- FX – USDIndex closed lower at 102.18. EUR steady within 1.1860-1.0880. JPY failed to break 136.40. Sterling steady for 3 days at 1.2450-1.2530.

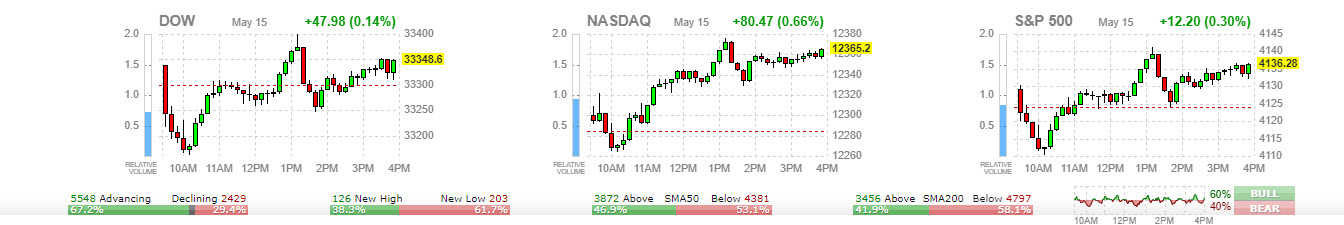

- Stocks – The US100 rallied 0.65%, while the US500 and the US30 were up 0.30% and 0.14%, respectively.

- Commodities – USOil – rose 0.41% to $71.40 per barrel. Gold pullback to 2002.57 this morning.

- Cryptocurrencies – BTC steady within $26600-27600.

Today – President Biden and Speaker McCarthy have scheduled a meeting on the debt limit. EU GDP and German ZEW, US Retail Sales and Canadian Inflation. Speeches: Fed’s Bostic, ECB Lagarde, Fed’s William, Logan and Mester.

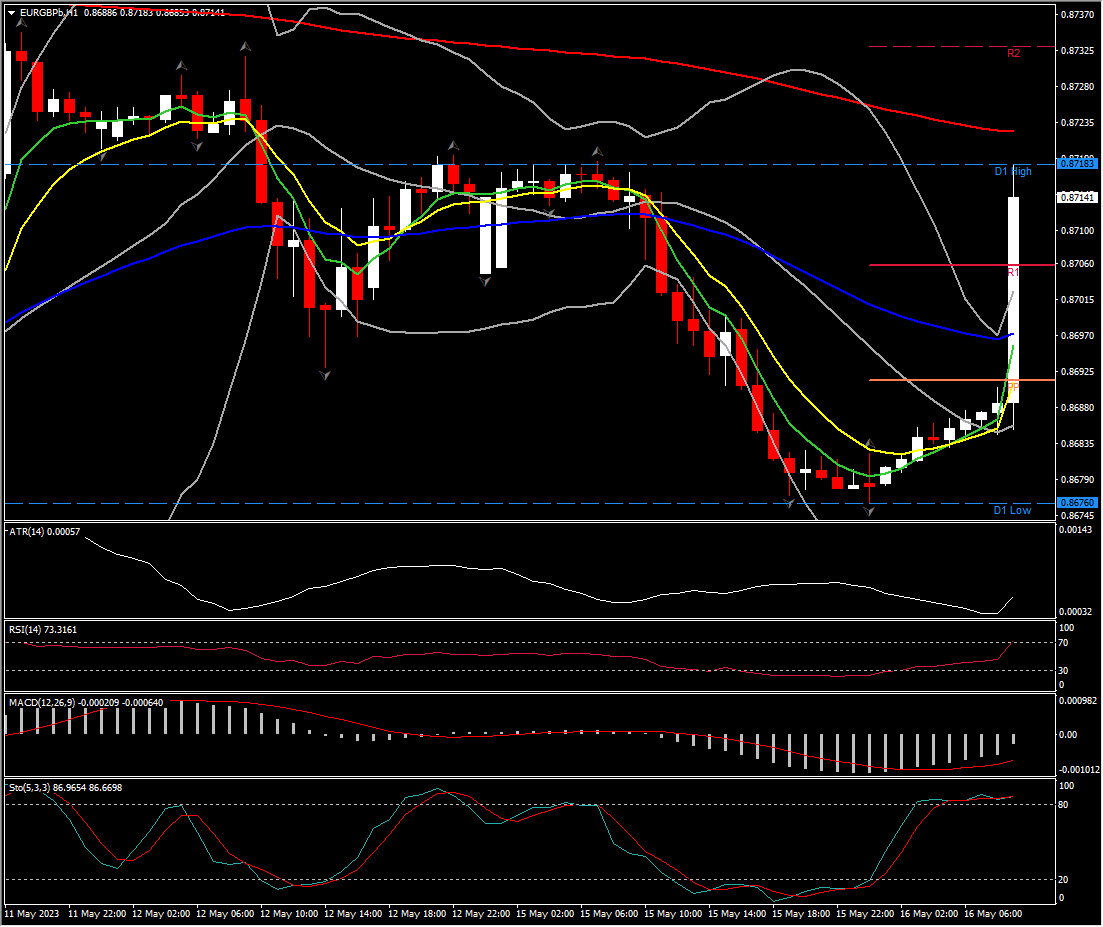

Biggest FX Mover @ (06:30 GMT) EURGBP (+0.50%). Spiked to 0.8718 from 0.8683. MAs aligned higher, but MACD histogram & signal line remain below 0, RSI 72 & rising. H1 ATR 0.00057, Daily ATR 0.00473.

Biggest FX Mover @ (06:30 GMT) EURGBP (+0.50%). Spiked to 0.8718 from 0.8683. MAs aligned higher, but MACD histogram & signal line remain below 0, RSI 72 & rising. H1 ATR 0.00057, Daily ATR 0.00473.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.