At last Friday’s close, the DJ Industrial (US30) was negative on the year, despite its strong performance to close the week. As of 30 December 2022 it had closed at 33,147, about 0.16% higher than the last trading session (33,093). In comparison, the SP500 is up 9.52% YTD, the Nasdaq 30.95%. During 2022 the US30 had fallen 8.78%.

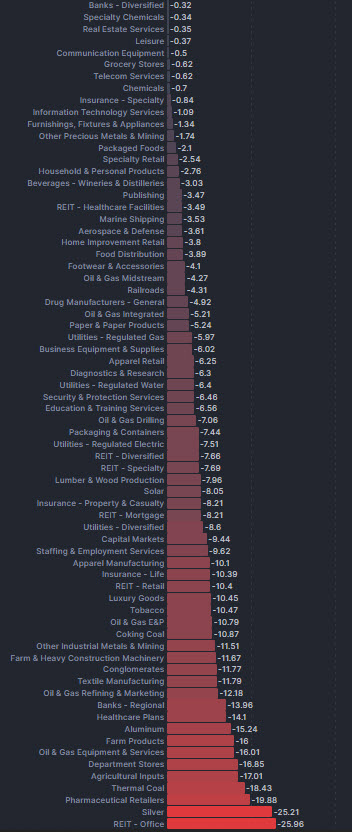

More than half of the 30 names in the index have performed negatively this year, and some of them are well known. Among the  worst performers are some consumer goods giants, such as P&G (-4.06%), Johnson & Johnson (-12.62%), but also Coca Cola (-5.27%) and Nike (-8.12%). The industrial sector did not fare any better, with Caterpillar (-11.59%) and conglomerates such as 3M and Honeywell (-9.59%) heavy; then there was the healthcare-related sector (Walgreens Boots –19.67%, United Health -9.18%, Amgen -17.40%). The same has been seen in IT names such as IBM (-8.52%) and Verizon (-11.17%), financials such as Goldman Sachs (-3.31%) and energy companies like Chevron (-14.16%).

worst performers are some consumer goods giants, such as P&G (-4.06%), Johnson & Johnson (-12.62%), but also Coca Cola (-5.27%) and Nike (-8.12%). The industrial sector did not fare any better, with Caterpillar (-11.59%) and conglomerates such as 3M and Honeywell (-9.59%) heavy; then there was the healthcare-related sector (Walgreens Boots –19.67%, United Health -9.18%, Amgen -17.40%). The same has been seen in IT names such as IBM (-8.52%) and Verizon (-11.17%), financials such as Goldman Sachs (-3.31%) and energy companies like Chevron (-14.16%).

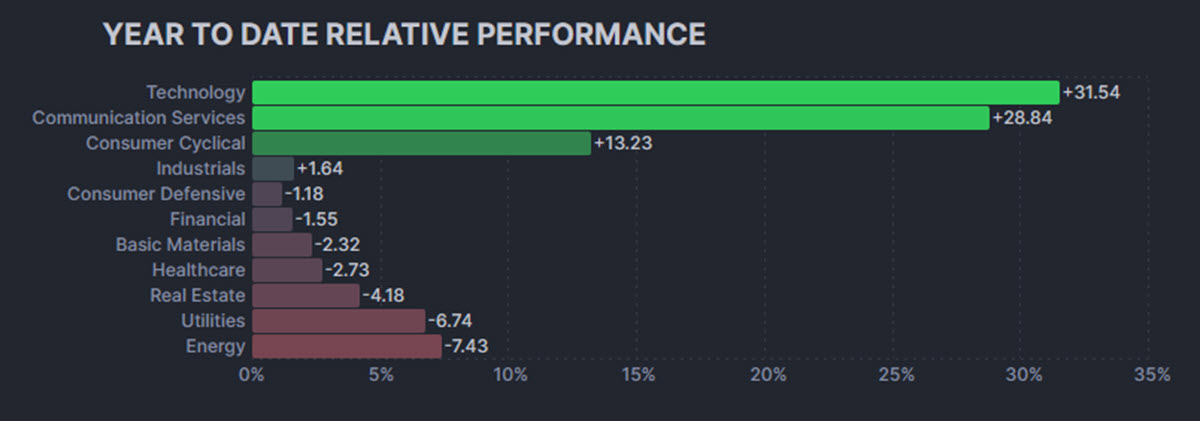

Focusing on sector performance, we can see that Energy has suffered the most (certainly given the lower commodity prices), followed by Utilities, Real Estate, Healthcare, Basic Materials, and Financials. All the gains came from Technology, Communication Services (whose group includes names such as Google, Alphabet and even Netflix) and Consumer Cyclical (driven by Amazon and Tesla).

