GBPJPY, Daily

UK Retail Sales much stronger than expected. Sales jumped 1.2% in February, while the January reading was revised up to 0.9% from the 0.5% reported initially. The February data is the largest increase for retail spending since October 2022. Strong sales in discount department stores and sales in food shops also rose, after shortages of fresh products a month earlier. Higher food prices are one of the main drivers fuelling overall inflation, with the cost of everyday basics such as eggs, cheese and milk rising sharply. The rate at which prices are rising remains close to its highest level for 40 years, hitting 10.4% in the year to February – more than five times the Bank of England’s target.

Excluding auto fuel, retail data was even stronger – showing a rise of 1.5% last month. More signs that the UK economy is performing better than anticipated and that a recession this year could be avoided, if there is not another setback. The government’s spring budget, which extended energy support measures, will help, although the rise in interest rates will hit those having to re-mortgage this year who will feel the pain. The data justifies the additional rate hike the BoE delivered yesterday but doesn’t change the view that at 4.25% the Bank Rate could now have peaked.

BOE Governor Andrew Bailey, tried to reassure markets and the wider UK public that recession could be avoided, only months after also warning that the UK faced a deep and prolonged (2 years+) slow down. He warned of raising prices risks allowing high inflation to persist and hurting the “least well off”. “If all prices try to beat inflation we will get higher inflation,” Mr Bailey told Radio 4’s Today programme. He warned interest rates would rise again if prices continued to increase.

Following the better Retail Sales, UK PMI reports were weaker than anticipated. The S&P Global/CIPS Services PMI declined to 52.8 from 53.5, while the manufacturing reading dropped to 48.0 from 49.3. As in the Eurozone an acceleration in the pace of contraction there and in the UK that wasn’t compensated by a rise in services sentiment, leaving the Composite at 52.2 – down from 53.1 in the previous month.

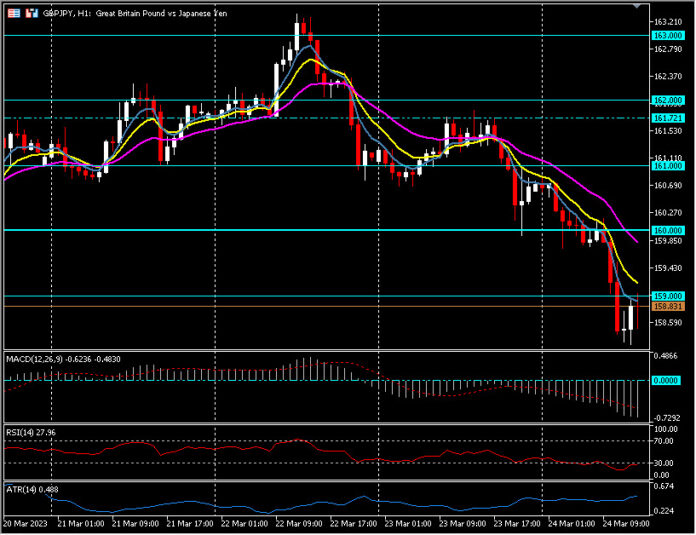

Sterling peaked ahead of the Dovish hike from the BOE yesterday, GBPUSD touched 1.2340 but trades down at 1.2200 now as Stock markets dive in the UK and Europe and the USD recovers. EURGBP hit a 9-day high at 0.8865 yesterday and trades down at 0.8790 now and GBPJPY peaked at 161.70 yesterday but as sentiment weakens significantly today the pair remains below 159.00.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.