fed sticks to it. Having a 2% target helps to keep expectations down.

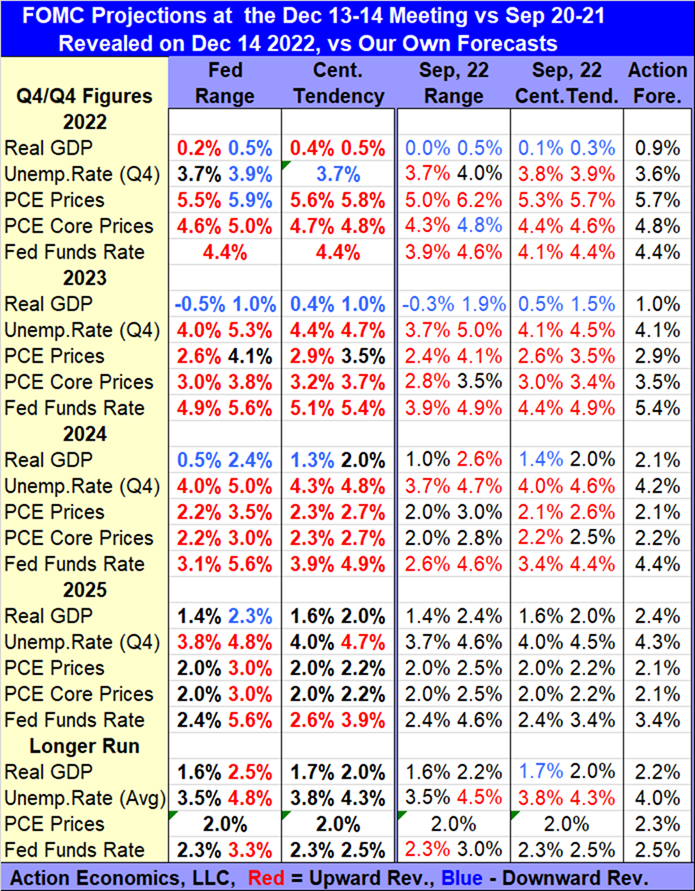

The topic of shifting the inflation goal continues to come up. With inflation at 6% it looks very ambitious, and bringing it down to the target could conceivably crush the economy. While attaining it is achievable, it will be a question of how fast the Fed wants to get there, and how damaging it is to the economy. The upcoming dot plot will be scrutinized for indications on the inflation outlook, with the likelihood that the PCE dots are moved out further into the future, as they were with the December forecasts.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.