The US500 broke free from the bear market last Thursday, ending the downtrend which lasted for 248 trading days. Historical data suggests that there is an average of 75% probability that the index will continue to rise for a subsequent year after entering the bull market. Is this a new beginning for the bulls?

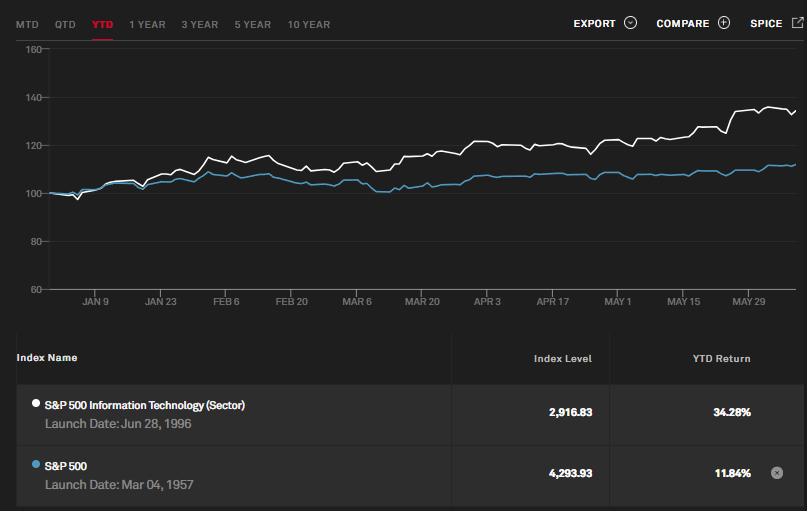

The information technology sector alone has risen over 34% this year, much better than the US500 which achieved YTD gains slightly over 11%. Weaker-than-expected labour data last week has been a positive catalyst for the stocks market in general. Fedwatch displayed that market participants expect the Fed to maintain its benchmark rate unchanged in the coming meeting (14th June), instead of a rate hike (maybe next month?).

Today, we will look at Cognizant Technology Solutions Corp. Founded in 1994, the company engages in the provision of information technology, consulting, and business process outsourcing services. It operates via several business segments, namely Financial Services (banking and insurance), Healthcare, Products and Resources (retail and consumer goods, manufacturing and logistics, travel and hospitality, and energy and utilities), Communications, Media and Technology.

Last month, Cognizant announced the launch of an enterprise-wide generative AI platform (Cognizant Neuro), which aimed to assist clients to better understand, consume and customize AI models that drive business outcomes, eventually harnessing its business value in a scale-able, flexible, secure and responsible way. While these features may sound exciting, it is also important to note that in the week through June 7, tech funds sustained $1.2 billion of outflows, the first time in eight weeks – a pause in the AI frenzy?

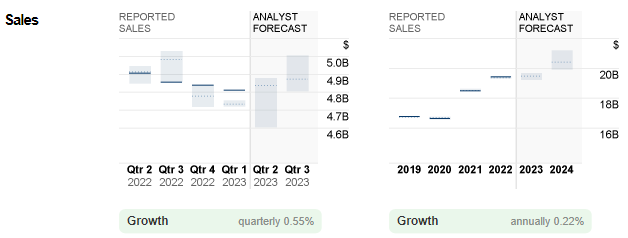

In Q1 2023, the company generated $4.8B in sales (unchanged from Q4 2022), slightly down -0.3% from the same period last year. Fundamentally, a strong partnership with companies like Amazon, Microsoft and Alphabet may act as a plus point for Cognizant. However, to some extent this has been offset by headwinds such as challenging macroeconomic conditions and stiff competition among peers.

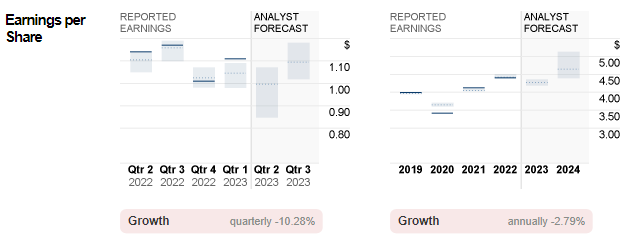

Adjusted diluted EPS for the quarter hit $1.11, up 9.9% from the previous quarter, and up 2.78% from the same period last year. The company will report its earnings result for Q2 2023 on 26th July. Consensus forecast for sales and EPS stood at $4.8B (unchanged from previous quarter) and $1.00 (down -9.9% (q/q)), respectively.

Technical Analysis:

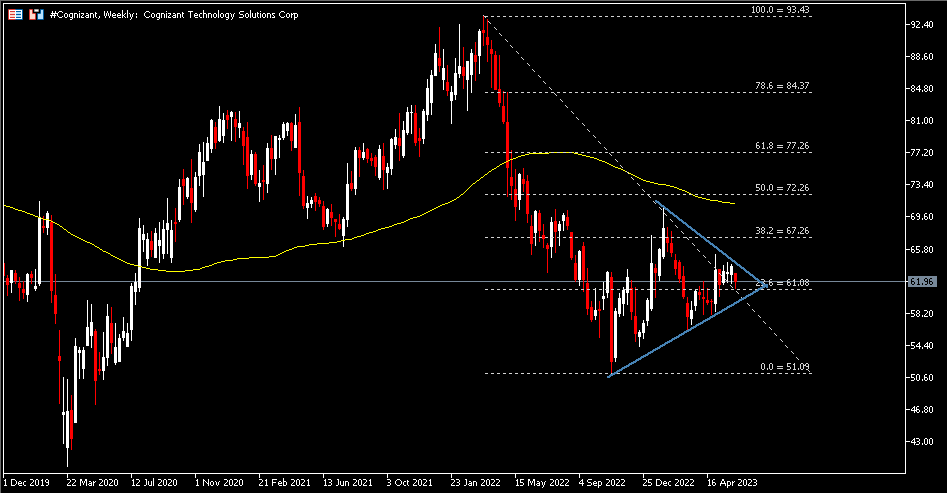

The #Cognizant (CTSH.s) share price printed its yearly high in early February, at $70.84, before paring all the gains by the end of the first quarter. The asset price has remained consolidated around $7 in the second quarter, currently just closed above support $61.08 (FR 23.6% extended from March highs 2022 to November lows in 2022). The shares remain pressured below the 100-week SMA. A close below the said support may lead to sellers pushing the price lower, testing the lower line of symmetry triangle, followed by the next support which is last year’s low at $51.09. Otherwise, the upper line of the triangle serves as the nearest resistance. A break above this line may lead the bulls to continue testing $67.25 (FR 38.2%), followed by the 100-week SMA and $72.25 (FR 50.0%). A break above the latter two levels may indicate correction of the current trend.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.