The Dow Jones Index had its worst week since 2023 with a 4.5% drop last week. In the previous five trading days, the top US Index fell by more than 1300 points. The two main developments affecting US equities at the moment are the upcoming interest rate hike and the failure of Silicon Valley Bank. The S&P 500 and Nasdaq 100 also ended last week by setting new monthly lows.

On Monday, the Dow fell further as investors were still waiting for more details on the future of SVB, although the market has stabilised after the latest announcement from the US banking regulator. In Tuesday’s trading however, the Dow closed 336 points or 1% higher, while the S&P 500 and Nasdaq 100 gained 1.6% and 2.1% respectively, as February inflation eased and fears of a broader financial crisis eased.

The Labour Department’s CPI report showed that monthly inflation rose 0.4% in February from January, in line with expectations, resulting in annual inflation slowing to 6%, the lowest since September 2021. Investors speculated that the Fed may soon be able to pause its tightening cycle as concerns mount over the health of the broader financial system following the SVB failure and SB closure. On the corporate front, regional bank stocks rallied again after a turbulent few sessions.

Technical Review

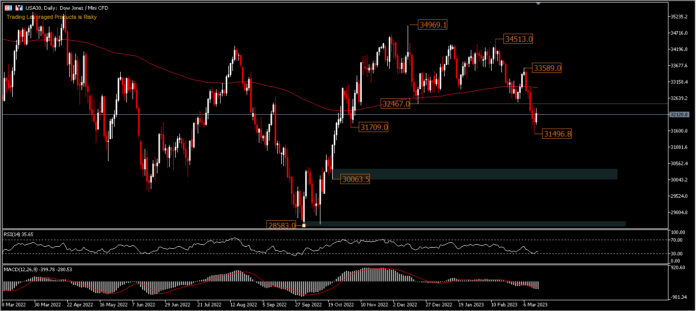

USA30, D1 – The index hit a fresh yearly low in its last trading session. The USA30 temporarily still failed to surpass the November 2022 low located at 31,709. This is a zone of strong demand that could lead to a bounce, and the bears temporarily only registered a fresh low at 31496.8 before closing at 32,145.8.

A shift in interest has been underway, since the index broke the 32,467 support last week and now prices are below the 200-day EMA. If the price fails to defend the 31,709 level, then the Index could fall to 30,063.5. This would also put a possible new 2-year low currently at 28,583.

To improve investor sentiment, the index needs to break above the 200-day moving average in the coming time to seize the 33,589 level. The RSI has bounced off the oversold area, but the MACD is still validating the recent price action.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.