But it’s not only in the US30 that we find such a dichotomisation: 324 out of 500 stocks within the SP500 are trading below their 50 MA; dwelling on the fundamental data, we can also note that manufacturing PMIs have been contracting for months, in contrast to services ones.

This difference in performance indicates that the economic reality that lies beneath the indices is much less uniform than the indices themselves and may be hiding useful information for our understanding of the markets and uncovering pockets of currently hidden value. On the contrary, the usual well-known stocks have a very high influence – perhaps even a “dangerous” one – and hide a more varied reality behind their solid performance. In short, we are finally back to a time when stock picking can be useful again.

TECHNICAL ANALYSIS

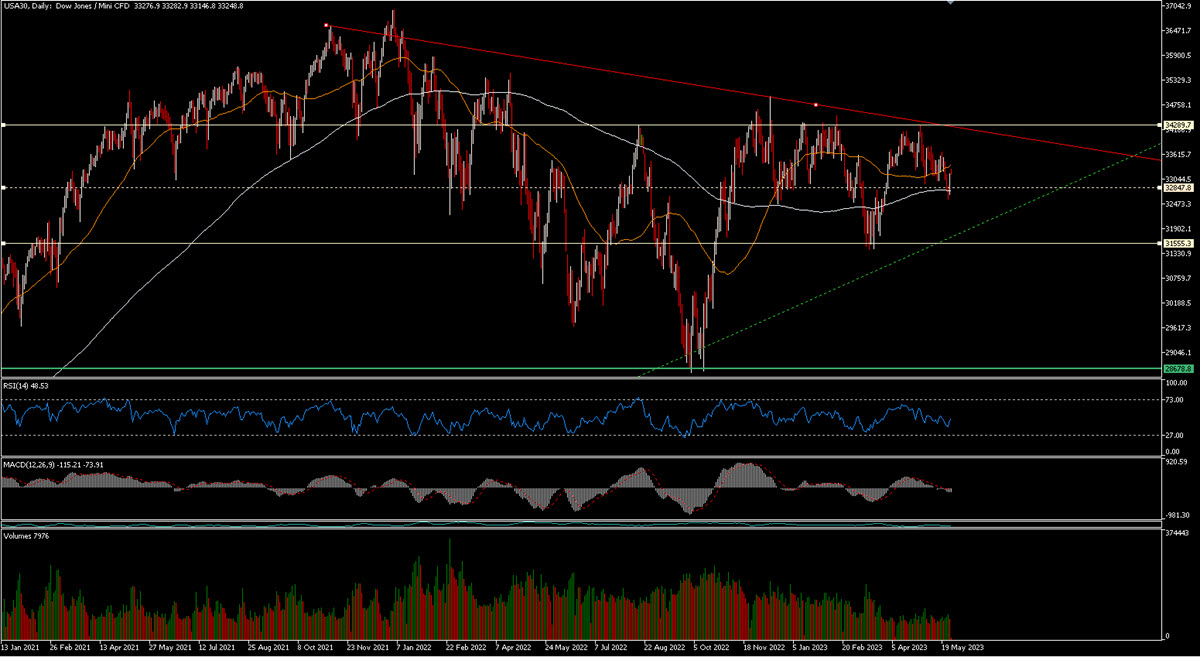

The Dow Jones, unlike the other two major US indices, has not broken long term trend lines, remaining more ”congested” and currently trading at the same area as 12 months ago. The two most important long-term levels are in the 31,550 and 34,300 areas: in short, we are currently in the middle of the ford, in which is also the middle of the MM50 and MM200. The chart is nevertheless cleaner than the one of other US indices, guaranteeing clearer technical analysis references. The different relative strength – evidently – can help us both to use the index as a hedge and to observe future sectoral repositioning (technological will not continue to outperform forever) which could lead the DJIA to strengthen relatively against its peers.

Click here to access our Economic Calendar

Marco Turatti

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.