After a horrible CPI inflation figure in the UK the bar is set pretty high for the Bank of England to accelerate the pace of rate hikes to 50 basis points this week. The market gives it a 50% chance. At the same time it believes that by August 23 rates will rise to 5.25% (from the current 4.5%) and by the end of the year to 6%. Are sterling traders running ahead of themselves? ‘Incredibly’- well, maybe not for those who have been in the market for many years – the pound is falling with conviction today, both against the EUR and the USD (about -0.50%).

Headline inflation remained stable at 8.7% in May, while core inflation (excluding the more volatile elements of food and energy) rose to 7.1% from 6.8% in April: the days when the CPI fell below 10% (in March) are long gone, and the words of both Bailey of the BOE and UK PM Sunak (inflation will halve by the end of the year) seem but a blurred shade from the past. What is surprising is the persistence of price growth in services, which is also what the BOE is focusing on the most.

In fact, year-on-year inflation is set to fall in the summer, especially given the very unfavourable comparison with last June’s figures and the clear fall in energy and fuel prices that is taking place now.

The problem, also expressed by the central bank, is that it is not only prices that need to be watched, but also the labour market and wage growth. The BOE, using a model developed by former Fed Chairman Yellen, is quite convinced that the rise in wages is due to consumers’ expectation of higher prices. But they could be wrong: it could be, as according to other models, the shortage of workers influencing wage growth. And this would be more structural.

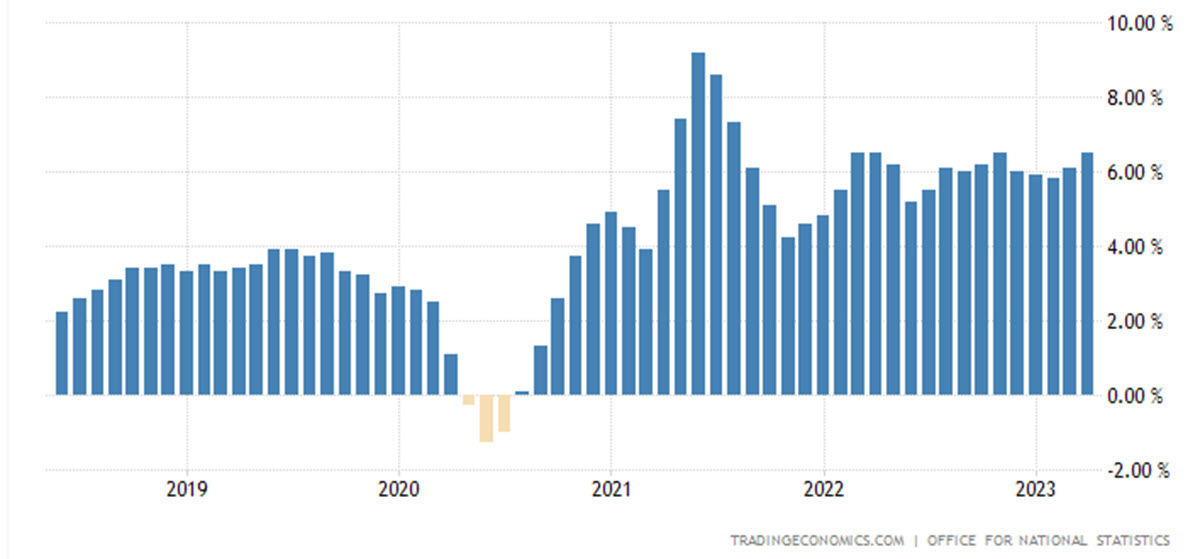

Earnings Growth in UK

The Bailey-led institution has already said that the effects of monetary policy have not yet fully spilled over to the real economy. It is unlikely, however, that they will disregard market expectations of a terminal 6% rate at tomorrow’s meeting, only to have to admit they were wrong in the future.

In all this, the pound is falling today.

Technical Analysis

Today’s move by Cable could just be profit taking after a long rally, a purely technical move and in contrast to the sharp rise in rates that is taking place. The pair seems to have broken bearish a few days ago and retesting it to levels around 1.2670 would be a healthy move. Even a test towards the MA 200 (and the bullish trendline from October 2022) would still not compromise a strong structure for the GBPUSD. RSI, MACD are positive, price is above the long term MAs.

GBPUSD, Daily

A similar argument applies to the EURGBP, which had recently broken the lows that had held since autumn 2022. Here honestly the RSI and MACD indicators are positive, the MAs not so much. A test of 0.8635 or even higher near 0.87 would be nothing unusual. The trend is still bearish.

EURUSD, Daily

Click here to access our Economic Calendar

Marco Turatti

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.